Crypto investment products show $2.5 billion inflows in a week

Bitcoin dominated 99% of last week’s inflows, while Ethereum showed $21 million growth in AUM during the same period.

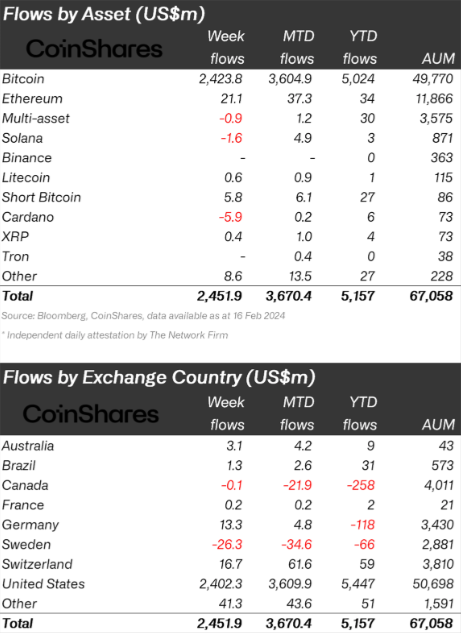

Crypto investment products experienced $2.45 billion inflows last week, according to a report by asset manager CoinShares. This surge has pushed the year-to-date inflows to a notable $5.2 billion. As a result of these inflows, combined with recent upward trends in prices, total assets under management (AUM) have climbed to $67 billion, a peak last observed in December 2021.

Bitcoin dominated the inflows, capturing over 99% of the total. Despite this, there was noticeable interest in short-bitcoin positions, which attracted $5.8 million in inflows. Ethereum also saw positive activity, with $21 million in inflows. On the other hand, Solana experienced a downturn, with outflows of $1.6 million attributed to its recent downtime.

Other cryptocurrencies such as Avalanche, Chainlink, and Polygon also saw positive inflows, each receiving around $1 million, maintaining a consistent trend of weekly inflows throughout the year.

Regionally, the majority of these inflows were concentrated in the United States, which accounted for 99%, or approximately $2.4 billion, of the total. This marks a significant uptick in net inflows across various providers, highlighting a growing interest in spot-based ETFs.

Meanwhile, outflows from established entities have seen a marked decrease. In contrast, other regions experienced more modest movements, with Germany and Switzerland recording inflows of $13 million and $1 million, respectively, and Sweden facing outflows of $26 million.