Ethereum flips Costco, Johnson & Johnson as market cap grows by $150B this month

Rising institutional demand and supportive US legislation drive Ethereum’s surge, pushing it above top corporate market caps.

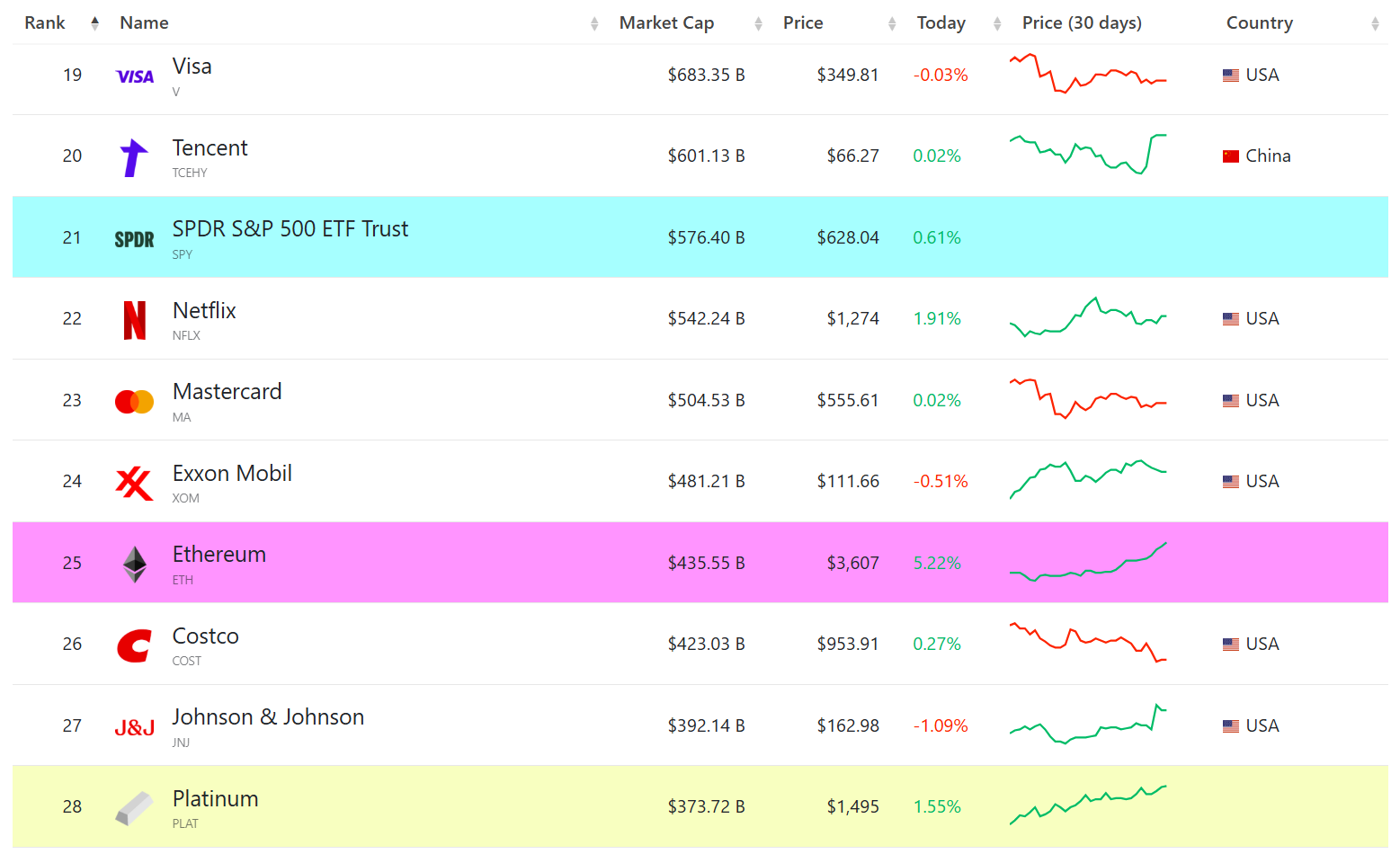

Ethereum (ETH) has climbed 43% in a month, boosting its market cap past $435 billion and putting it ahead of retail giant Costco and healthcare heavyweight Johnson & Johnson in size, CompaniesMarketCap data shows. Ethereum’s market cap has climbed by over $150 billion since July 1.

The second-largest crypto asset is now closing in on Mastercard and Netflix, the next two giants ahead of it by market cap. Mastercard is valued at over $504 billion, while Netflix sits at around $542 billion.

Ethereum’s recent rally has been fueled by several factors, mainly market-wide optimism during “Crypto Week,” which ended favorably with the House passing three major crypto bills, and increased accumulation of ETH by institutions and corporations.

On the ETF front, US-listed spot Ethereum ETFs saw a record $726 million in daily inflows on Wednesday, their highest since launching nearly a year ago. Over the past nine consecutive trading days, the nine Ethereum funds have collectively attracted $2.3 billion.

SharpLink Gaming, meanwhile, has been actively accumulating Ethereum. The company has recently expanded its equity offering from $1 billion to $6 billion to support its crypto gaming initiative and growing ETH reserves.

Ethereum was changing hands at over $3,600 at press time, marking a 5% daily gain, CoinGecko data shows. Trading volume stood at a strong $70 billion.

The crypto asset is still 26% away from its all-time high of $4,878 set in November 2021.