Crypto funds see $942 million outflow, ending 7-week run

Recent crypto price drop triggers first fund outflows in nearly 2 months

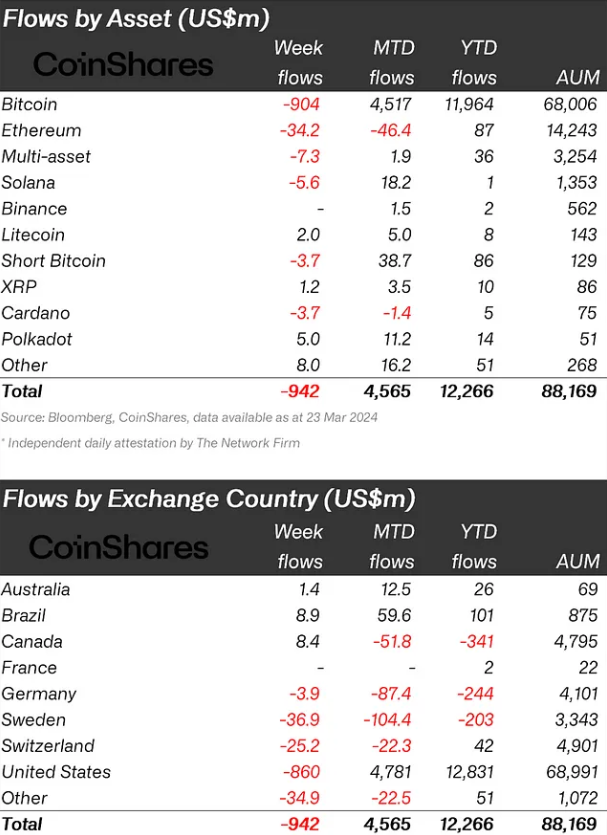

Crypto investment products saw record weekly outflows totaling $942 million, the first outflow following a 7-week run of inflows totaling $12.3 billion, according to a report by asset management firm CoinShares. Trading volumes in ETPs hit $28 billion for the week, around 66% that of the prior week.

“We believe the recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the US, which saw $1.1 billion inflows, partially offsetting incumbent Grayscale’s significant $2 billion outflows last week,” James Butterfield, head of research at CoinShares, stated in the report.

The outflows were focused on Bitcoin, which saw a $904 million exit. Ethereum, Solana, and Cardano also suffered, seeing $34 million, $5.6 million, and $3.7 million outflows respectively. However, the rest of the altcoin-related products, such as Polygon and Avalanche, saw net inflows of $16 million.

Regionally, Sweden, Switzerland, Hong Kong, and Germany experienced significant outflows, totaling US$37 million, US$25 million, US$35 million, and US$4 million, respectively. Conversely, Brazil and Canada saw inflows totaling $9 million and $8.4 million, respectively.

Brazil has been on a hot streak in crypto exposure through funds, with 13 consecutive weeks of positive inflows totaling $101 million in 2024.

Nonetheless, the year-to-date flows directed to crypto funds are still over $12 billion in 2024. Despite receiving significant investor attention in 2023, Solana’s netflow is just $1 million this year, while Ethereum shows $87 million in the same period.

Earn with Nexo

Earn with Nexo