How traders are using Delta Exchange’s trackers to simplify crypto moves

Delta Exchange trackers give traders quick and simple BTC exposure with lower fees and no leverage complexity.

Imagine checking your crypto portfolio one morning — Bitcoin is up 6%, but you didn’t trade. You were waiting for the right moment, and now you’ve missed the opportunity.

Sounds familiar?

Many traders hesitate because most tools either feel too complex or come with risks they’re not ready to handle. While futures and options offer precision, they aren’t always beginner-friendly or time-efficient for short-term moves.

Enter – Trackers on Delta Exchange – an approach designed for fast-paced decision-making without added technical complexity. In this post, we’ll discuss how trackers can be a good choice for short-term trading in crypto.

About Trackers on Delta Exchange

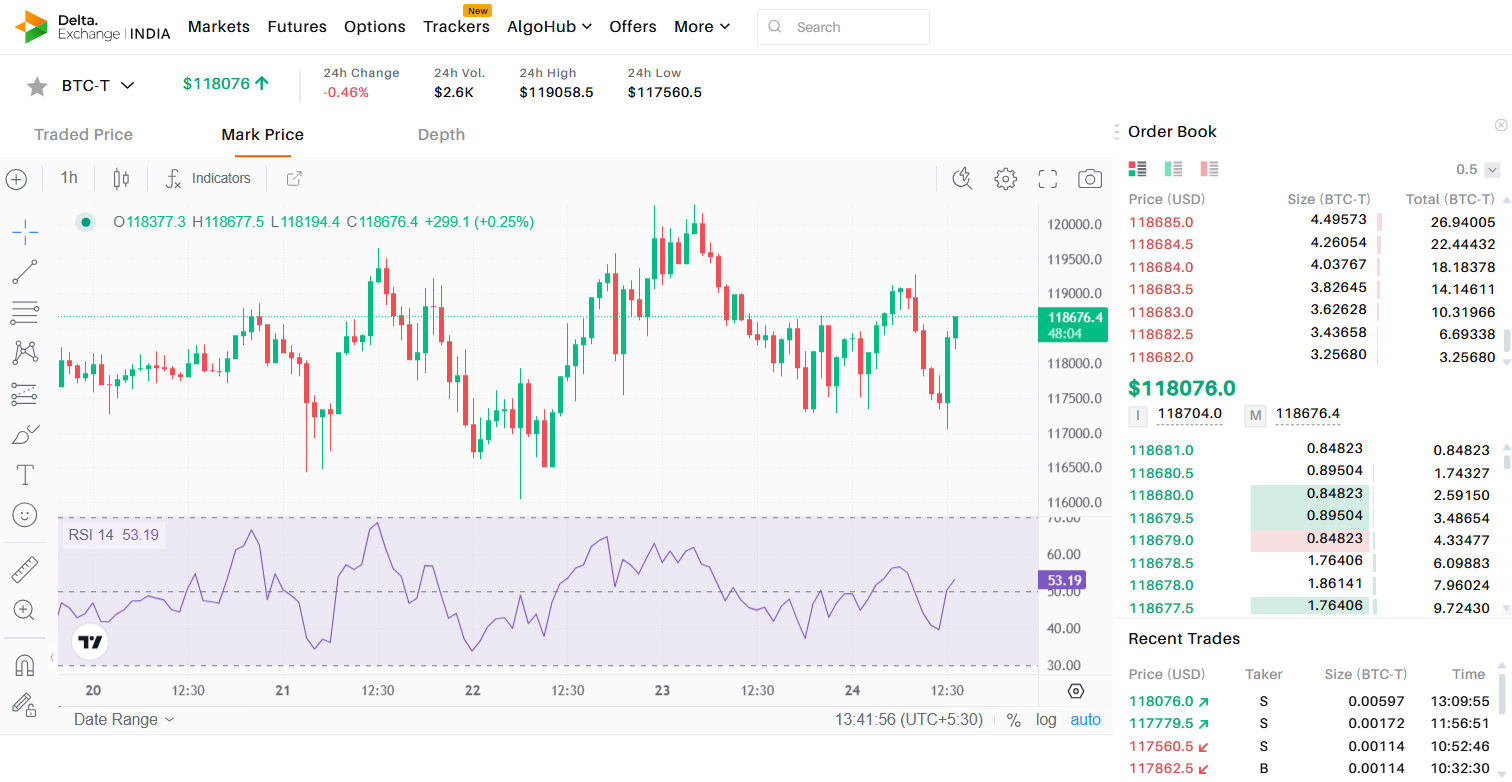

Trackers on Delta Exchange are built for those who want a simpler way to respond to price movements, especially in fast-moving markets. These contracts closely follow the price of crypto assets, similar to spot trading. So if you buy a BTC Tracker (BTC-T), you benefit when Bitcoin rises, without needing to set up a leveraged position.

Since trackers are non-leveraged, sharp price drops won’t result in liquidations. You hold and sell BTC-T when you’re ready. Unlike many futures and options contracts, trackers don’t allow short selling, so they’re ideal if you’re only looking to take long positions in BTC or altcoins.

So while they behave like a spot position, they benefit from easier tax treatment since they are still a derivative product.

How Trackers Are Built for Short-Term Moves

If you want quick exposure without complex setups, Delta Exchange trackers are a solid option. Compared to directly buying crypto assets, trackers often have tighter spreads and lower slippage — especially during volatile swings. That matters when you’re frequently entering and exiting positions.

They also tend to cost less to trade than the actual asset. And while there is a small daily holding fee, short-term traders usually close positions before that becomes significant. Since these are derivatives, VDA-specific taxes do not apply.

What Are the Costs Involved?

