Shutterstock cover by Vector FX (edited by Mariia Kozyr)

Ethereum Faces Crash to $600 as Crypto Bear Persists

Ethereum has dipped below a critical area of support, hinting that further losses could be on the horizon.

Ethereum looks like it’s at risk of a steep correction as crypto’s rocky June draws to a close. Market participants are rushing to exchanges to exit their positions, while Ethereum is sitting on little to no support.

Ethereum Faces Lower Lows

Ethereum looks primed for a significant price movement as selling pressure accelerates.

The number two cryptocurrency has suffered from a price drop of over 20% over the past four days. It was trading at a local high of $1,280 on Jun. 26 before dipping as low as $1,015. Notably, Ethereum broke below the crucial $1,000 level on Jun. 18, and the losses could extend further as downward pressure appears to be on the rise.

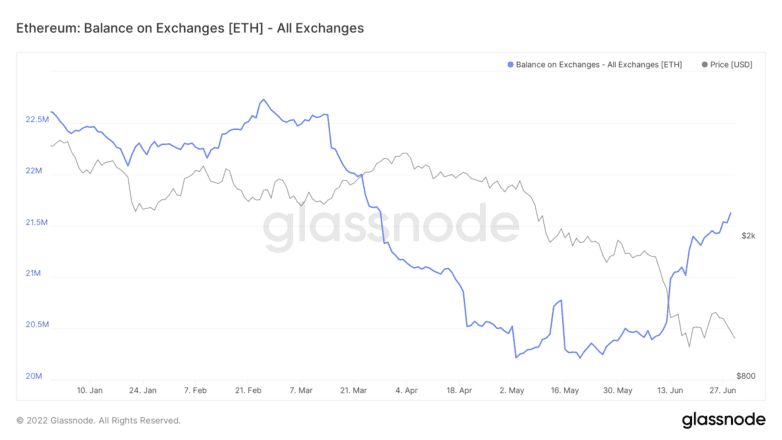

On-chain data from Glassnode shows that the number of Ethereum held on known cryptocurrency exchange wallets has significantly increased. Nearly 193,000 ETH worth roughly $200 million has flowed into trading platforms since Jun. 26. The spike in the balance held on exchanges coincides with the recent downward price action, hinting at a sell-off.

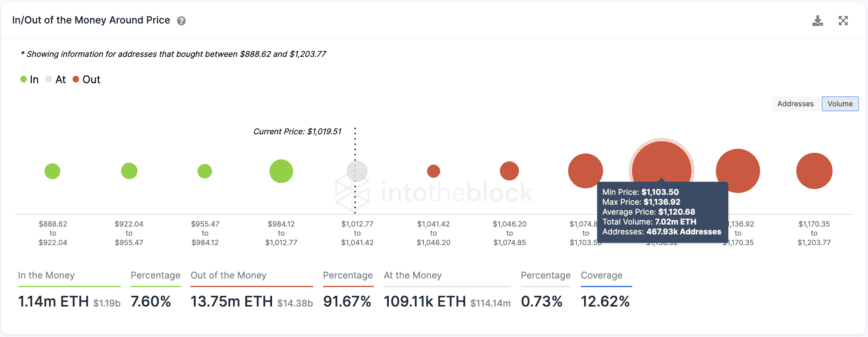

Moreover, transaction history shows that Ethereum lacks the demand it needs to prevent further losses. Ethereum’s next significant support level is at $600, where 12.8 million addresses hold 9.55 million ETH. This interest zone is crucial as market participants may sell their holdings in a bid to prevent their investments from going “Out of the Money.”

The most critical resistance level for Ethereum is currently at $1,120, where 468,000 addresses have previously purchased over 7 million ETH. A daily candlestick close above this hurdle could invalidate the pessimistic outlook, potentially leading to a surge to $1,300 or even $1,500.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.