Crypto funds show $7.6b in year-to-date inflows

Record trading volumes as Bitcoin and Ethereum lead the charge.

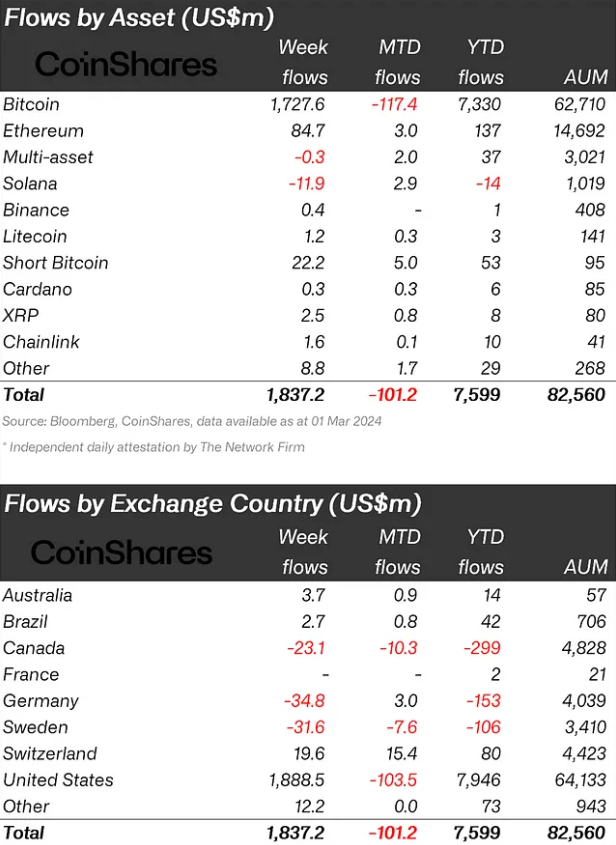

Crypto investment products experienced a monumental week with inflows surpassing $1.8 billion, marking the second-highest on record, a Mar. 4 report by asset manager CoinShares shows. Bitcoin was the standout, attracting 94% of these inflows, which amounted to $1.73 billion. This surge comes despite recent market volatility, which saw short investors inject an additional $22 million into short Bitcoin products.

Ethereum also witnessed significant activity, with inflows almost reaching $85 million last week, the largest since mid-July of 2023. However, its assets under management (AUM) stand at $14.6 billion, still below the peak of $23.7 billion. Meanwhile, total AUM across all digital assets is nearing an all-time high at $82.6 billion, approaching the previous record of $86 billion set in early November 2021.

The US market remains the epicenter of these inflows, contributing a net of close to $1.9 billion. This was despite Grayscale’s Bitcoin ETF experiencing outflows of $1.46 billion. New issuers more than compensated for this with a combined inflow of $3.2 billion. Other regions presented a mixed picture, with Switzerland seeing inflows of $20 million, while Sweden, Germany, and Canada faced outflows totaling $32 million, $35 million, and $23 million, respectively.

Polygon also made significant moves with inflows of $7.6 million, representing 22% of its AUM. In contrast, Solana faced outflows of $12 million. As the week concluded, trading volumes in investment products shattered previous records, exceeding $30 billion and at times accounting for half of the global Bitcoin trading volume on trusted exchanges.

Earn with Nexo

Earn with Nexo