The trading fees are transparent. Trading trackers on Delta Exchange involves a small trading fee and a daily holding cost. The trading fee is 0.05%, charged when you buy and sell.

For example, if you buy 100 lots of BTC-T at 1 PM, worth $100, you’d pay $0.05 as an entry fee. If you buy another 100 lots the next day and sell all 200 lots before 5:30 PM, only trading fees apply — no holding cost.

But, if you hold the 200 lots beyond 5:30 PM, a small daily holding fee (say 0.03% per lot) is applied.

Benefits Over Other Crypto Instruments

-

Trackers on Delta Exchange offer a simpler and cleaner way to trade BTC, especially if you’re looking for short-term exposure in the volatile market.

-

Compared to spot trading, trackers typically come with lower trading fees, making them cost-effective for quick entries and exits.

-

Unlike futures and options on crypto exchange, there are no margin calls, no funding rates to track, and no need to manage leverage. That takes a lot of pressure off if you prefer keeping things straightforward.

Why Delta Exchange is Among the Top Crypto Trading Platforms?

Over the years, Delta Exchange has become the go-to choice for many and is one of the leading cryptocurrency trading platform, and here’s why:

-

FIU-compliant: Delta Exchange operates under the regulatory standards of the Financial Intelligence Unit of India, giving traders a chance for INR transactions.

-

Demo account: If you want to try out trackers on Delta before investing real funds on the line, you can experiment using a demo account setup.

-

Payoff charts: Visual tools like payoff charts make it easier to evaluate trades with breakeven points, potential gains and losses, all in one glance – before finalising trades.

Final Thoughts

Delta Exchange continues to roll out new features that align with how today’s traders operate. With a daily trading volume crossing $4 billion, the platform has proven it can handle high-frequency trades.

Whether you trade BTC casually or explore futures and options in crypto more actively, the platform is built for both. Tools like trackers on Delta make it easier to act on short-term market signals without needing large capital or complex setups.

Disclaimer: Cryptocurrencies are highly volatile and carry inherent risks. Kindly do your own research before investing in digital currencies or crypto derivatives on www.delta.exchange.