Shutterstock cover by Ivan Babydov

Fantom Hits Resistance After 50% Upswing

Fantom’s FTM token has encountered a challenging hurdle on its uptrend.

Fantom has managed to recover significantly from the downtrend it entered in late January. Still, there is one hurdle FTM must overcome to be able to march to greener pastures.

Fantom at Make-or-Break Point

Fantom is soaring as it attempts to catch up with the rest of the market.

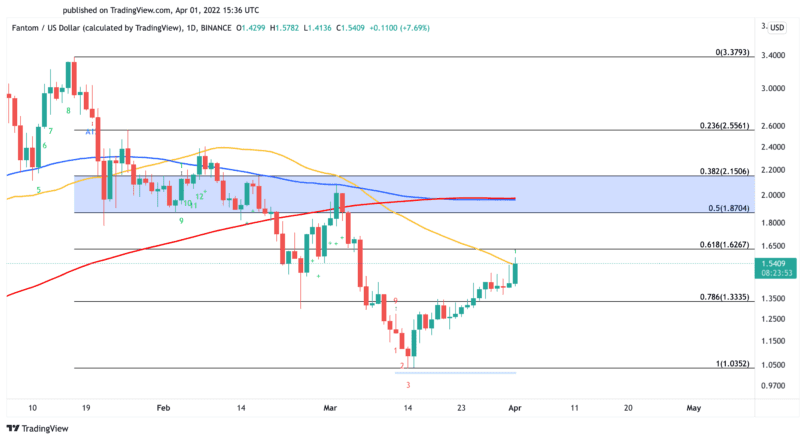

Fantom suffered a steep correction that began in late January to hit a yearly low of $1.04 on Mar. 14. The Layer 1 token appears to have formed a local bottom because its price has risen by more than 50% since then. Although a few obstacles are ahead, FTM may have the strength to advance further.

From a technical perspective, it appears that Fantom has met stiff resistance after the recent upswing. The 50-day moving average at $1.54 seems to be keeping FTM at bay, preventing it from making higher highs. A decisive daily candlestick close above this resistance level and the 61.8% Fibonacci retracement level at $1.63 could encourage sidelined investors to get back in the market.

After breaching such a critical resistance zone, a spike in buying pressure could propel Fantom towards the next supply area between the 50% and 38.2% Fibonacci retracement levels. These key resistance points sit at $1.87 and $2.15, respectively.

Although things appear to be looking up for Fantom, waiting for a sustained close above the $1.54-$1.63 resistance wall is imperative. Failing to overcome this critical hurdle could result in a spike in profit-taking, pushing FTM back down. Under such unique circumstances, the Layer 1 token would likely dive to the recent low at $1.04 to attempt to form a double bottom pattern.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.