Crypto funds inflows surpass $15 billion and set new record

US and Switzerland lead crypto inflow surge, with Ethereum's outlook brightening.

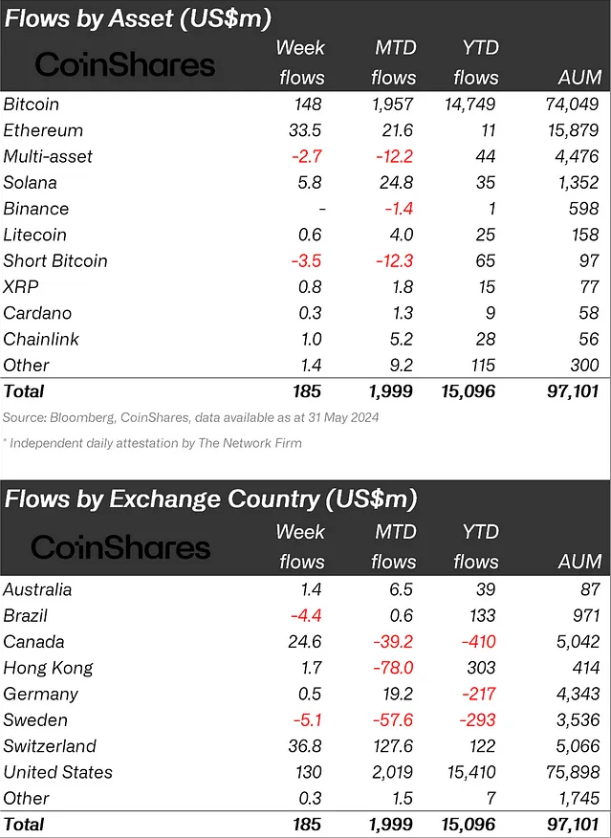

Crypto funds registered $185 million in inflows last week, amounting to $2 billion in May, and $15 billion in 2024. According to asset management firm CoinShares, trading volumes experienced a dip despite the positive influx, descending to $8 billion compared to $13 billion the previous week.

Bitcoin continued to attract investor confidence with inflows of $148 million, whereas short Bitcoin products faced outflows of $3.5 million, indicating a sustained positive sentiment among ETF investors.

Buoyed by the SEC’s nod to a spot-based ETF set for a July 2024 launch, Ethereum enjoyed a second week of inflows, reversing a 10-week streak of outflows that amounted to $200 million. This upbeat shift for Ethereum also positively influenced Solana, which registered an additional $5.8 million in inflows.

Regionally, the US dominated the inflow landscape, contributing a net of $130 million. However, established ETF issuers experienced a spike in outflows, reaching $260 million. Switzerland celebrated its second-largest week of inflows for the year at $36 million, while Canada reversed its trend with inflows of $25 million, offsetting a cumulative outflow of $39 million in May.

In contrast to the direct investment gains in digital assets, blockchain equities faced challenges, with outflows of $7.2 million last week, contributing to a total of $516 million in outflows this year.

Earn with Nexo

Earn with Nexo