DeepBrain Chain ICO Review And DBC Token Analysis

The DeepBrain Chain ICO and DBC token sale is looking to raise funds for a decentralized platform that will give AI developers access to cheaper, more extensive computing power and data.

DeepBrain Chain ICO Overview

The artificial intelligence industry is set to take off. At the core of the industry are three essential elements that drive development forward: computing power, algorithms and data. As is often the case with technological innovation, scaling these elements to meet the pace of development requires radically lowering costs and increasing efficiency. The cost burden of scaling on small and medium size enterprises in the AI industry can be especially prohibitive toward product development. Machine learning and neural networks require large data sets on which to train; the more data, the more computing resources are needed. Such processes can take weeks or even months due to limits on data quality and processing power, which translate to higher costs for AI companies. Once a neural network is developed, large amounts of processing power are needed again to decode them. Add to these factors the difficulty of accessing high-quality data sets and a picture starts to emerge of how many barriers there are that keep the AI industry from blossoming. The DeepBrain Chain ICO application of blockchain to AI development holds great promise in overcoming those barriers and propelling the industry forward by leaps and bounds.

DeepBrain Chain ICO Value Proposition

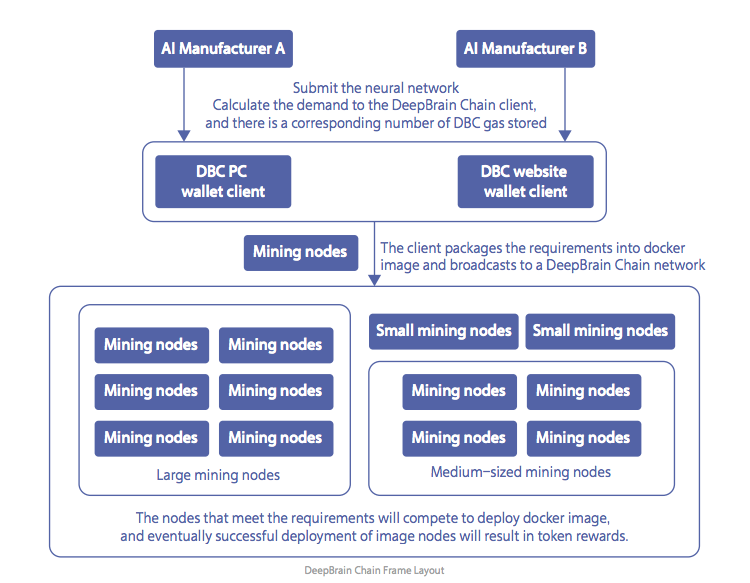

The goal of DeepBrain Chain is to provide a more efficient and cost-effective way forward for AI development. Utilizing the blockchain to access computing power, DeepBrain Chain creates a decentralized ecosystem that incentivizes provision of processing power and data sets for a reward. Idle computing nodes can be deployed for use by developers to earn DeepBrain Coin (DBC) in return. The decentralized network drastically reduces costs for developers because there is no need to acquire more hardware to access larger amounts of computing power. It also dramatically increases the scalability of AI development through access to exponentially greater computing power via the blockchain, meeting another fundamental demand of the industry. Lower costs combined with higher processing capabilities will reduce the difficulty faced by many companies with AI use cases for implementing the technology, spurring development and adoption in turn.

DeepBrain Chain ICO Team

CEO Feng He made his foray into the AI industry in 2012, taking charge of developing China’s first voice assistant Smart 360, with tens of millions of users. Since then he has successfully launched another voice assistant product and more recently led the DeepBrain platform.

Chang Shu is an expert in AI development, with an extensive background in big data analysis and computational linguistics. He’s held research positions at the University of Nottingham and National Institute of Informatics in Japan and serves as the CTO for the project.

Chuangfeng Lee also began his experience in the AI industry leading the marketing team for Smart 360, growing the user base to 17 million. He serves as CMO at DeepBrain Chain.

On the blockchain development side, the situation is a bit murkier. From the whitepaper, it’s unclear if Senior Engineer, Lingbing Wang, has any prior blockchain experience under his belt. Jason Yi’s profile references the Bytom chain but his level of involvement is also murky. With the level of DeepBrain Chain’s complexity, it would be more assuring to have a lead development team that’s has stronger traction with blockchain.

