CryptoCompare Report Shows Exchange Security Still Worrying

Don’t drink and drive, and don’t keep your coins online. Exchange security is still largely dismal, according to a CryptoCompare report.

Don’t drink and drive, and don’t keep your coins online. Exchange security is still largely dismal, according to a sobering report by CryptoCompare. Many trading venues are still lacking when it comes to protecting users’ funds, and only one third of exchanges store the vast majority of their users’ coins in cold wallets.

The numbers were collated in the November 2018 Exchange Review, which was based on a study of 130 top cryptocurrency exchanges over the course of the past month.

The review found that, of the top 130 exchanges by daily trading volume, “only 86% have both a public privacy policy and a terms & conditions page,” meaning that a full 14% of exchanges do not inform users how their data will be used or what rights they surrender by using the exchange. Eleven percent of the exchanges studied “have been hacked in the past.”

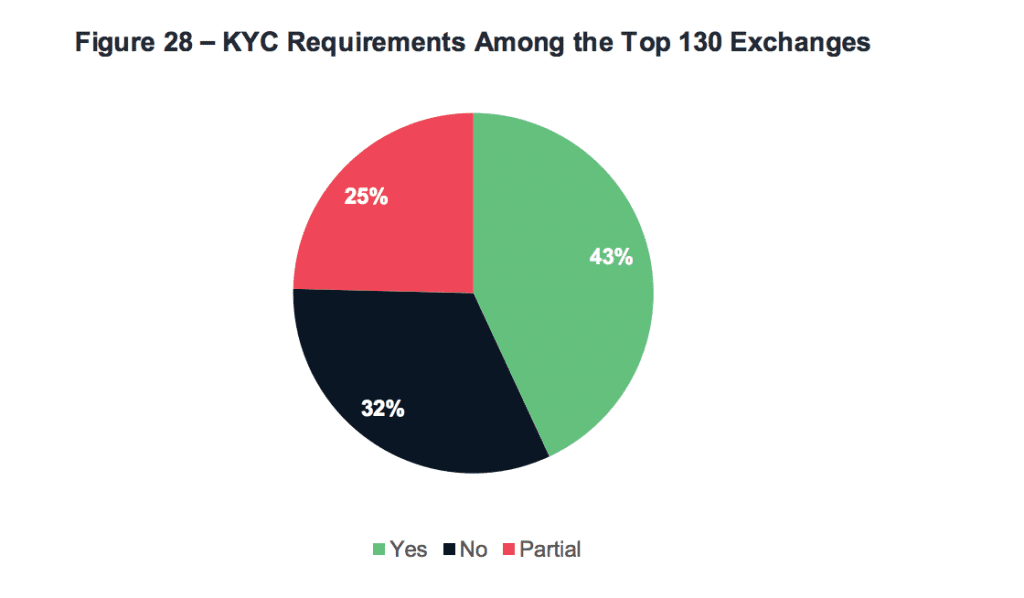

There are other causes for concern, since “Less than half of top exchanges impose strict KYC requirements, while just under a third do not impose KYC requirements.” Although KYC does not guarantee the security of users’ accounts, strict identification requirements may have a detrimental effect against hacks.

