dYdX community approves 60 million token stake with Stride

Staking service by Stride enhances dYdX's treasury and network security.

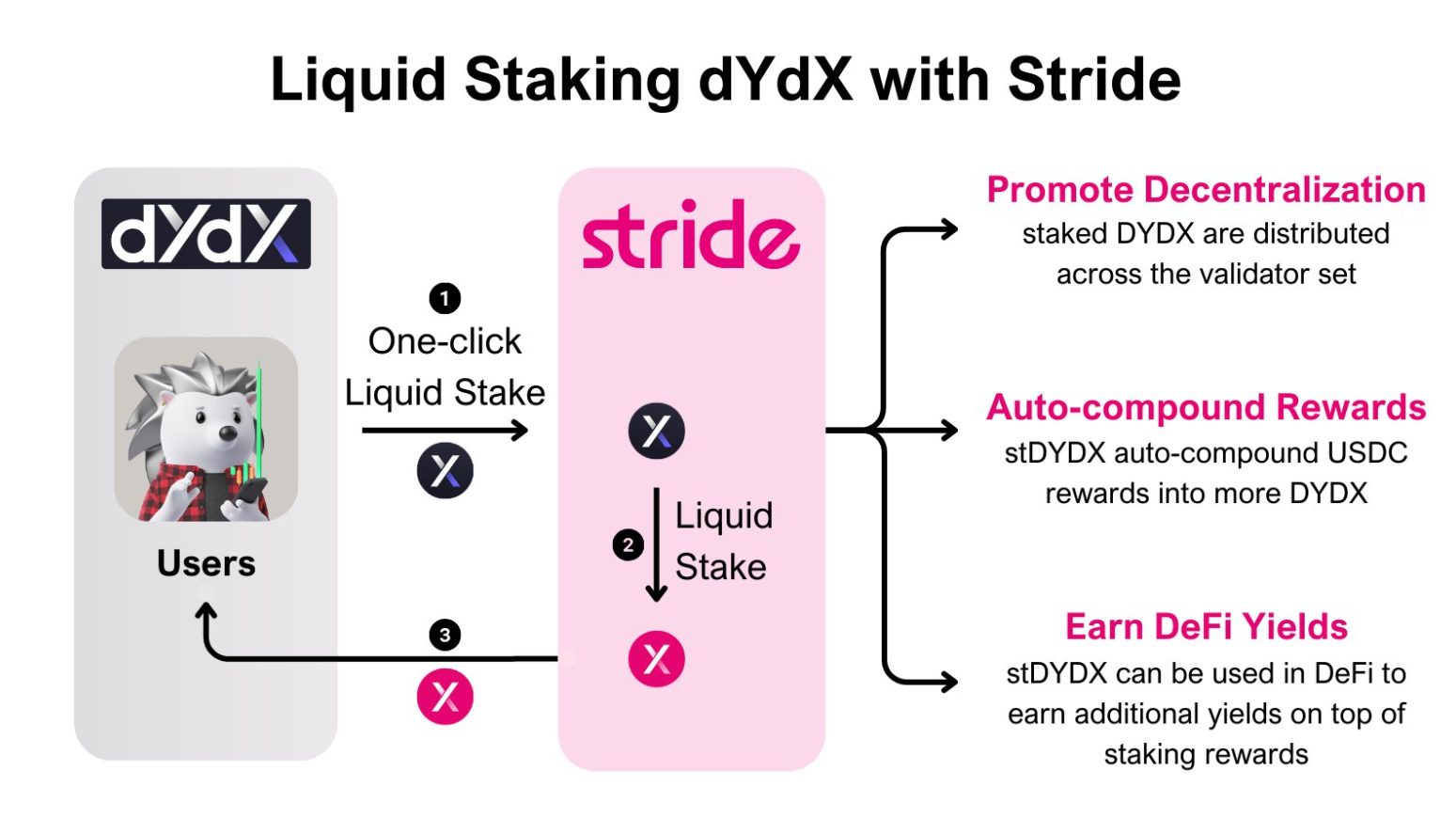

The dYdX community approved on April 6 a proposal to stake 20 million DYDX tokens on liquid staking protocol Stride, valued at over $60 million at the time of writing. Riley Edmunds, Stride’s co-founder, explained on an X post that the USD Coin (USDC) rewards from staking will be auto-compounded into DYDX, and the tokens will be distributed over a validator set to bolster network security.

2/7 Every time you liquid stake DYDX, the Stride chain:

• Issues stDYDX to your wallet instantly ⚡

• Stakes your tokens with qualified validators 🛡️

• Auto-compounds USDC rewards into more staked DYDX ➰

All of this is done in 1 click 💥

— Riley | Stride (@interchainriley) April 7, 2024

Stride’s system issues a DYDX liquid staking token, the stDYDX, to the user’s wallet, stakes the original tokens with reputable validators, and auto-compounds USDC rewards into more staked DYDX. This auto-compound means that Stride will add DYDX to its treasury.

Moreover, this entire operation is automated and occurs every six hours, and doesn’t demand interactions from users.

Stride’s Interchain Accounts (ICA) play a crucial role by claiming staking rewards on the dYdX chain and converting USDC into DYDX through a series of transactions, which will involve asset issuance blockchain Noble and decentralized exchange Osmosis.

The staking mechanism also promotes decentralization by delegating stakes evenly across a set of validators, excluding the top 33% of vote power to improve stake distribution. To users, the process of staking and unstaking remains the same.

Earn with Nexo

Earn with Nexo