Shutterstock cover by Vladimir Kazakov

Compound Surges on Plans to Cut Rewards

Compound wants to eliminate COMP farming and launch a new rewards distribution program.

Compound has reached a crucial resistance level after the DeFi startup revealed plans to eliminate its rewards distribution program. Further buying pressure around the current price levels could push COMP to break out.

Compound Could Break Out After Protocol Upgrade

Compound has seen its price surge by more than 24% over the past 12 hours after announcing a proposal to reduce protocol rewards.

The DeFi startup appears to have realized that its rewards distribution program has a problematic effect on COMP’s price. Compound maintains that most COMP rewards are instantly sold off, creating a “great disservice” for existing users and token holders. Instead, these tokens should be used to grow the protocol.

For this reason, Compound created a rewards adjustments proposal that aims to start a new rewards program with the sole purpose of “kickstarting new markets.” The goal is to cut existing rewards by 50% and eventually end COMP farming.

Community members appear to have welcomed the new proposal. Some claim that COMP holders will no longer be diluted as the rewards cut ends the rampant inflation the network has been experiencing. Meanwhile, others appear to be rushing to exchanges to buy the token.

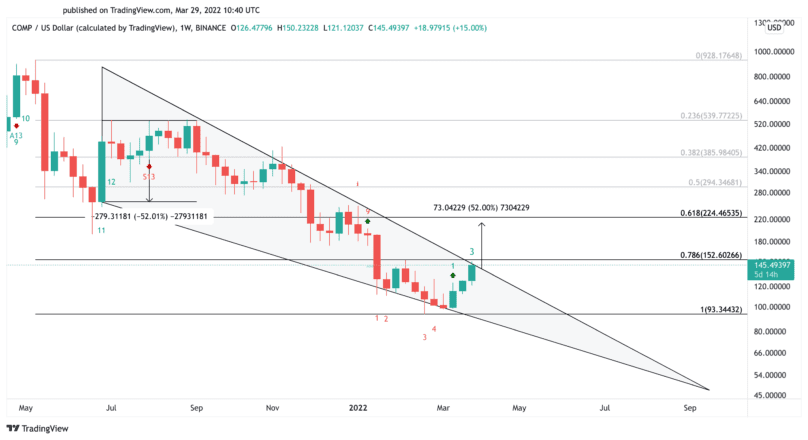

COMP has gained nearly 30 points in market value since the announcement to test the $152 resistance level. This hurdle is significant because it sits around the descending trendline of a wedge that has been forming on its weekly chart.

A decisive candlestick close above $152 could signal a breakout from the consolidation pattern. Under such circumstances, sidelined investors could re-enter the market, pushing COMP by roughly 52% toward $224.50.

Still, Compound will likely need a sustained daily close above $152 to confirm the bullish thesis. If COMP fails to break this resistance level, the asset could suffer a correction to the wedge’s descending trendline at $93.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.