Crypto funds register $126 million in outflows led by investor hesitancy

Investor caution evident as ETP market share declines, according to CoinShares.

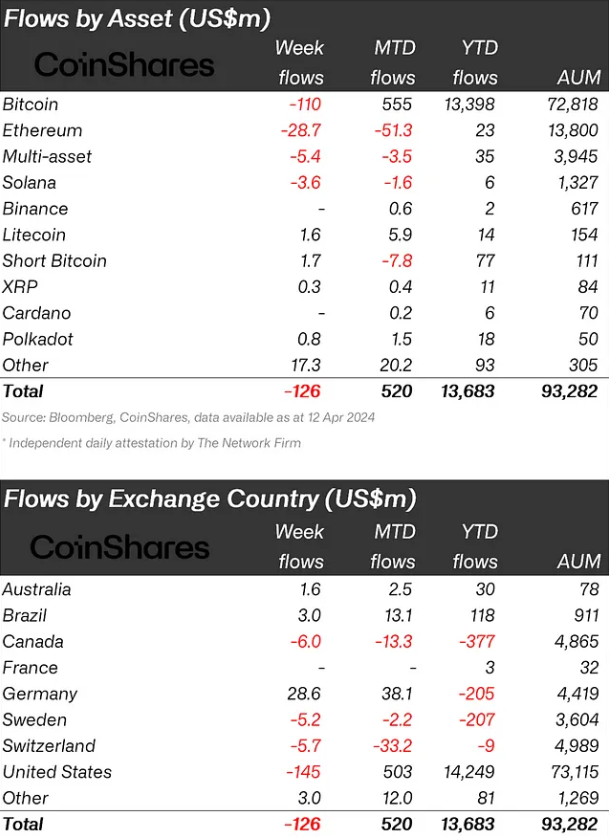

Crypto products recorded $126 million in weekly outflows, a report by asset management firm CoinShares shows. The movement is seen by James Butterfill, head of research at CoinShares, as investor caution as the recent surge in prices appears to have lost momentum.

Nevertheless, trading volumes saw a slight increase from $17 billion to $21 billion week-on-week, despite the share of exchange-traded products (ETP) activity in the total market volume on trusted exchanges dropped from 40% to 31% over the last month, which underscores the more cautious approach among investors.

Bitcoin, despite $110 million in outflows, maintains a positive monthly inflow of $555 million. Short Bitcoin positions saw a change in trend with minor inflows of $1.7 million, suggesting investors are looking to capitalize on the recent price drops.

Ethereum’s challenges persisted, with the platform facing its fifth consecutive week of outflows, totaling $29 million. On the other hand, altcoins like Solana experienced $3.6 million in outflows, but other less mainstream assets such as Decentraland, Basic Attention Token, and LIDO saw inflows of $4.9 million, $2.9 million, and $1.8 million, respectively.

In the US, outflows reached $145 million, the highest among all regions. Switzerland and Canada also experienced outflows of $5.7 million and $6 million, respectively. Conversely, German investors viewed the recent price downturn as a buying opportunity, resulting in $29 million in inflows.