Photo: Callaghan O'Hare

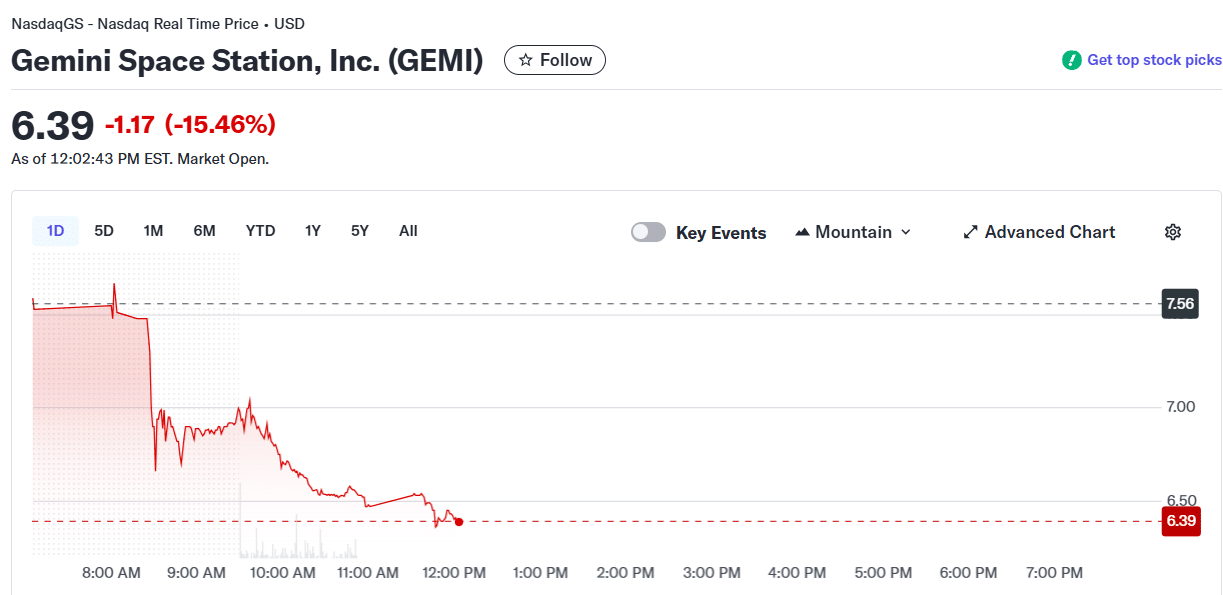

Gemini stock drops 15% after key executives step down

Gemini 2.0 is focused on leveraging AI to increase efficiency, expanding its prediction market platform, and narrowing operations to the US.

Gemini Space Station (GEMI), which operates the Gemini crypto exchange, saw its shares drop 15% during Tuesday’s trading session after the company disclosed the departure of senior executives.

According to a new SEC filing, Gemini is parting ways with operations leader Marshall Beard, finance head Dan Chen, and legal chief Tyler Meade, effective February 17, 2026, with transition support expected during the interim period.

Beard, who worked at the crypto company for more than seven years, has also stepped down from the board, and his duties will be absorbed by Cameron Winklevoss, Gemini’s co-founder, while no new COO will be named.

Gemini has appointed Danijela Stojanovic as Interim CFO and Kate Freedman as Interim General Counsel to maintain leadership continuity.

The leadership upheaval comes as the firm executes a dramatic strategic retreat. Earlier this month, the exchange said it was winding down operations across the United Kingdom, European Union, and Australia while eliminating roughly one-quarter of its workforce.

Following its debut on Nasdaq last September, Gemini is reshaping its operations to focus on the US. The company is adopting AI to boost productivity and targeting the development of its prediction market, as well as 401(k) crypto integration.

Earn with Nexo

Earn with Nexo