DeepBrain Chain ICO Strengths and Opportunities

We think the utility of DBC is a strong point of the project. The token rewards the use of any available processing power, making more efficient use of existing infrastructure on the decentralized network instead of adding more machines at the individual enterprise level. The ability to reduce the overall cost of AI development also lowers the barrier for companies with a use case to integrate the technology, adding further value to the token utility. Within the ecosystem, there is both incentive to mine, reward and accumulate the token. In our view, these are all promising factor that indicate excellent token utility.

Currently, more than 100 corporate clients and 200,000 users are already using the DeepChain platform, including Microsoft, Siemens and Samsung. Building on their current product, the DeepBrain Chain will integrate existing data sets and indigenous AI skill applications into the ecosystem. With a solid user base and successful product already in place, the groundwork has been laid for continuous scaling. Growth projections of the AI industry show in 2018 alone the potential is enormous. The timing for such a product is right on the money.

The strong fundamentals of the DeepBrain Chain ICO have attracted investment from large VC players Gobi Partners and GSR Ventures. The NEO Council has also invested in the project and is actively promoting it as another pioneer of the Smart Economy. The community support for the project is palpable, with lots of buzz on social media and a decent following.

DeepBrain Chain ICO Weaknesses and Threats

The DeepBrain Chain ICO is not alone in their mission to fuse blockchain and AI. SingularityNET is set to dish out some healthy competition, with Chief Humanoid, Sophia Hanson, drawing her fair share of attention. While the projects offer different core value propositions, they are competing as platforms for the trade and exchange of AI data sets, services, algorithms and applications.

The development team lacks the blockchain experience we’d like to see for tackling all of the potential challenges presented by such a complex and innovative project. The lack of a testnet adds more uncertainty to this effect with no indicators to gauge technical progress thus far. External support for blockchain development would warrant more confidence in the eventual on-chain product, which at the time of the ICO still remains speculative. Still, we think with a proven business case, the long-term gains far outweigh the short-term challenges of moving the project on-chain.

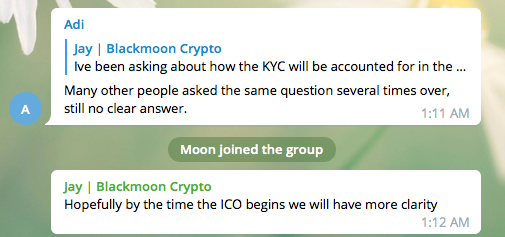

The team’s communication with prospective investors in the days leading right up to the DeepBrain Chain ICO has been suboptimal. No team members are available to answer questions in the Telegram group, and confusion over how to participate in the token sale is rampant. Admins of the group simply offer a shared Google doc that mirrors the website exactly in response to questions. Without a voice from the team to address the community directly on fundamentals, the confusion only serves to stifle an otherwise fantastic project. Below is a screenshot from the Telegram group illustrating this point:

The Verdict on the DeepBrain Chain ICO

The project concept is outstanding for the potential it holds to transform the AI industry and a solid foundation is already in place for that concept to materialize. DeepBrain Chain has already demonstrated their ability to excel in the current AI market, which is on the verge of massive expansion. Yet, for all the strengths we see in the project, we’ve deducted points for the team’s weak communication and investor confusion around the ICO. As for our final call, we’ll be making a medium size bet on the DeepBrain Chain ICO.

Learn more about the DeepBrain Chain from our Telegram Community by clicking here.

Todays Date: 12/14/17

Project Name: DeepBrain Chain ICO

Token Symbol: DBC

Website: https://www.deepbrainchain.org/pc/indexEnglish.html#td

White Paper: https://www.deepbrainchain.org/pc/DeepBrainChainWhitepaper.pdf

Crowdsale Hard Cap: US$8-9 million (12,000 ETH according to website)

Total Supply: 10,000,000,000

Token Distribution: 15% to pre/crowd sale, 10% to team/advisors, 50% for mining production and 25% for DeepBrain Chain foundation and ecosystem

Price per Token: 2200-3000 DBC = 1 NEO

Maximum Market Cap (at crowdsale price): US$60 million

Bonus Structure: n/a

Presale Terms: Presale is over

Whitelist: Ongoing KYC https://www.deepbrainchain.org/pc/kycEnglish.html

Important Dates: ICO begins on 12/15

Expected Token Release: TBA

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Earn with Nexo

Earn with Nexo