Decentralized Machine Learning ICO Review (DML)

Share this article

Decentralized Machine Learning ICO Overview

The Decentralized Machine Learning ICO and DML Token Sale are offering a platform that utilizes the untapped private data and idle processing power of user devices for AI model training while protecting data privacy.

DML have set out to build a trustless, middle-man free machine learning infrastructure that connects developers, enterprise clients and users, democratizing the machine learning and big data market by providing all stakeholders a way to benefit from their participation.

DML plan to accomplish this through federated learning, enabling individual mobile phones to train prediction models while still keeping all training data on the device, eliminating the need to store data elsewhere.

Decentralized Machine Learning ICO Value Proposition

DML intend to unlock the massive breadth of untapped data while lowering the bar for developers to sell useful algorithms.

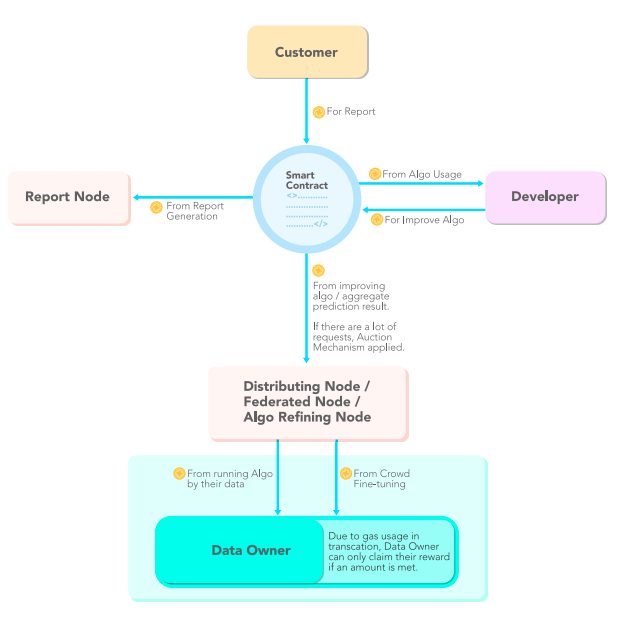

At the core of the DML protocol is the the smart-contract based DML Algo Marketplace, where any developer can list a machine learning model for sale in a middleman-free environment. Customers may source the desired machine learning model from the DML Algo Marketplace, crowdsourced from the developer community, and access valuable insights via the DML protocol.

The DML Application provides the channel for developers and enterprise users of the DML Algo Marketplace to source real-time data from anyone with a smart device. With the DML App, users authorize specific types of datasets, such as photos, for machine learning algorithms to train on.

In addition, with user authorization, non-public data located on other applications such as social media can be used to train machine learning algorithms via API integration. Therefore, DML not only connects private data stored inside the device, but also provides a channel to access the massive amount of data stored within existing networks.

The unlocking of all untapped data available on user devices and apps opens up the possibility for radically improved predictive models in fields such as finance, politics and consumer trends.

The Decentralized Machine Learning Token (DML) has several uses within the ecosystem and is ERC20 compatible. DML is paid to users for contributing both data and idle processing power to train machine learning algorithms.

DML is also used to incentivize the developer community to create machine learning algorithms. Customers can then deploy these algorithms available on the marketplace by purchasing them with DML tokens. Additionally, developers seeking to train and enhance the accuracy of their models can reward trainers with DML tokens.

DML tokens are also used to incentivize nodes. Nodes serve functions within the ecosystem such as as distributing algorithms, aggregating and averaging local machine learning results through federated learning and producing aggregated machine learning reports.

Diagram of the DML Ecosystem from whitepaper

Decentralized Machine Learning ICO Team

Michael Kwok is the Project Lead Director and Co-founder of DML. Michael has achieved previous success with startups as a Co-founder of Capheart, an app that provides expedited ambulance services to cardiac arrest patients. He also has experience in the finance sector with 3 years as a relationship manager for Hang Seng and Standard Chartered Bank. He has another 4 years experience as a Financial Analyst with Bank of China.

Jacky Chan (serves as Blockchain Developer and is a Co-founder of DML. He is currently also VP of Engineering at the blockchain consultancy company Kyokan Labs and is a contributor to Metamask and DFINITY. He has previous experience as a software developer at Uber and was also an engineer at Symphony Communication, which was later acquired by Goldman Sachs. He is not pictured above.

Victor Cheung is a Blockchain Developer for DML. He graduated from University of Hong Kong with an MSc in Computer Science, and has been a full stack developer since 2010. He also has experience in the startup world alongside Michael Kwok as CTO and Co-founder of Capheart.

Pascal Lejolif serves as one of the Machine Learning Engineers for the project. His past experiences include roles as a project manager in tech and time as a CTO for an IT services company.

The advisors for the Decentralized Machine Learning ICO include 4 experts in the AI field and 2 in blockchain. Among them is Michael Edesess, who serves as Chief Investment Strategist at Compendium Finance.

A complete list of the team can be found here.

DML ICO Strengths and Opportunities

DML have made good progress on their product development. A working prototype of the DML Algo Marketplace and DML App is running on an Ethereum testnet. A video demonstration of the DML Algo Marketplace and App are available on their Medium page.

There is also significant activity on the Decentralized Machine Learning Github indicating the team is focused on developing the product and delivering a beta version of the DML Algo Marketplace for the Token Generation Event.

