Shutterstock covers by Kaspars Porins and nartawut (edited by Mariia Kozyr)

Ethereum Breaches Resistance, Targeting Higher Highs

Ethereum appears to be gaining momentum for a significant price movement.

Ethereum could be ready to rise after overcoming a significant supply barrier. A spike in buying pressure could result in a major rally.

Ethereum Breaks Critical Resistance

Ethereum appears to be bound for significant price action as its on-chain activity turns bullish.

The second-largest cryptocurrency by market cap has risen by more than 15.7% over the last five days, gaining over 400 points in market value.

According to technical analyst Luke Martin, the upward price action allowed ETH to breach a critical trendline that had been preventing it from rallying since the beginning of the year. Further buying pressure could push Ethereum past the psychological $3,000 resistance level.

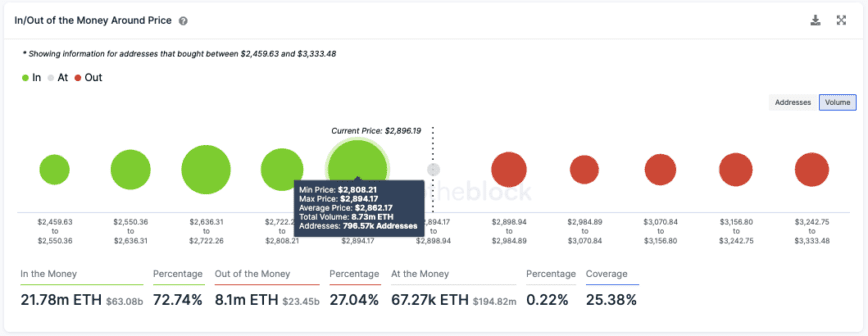

On-chain data from IntoTheBlock shows that Ethereum faces little to no resistance ahead. The most significant supply wall was at $2,860, where nearly 800,000 addresses have previously purchased 8.73 million ETH. Now that this hurdle has been turned into support, ETH could be ready to advance to $3,300 or higher.

Recent exchange outflows adds credence to the bullish outlook. 180,000 ETH was withdrawn from known cryptocurrency exchange wallets today. IntoTheBlock maintains that this is the largest outflow from centralized exchanges recorded in 2022. The last time such a high quantity of ETH was removed from exchanges was in October 2021. The price of ETH surged 15% soon after.

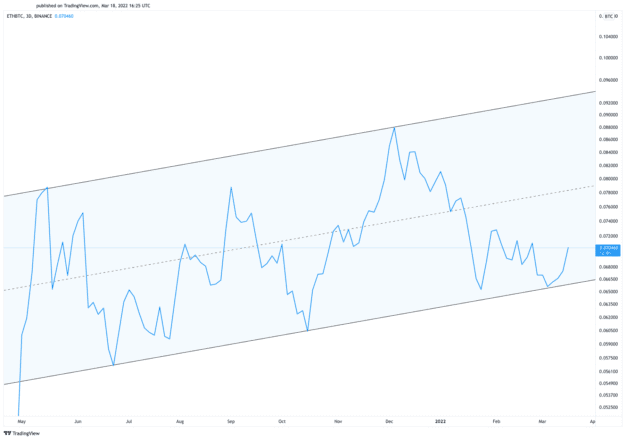

The ETH/BTC trading pair also appears to be primed for an upswing. It has been contained in an ascending parallel channel since May 2021, where each time it tests the lower boundary of this technical formation, it rises by more than 40% towards the upper trendline to the retrace again.

Similar price action could see the ratio between Ethereum and Bitcoin surge to 0.078 or even 0.094. At a ratio of 0.079, Ethereum would be half the market cap of Bitcoin. The ratio would need to be 0.159 for Ethereum to “flip” Bitcoin like many crypto enthusiasts have predicted.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.