Shutterstock photo by Enna8982

Dogecoin Overtakes Tether in Market Cap After Making New All-Time High

Dogecoin has caught the market's attention after rising by 181% in the last 24 hours.

Dogecoin continues its staggering advance thanks to a new wave of interest. Even after nearly 200% in gains, DOGE may just be getting started.

Dogecoin Leads the Charts

Dogecoin has stolen the crypto spotlight after skyrocketing by a more than 180% in the last 24 hours. While the rest of the market bled, DOGE surged from $0.18 to make a new all-time high of $0.46.

The sudden bullish impulse pushed it up in the rankings to become the fifth-largest cryptocurrency by market capitalization, above Tether.

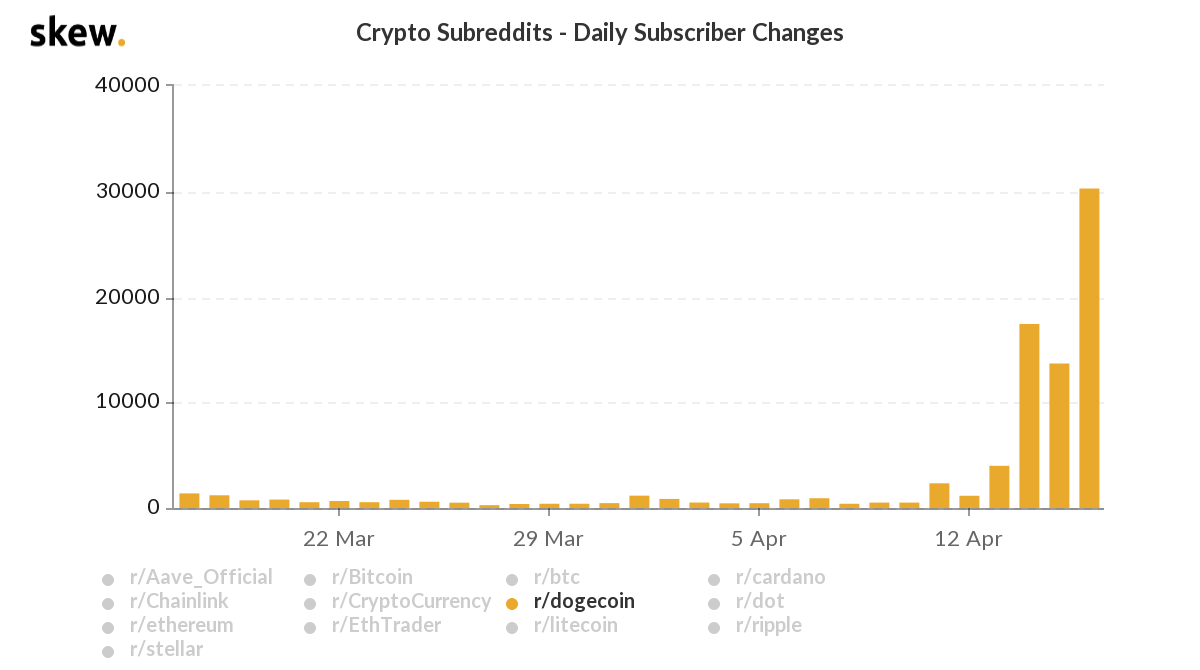

Skew implied that the hype behind Dogecoin is real. The data analytics firm recorded a significant spike in the number of daily subscribers on Dogecoin’s subreddit over the past week.

There were roughly 500 subscribers to r/dogecoin on Apr. 10. Now, more than 30,000 people have joined this subreddit community.

Further Gains on the Horizon

From a technical perspective, Dogecoin’s explosive price action comes from the breakout of an ascending triangle that developed on its daily chart since late January. The three-month-long consolidation period ended on Apr. 13, with a 416% upswing.

The most optimistic target is determined by measuring the height of the triangle’s y-axis from the bottom up and adding that distance to the breakout point. When taking this into account, DOGE has met the bullish target as it rose above the 200% Fibonacci retracement level at nearly $0.36.

As FOMO drives even more investors, Dogecoin may have a chance to advance to the 227.2% or the 261.8%Fibonacci retracement level. These areas of interest sit at $0.52 and $0.83, respectively.

Given the magnitude of Dogecoin’s uptrend, it would be reasonable for prices to slow down before targeting higher highs.

A rejection from the $0.36 hurdle might lead to a spike in profit-taking that sends DOGE back to look for support around the 161.8% or 141.4% Fibonacci retracement level.

These demand walls sit at $0.21 and $0.16, respectively.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.