Solana leads altcoins funds’ interest with $5.9 million in inflows

Grayscale's GBTC registered the smallest weekly outflows since January.

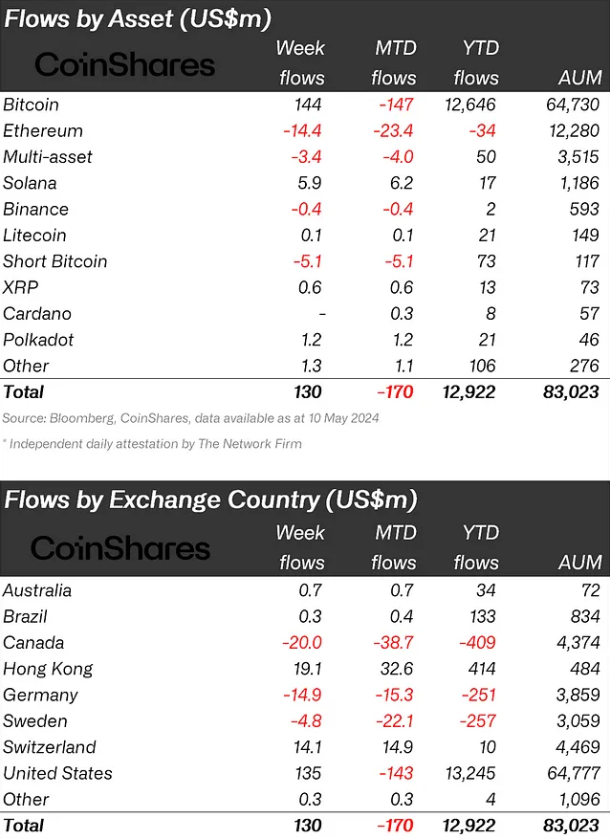

Crypto investment products showed $130 million in inflows last week, with Solana (SOL) leading the institutional investments in altcoins by growing $5.9 million. According to asset managing firm CoinShares, that’s the first weekly inflow for crypto funds in the past five weeks.

Bitcoin specifically garnered $144 million in inflows, recovering from what had been a lackluster month. Meanwhile, short Bitcoin exchange-traded products (ETPs) experienced outflows of $5.1 million, contributing to an eight-week total of $18 million in outflows.

The US regulators’ minimal engagement with ETF issuer applications for a spot Ethereum ETF has fueled speculation that approval may not be forthcoming. This sentiment is reflected in the $14 million in outflows observed last week.

In the US, inflows dominated, totaling $135 million, marking the smallest weekly outflows for Grayscale since January at $171 million. Switzerland also saw positive inflows, amounting to $14 million. Conversely, Hong Kong’s inflows slowed to $19 million after a previous week of record highs, indicating that the initial surge post-Bitcoin ETF launches may have been primarily seed capital.

Canada and Germany continued to face outflows, totaling $20 million and $15 million respectively, with their combined year-to-date outflows now reaching $660 million.

Despite this uptick, ETP volumes have decreased, with the week’s total reaching $8 billion compared to the $17 billion average in April. The current figures suggest a decline in ETP investor participation within the crypto market, now accounting for 22% of the total volume on trusted global exchanges, down from 31% last month.