Solana dominates altcoin inflows as investors buy last week’s dip

Solana emerges as top-performing altcoin with US$57m year-to-date inflows, while blockchain equities face continued outflows.

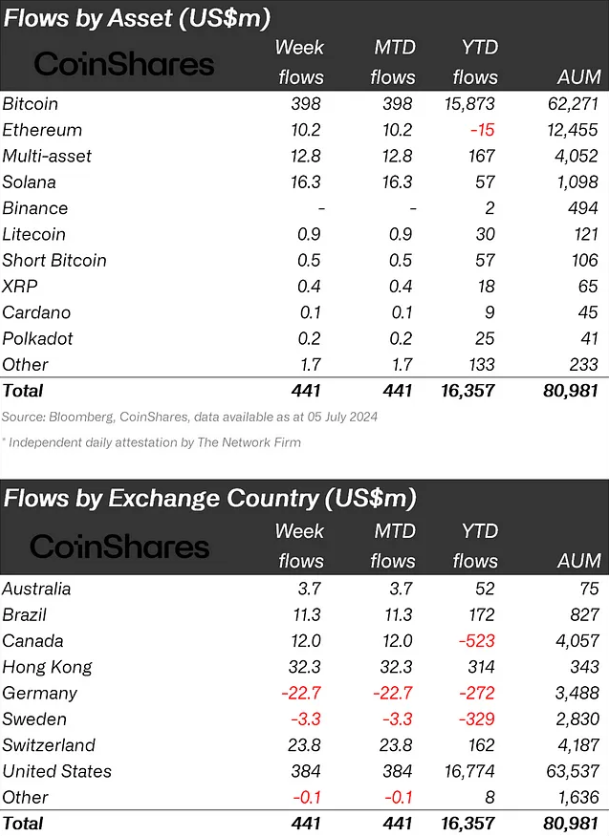

Crypto investment products saw inflows of US$441 million last week, as investors viewed recent price weakness as a buying opportunity, according to asset management firm CoinShares. The sell-off pressure from Mt. Gox and the German government likely prompted this surge in interest after three consecutive weeks of outflows.

Bitcoin dominated with US$398 million in inflows, accounting for 90% of the total. Despite the considerable dominance, the report by CoinShares highlights that this is relatively low, indicating that investors decided to diversify their investments in altcoins.

Solana emerged as the best-performing altcoin from a flows perspective, seeing US$16 million last week and bringing its year-to-date (YTD) inflows to US$57 million. Ethereum saw US$10 million in inflows but remains the only crypto-indexed exchange-traded product (ETP) with net outflows YTD.

Regionally, the US led with US$384 million in inflows. Hong Kong, Switzerland, and Canada also saw notable inflows of US$32 million, US$24 million, and US$12 million respectively. Germany was an outlier, experiencing US$23 million in outflows.

Blockchain equities, however, continued to see outflows, with an additional US$8 million last week, bringing YTD outflows to US$556 million.

ETPs’ volumes remained relatively low at US$7.9 billion for the week, reflecting typical seasonal patterns. This represents a 17% lower participation rate compared to the total market for trusted exchanges.