Investors pull $600 million from crypto products following hawkish FOMC stance

Bitcoin faces $621M outflow as investors react to FOMC's hawkish signals.

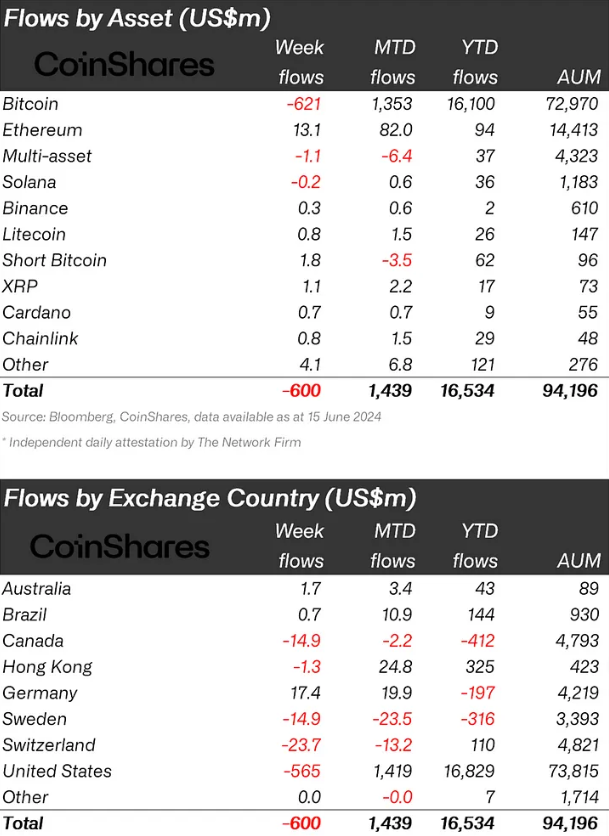

Crypto products saw $600 million in weekly outflows, marking the largest withdrawal since March, prompted by a “more hawkish-than-expected” Federal Open Market Committee (FOMC) meeting last week, according to CoinShares.

The recent outflows, coupled with a price sell-off, caused total assets under management (AUM) to drop from over $100 billion to $94 billion within a week. Notably, it also breaks the five-week streak of crypto products’ inflows.

Bitcoin (BTC) bore the brunt of the bearish mood, with outflows totaling $621 million. Conversely, the market’s cautious stance led to $1.8 million being channeled into short Bitcoin positions. Meanwhile, a variety of altcoins attracted inflows, with Ethereum (ETH), Lido (LDO), and XRP receiving $13 million, $2 million, and $1 million, respectively.

Additionally, the outflow was not evenly distributed across regions. The US accounted for the majority, with outflows of $565 million. However, the sentiment was widespread, with Canada, Switzerland, and Sweden experiencing outflows of $15 million, $24 million, and $15 million, respectively. Germany, Brazil, and Australia contrasted the trend with inflows of $17 million, $0.7 million, and $1.7 million, respectively.

Trading volumes dipped to $11 billion for the week, falling short of the $22 billion weekly average for the year, yet still substantially higher than the $2 billion weekly average last year. Despite the downturn, digital asset exchange-traded products (ETPs) continue to account for a consistent 31% of global trading volumes on reputable exchanges.