Ethereum ETF approval odds surge to 75%, ETH price jumps 8%

Bloomberg ETF analysts change their predictions as background noises from the SEC start.

Bloomberg ETF analysts Eric Balchunas and James Seyffart increased to 75% their odds of a spot Ethereum exchange-traded fund (ETF) being approved in the US. The previous odds were 25%. As a result, Ethereum (ETH) leaped 8.3% after the news.

Previously, both analysts explained that the low odds were related to the lack of background noise made by the SEC asking players about the ETF approval. However, due to political issues, Balchunas stated on X that the US regulator will “be doing a 180 on this.” Moreover, the odds at 75% are substantial, since Seyffart and Balchunas are still waiting on filing documents to boost it higher.

Seyffart joked on X about being criticized by Ethereum bulls since he and Balchunas were previously quenching their hopes up until now.

“Never gonna hear the end of this from the .eth people in my replies if this turns out to be true. But it’s what we’re hearing from multiple sources. Should see a bunch of filings over coming days if we’re correct,” he posted on X.

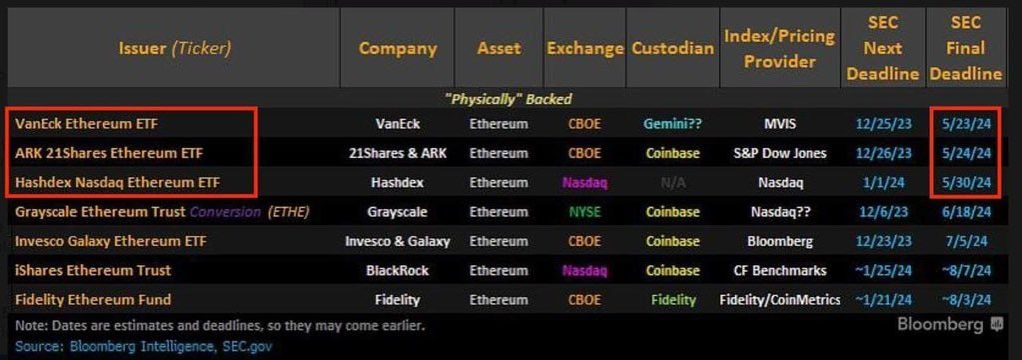

The first deadline for an ETF approval is on May 23, when the SEC must decide on VanEck’s Ethereum ETF filing. On the following day, the deadline for the ARK21 Shares Ethereum ETF also expires. The last deadline for this month is set for May 30, when the regulator must decide on Hashdex Nasdaq Ethereum ETF filing.

As reported by Crypto Briefing, not even notorious fund managers were expecting a spot Ethereum ETF approval in the US this week. Katherine Dowling, general counsel for ETF applicant Bitwise, said that “most people are universally expecting a disapproval order.” VanEck CEO Jan van Eck also predicted a likely denial during a CNBC interview.

In the last 24 hours, nearly $150 million in short positions were liquidated in crypto derivatives, according to data aggregator Coinglass. Of that total, $35.3 million were related to positions shorting ETH.