Grayscale Bitcoin ETF surpasses $20B net outflows

While the pace of outflows has slowed compared to earlier this year, the overall trend remains negative.

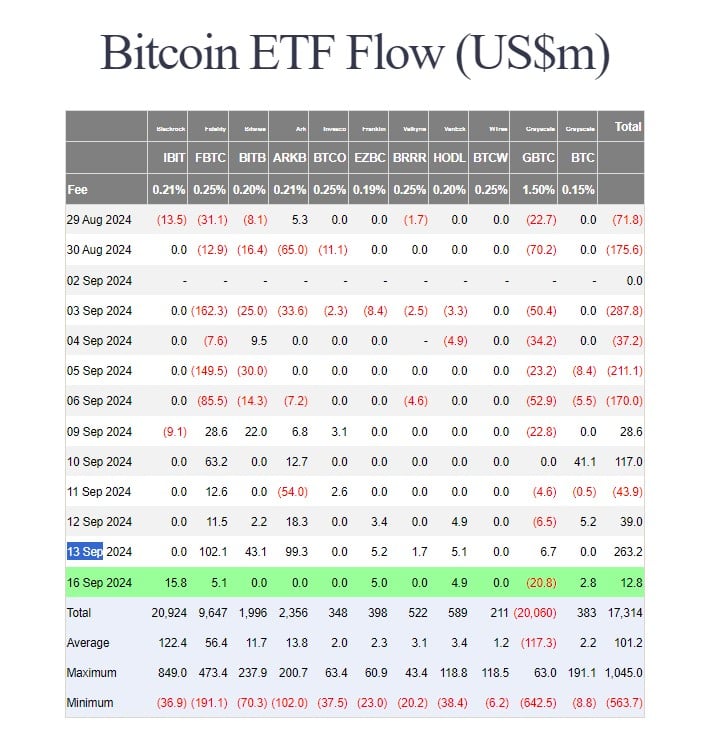

Grayscale Investments’ Bitcoin Trust (GBTC) continues to face investor redemptions, with another $20.8 million withdrawn on Monday, according to data tracked by Farside Investors. This brings the total net outflows since its exchange-traded fund (ETF) conversion in January to over $20 billion.

The pace of outflows has slowed compared to earlier this year. Data reveals that the first $10 billion was withdrawn within two months of its ETF conversion, while the subsequent $10 billion took over six months.

However, GBTC remains under pressure as investors continue to exit positions. The fund’s Bitcoin holdings have decreased to approximately 222,170, valued at around $12.8 billion, data shows.

Despite GBTC’s losses, the US spot Bitcoin ETF market as a whole remains positive. On Monday, these ETFs collectively attracted $12.8 million in net capital.

BlackRock’s iShares Bitcoin Trust (IBIT) saw a resurgence of inflows after a period of stagnation, taking in $15.8 million. Other prominent Bitcoin ETFs managed by Fidelity, Franklin Templeton, and VanEck reported inflows of around $5 million each.

Grayscale’s low-cost Bitcoin ETF also managed to attract some inflows, ending the day with $2.8 million. The rest reported zero flows.