In the realm of machine learning, one of the most obvious non-blockchain competitors is Kaggle, a platform for predictive modelling and analytics competitions. DML offers several advantages over the popular platform of particular note. Kaggle primarily focuses on building and training algorithms from scratch. With DML, developers and enterprise customers can deploy their own completed algorithm on the protocol to train on user data.

Enterprises may be able to source a valuable algorithm from a development competition via Kaggle, but still require data for meaningful output. While datasets are available on Kaggle and other similar platforms, they are limited in scope and quality. DML essentially provides real-time access to the data of any number of users running the app.

In addition, each algorithm can be used by multiple enterprise clients, providing an incentive for developers to utilize the Marketplace over a competition oriented platform such as Kaggle.

As all algorithms must undergo training, DML offers an additional incentivized solution for trainers and training data sets. DML will crowdsource trainers, who are voluntary DML app users, to spend time and contribute relevant data in exchange for DML tokens.

Conceivably, this crowdsourcing model of training will enhance algorithm accuracy by lowering the bar to entry for machine learning trainers while simultaneously offering wider access to quality data training sets. This represents a unique, incentivized approach to initially training predictive models, improving output quality and therefore adding value to the final product.

DML ICO Weaknesses and Threats

Google has recently released information about a new cloud-based infrastructure called Google Federated Learning for crowd training of algorithms. Google are testing the protocol for the purpose of personalizing mobile phone user experiences such as improved search predictions

At this early stage, it remains unclear what plans Google has for publically deploying the protocol. It’s conceivable that much like other publically available products such as Google Analytics, Federated Learning may follow the same path. On the other hand, if Google maintains a focus on device optimization with the product, there will be less competition to face from at least one of the tech giants entering the decentralized machine learning market.

The model delivered by DML has advantages that bolster confidence in the project even in the face of strong competition. By targeting personal devices in addition to apps like Facebook, DML offers a strong incentive both to users through direct rewards for participation and enterprise clients by offering access to an enormous untapped amount of data.

Moreover, the big data analytics market valuation is estimated to reach $200 billion by 2020, indicating there is ample space for many players. Yet, the ultimate value of the product is derived directly from the number of users running the DML App on their devices. Mass adoption is therefore the crucial variable which will decide the fate of DML.

To this accord, no partnerships have yet been established that could help onboard users. An articulate strategy for garnering a significant user base is still missing and we hope to see more development on this front.

The Verdict on Decentralized Machine Learning ICO

DML offers a product with the potential to unlock a huge source of value for developers, enterprises and users. Compared to other machine learning solutions that focus exclusively on incentivizing developers, DML have designed a more comprehensive and inclusive ecosystem.

Of course, the success of that ecosystem will ultimately depend on user adoption, which remains the big question at the moment.

As a Top 10% rated ICO, we will be placing a small bet on the Decentralized Machine Learning ICO (DML Token).

We have rated hundreds of projects to unearth ICOs in which members of our team intend to invest.

We won’t often go into further depth on projects that we don’t consider as candidates for our investments after the initial rating process, which is why you will usually see our stamp on our detailed ICO reviews – they are the best we have found. However, on occasion, we might also rate a well-hyped project that does not meet our personal investing criteria.

The Crypto Briefing Top 10 stamp is awarded to ICO projects that we rate in the top 10% of all projects.

Learn more about the Decentralized Machine Learning ICO from our Telegram Community by clicking here.

DECENTRALIZED MACHINE LEARNING ICO REVIEW SCORES

SUMMARY

The Decentralized Machine Learning ICO has the potential to create an incentivized marketplace for the development and exchange of AI algorithms that draw on both public and private data sources. As such, it is looking to enterprise clients who use Big Data in order to improve their predictive analytics. It can’t be stressed highly enough that this is what such enterprises – political, commercial, governmental – seek. If the DML token gains widespread adoption (for which we don’t see a fleshed-out plan yet) it could be hugely disruptive.

Founding Team……………………….8.4

Product…………………………………..6.5

Token Utility…………………………..9.5

Market…………………………………..8.2

Competition…………………………..5.0

Timing……………………………………9.4

Progress To Date……………………1.2

Community Support & Hype…..7.2

Price & Token Distribution……..7.8

Communication……………………..10.0

FINAL SCORE……………………….7.5

UPSIDES

- Team has prior startup success along with strong tech background

- Innovative solution for big data analytics

- Target market has huge potential

DOWNSIDES

- Competition set to heat up in the machine learning space

- No visible partnerships to date

Today’s Date: 3/10/18

Project Name: Decentralized Machine Learning

Token Symbol: DML

Website: https://decentralizedml.com/

White Paper: DML Whitepaper

Crowdsale Hard Cap: 28,000 ETH

Total Supply: 330,000,000 DML

Token Distribution: 54.2% to Crowdsale, 19.5% to Team and Advisors, 15% to Reserves, 8.8% to Strategic Partnerships, 2.5% to PR and Marketing Partners

Price per Token: 1 ETH = 3,780 DML

Maximum Market Cap (at crowdsale price): $46,000,000 USD

Accepted Payments: ETH

Countries Excluded: USA, China, Singapore and Hong Kong

Bonus Structure: 10% for Early Whitelist Participants in TGE

Presale Terms: N/A

Whitelist: https://decentralizedml.com/main_whitelist_form

Important Dates: Crowdsale- Mid-March 2018 (Expected)

Expected Token Release: TBA

Additional Information: DML TGE Information

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article