Crypto.com Visa card usage grows 29% in one year, reveals recent report

Crypto.com card data shows a shift towards online and entertainment spending.

The crypto “spending index” of Crypto.com’s card grew 29% on a year-over-year basis, a report by the exchange and Visa revealed. The most significant growth was observed in information and communication expenditures, which increased by 22%. Overseas spending followed closely, increasing by 21%, indicative of a rebound in consumer confidence and market revitalization post-pandemic.

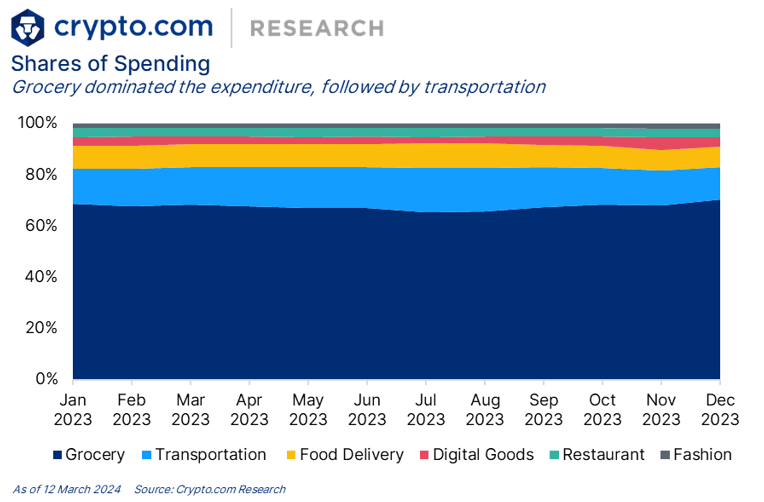

Conversely, spending on housing and household-related expenses saw a notable decline of 18%. Despite this, grocery shopping remained the predominant spending category, capturing 62% of the total volume in 2023, a stark increase from 36% in the previous year.

Online purchases continued to dominate, accounting for 55% of total spending. Amazon led the online market with a 19% share, while Booking.com held a 16% share. In terms of out-of-home consumption, entertainment-related spending, including concerts, arts, exhibitions, and sports events, experienced a 21% growth. Dining out also saw a modest increase of 3%, whereas fashion spending dropped by 10%.

The report also highlighted that Crypto.com Visa cards were used for transactions across more than 200 countries and regions. Over half of the travel spending (51%) occurred within the European Union, with Booking.com remaining the top choice for online travel bookings among card users.

E-commerce’s average proportion of spending inched up from 53% in 2022 to 55% in 2023. This marginal growth contrasts with an 8% decrease in the online sales split from global sales channels, suggesting that Crypto.com Visa cards retain their appeal for online shoppers. Amazon, AliExpress, and eBay were the most popular e-commerce platforms among users, with market shares of 50%, 7%, and 7%, respectively.

Earn with Nexo

Earn with Nexo