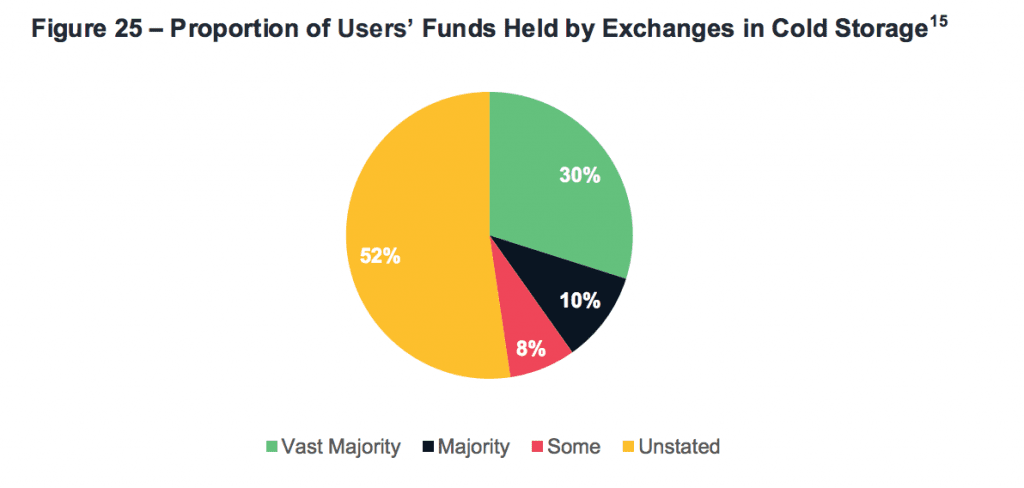

Custody may also be a cause for concern, with only only 30% of exchanges storing the vast majority —over 90%—of custodial funds in cold wallets, the study found.

Another 10% of exchanges stored 50-90% of user funds in cold storage, and 60% either stored “some” funds in cold storage or—more ominously—had no figures at all.

Meanwhile, the safest ways to trade funds are still among the least-used. Decentralized exchanges, which allow users to to trade without sending their funds to a third party, accounted for only $2.6 million USD per day: less than half a percent of all exchange volume.

Although alarming, the situation may be less dire than it looks. For one thing, the numbers are not weighed by exchange volume—which means that poorly-secured venues may be numerous but account for only small fraction of trading volume. Exchanges with stronger security protocols—like Bithumb and Coinbase—account for much larger slices of the transaction pie.

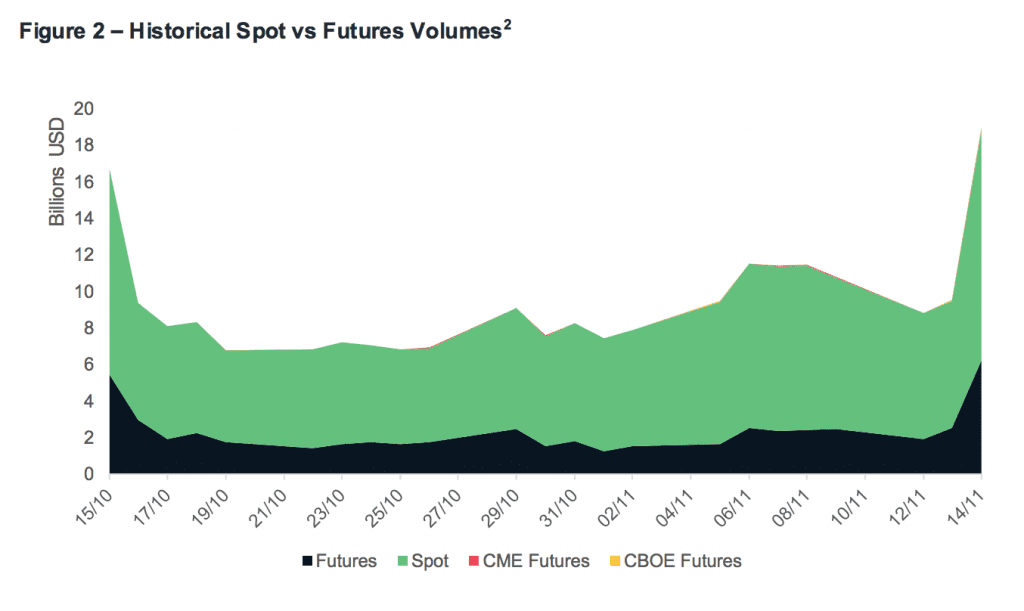

There are a few other things to learn as well. The Bitcoin Futures offered by CBOE and CME—once considered the tip of the Wall Street’s wedge for institutional investments—have had a nearly negligible effect on crypto trading, accounting for a mere 0.25% of crypto trades. By comparison, the volume of futures trading on BitMex and other crypto exchanges was about a hundred times greater.

CryptoCompare, which conducts this study, has recently announced a new commercial API service to offer updated real time and historical data for all coins and exchanges. The free service is used to deliver up to 180 million calls per hour at present – but the upgrade may help serious investors keep track of which exchanges are operating at an acceptable level of comfort.

Overall, the final picture from the Exchange Review is not a uniformly dismal one. But for traders hoping for a more mature and sophisticated cryptocurrency market, the latest figures show that they still have a long way to go.

The author is invested in digital assets, including Bitcoin.

Earn with Nexo

Earn with Nexo