Photo: Marco Bello/Reuters

FTX payout plan taking effect today—here’s what to expect

Creditors must verify identity, meet criteria, and choose a distribution manager to receive their funds.

After a long and arduous process following its dramatic collapse, the FTX payout plan has officially gone into effect today, January 3, 2025. This marks a major milestone for creditors who have been awaiting the recovery of their assets.

The FTX estate, which manages the bankruptcy proceedings of the collapsed crypto exchange, plans to begin repayments within 60 days of the effective date, the estate said in December.

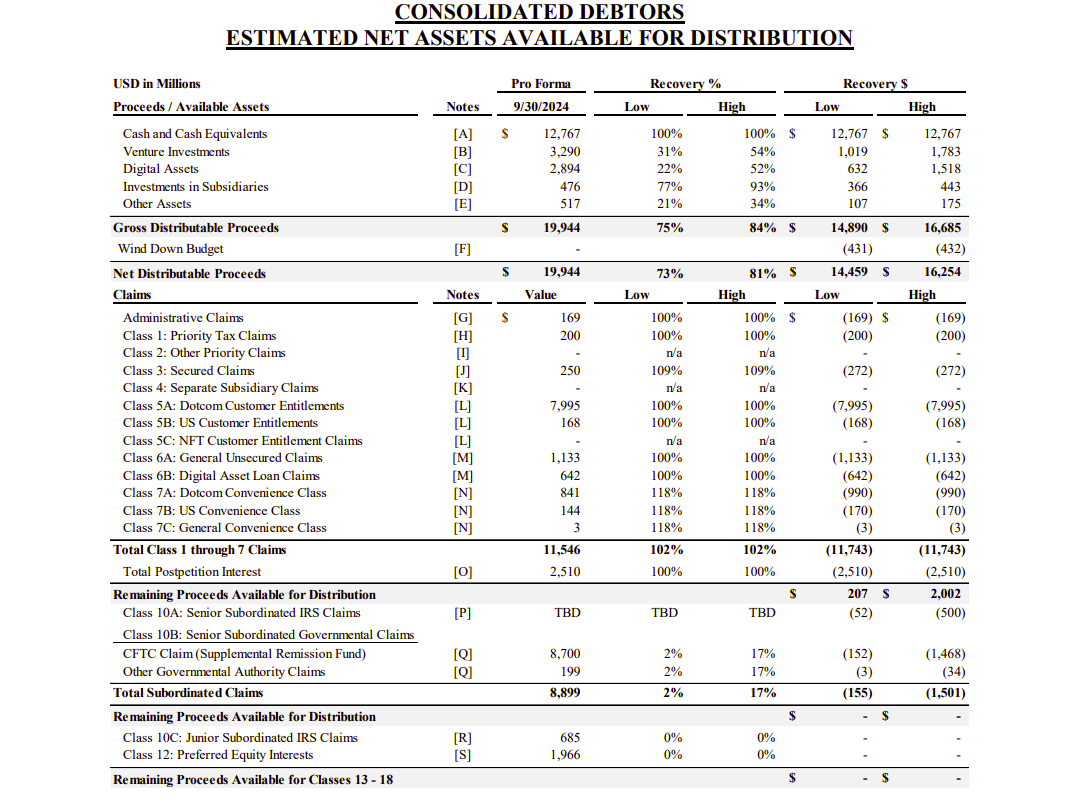

Although the estate estimates that total distribution will range between $14.7 billion and $16.5 billion, the first payout round will not reach that amount as it prioritizes convenience classes—those with allowed claims of $50,000 or less.

These creditors are expected to receive approximately 119% of their allowed claim amount, including principal and accrued interest, within 60 days. This amounts to roughly $1.2 billion in total, as per the plan.

According to Sunil Kavuri, a prominent advocate for FTX creditors, creditors with claims exceeding $50,000 will receive a share of a separate $10.5 billion pool. The distribution timeline for this group will take longer.

Important: FTX Distribution

3rd Jan 25: Initial Distribution Record Date

Feb/Mar 25: Convenience class holders <$50k = $1.2bn (119% paid within 60 days of today)> $50k = $10.5bn

FTX customers need to complete

1) KYC

2) Complete W-8 Ben form

3) Onboard with distribution… pic.twitter.com/43ZfirJNX3— Sunil (FTX Creditor Champion) (@sunil_trades) January 3, 2025

BitGo and Kraken have been designated to manage initial distributions to retail and institutional customers in supported jurisdictions. Creditors must complete KYC verification, submit tax forms through the FTX Debtors’ Customer Portal, and choose either BitGo or Kraken as their distribution manager.

K33 analysts estimate $2.4 billion may flow back into crypto markets following the plan’s execution.

The analysts note that $3.9 billion of total claims were acquired by credit funds, which are unlikely to reinvest in crypto assets. Moreover, 33% of remaining claims belong to sanctioned countries, insiders, or individuals without KYC verification who may be unable to claim funds.

Earn with Nexo

Earn with Nexo