Crypto assets rival real estate among Gen Z as homeownership becomes less achievable: Report

Young investors lean on social media for financial guidance over traditional sources.

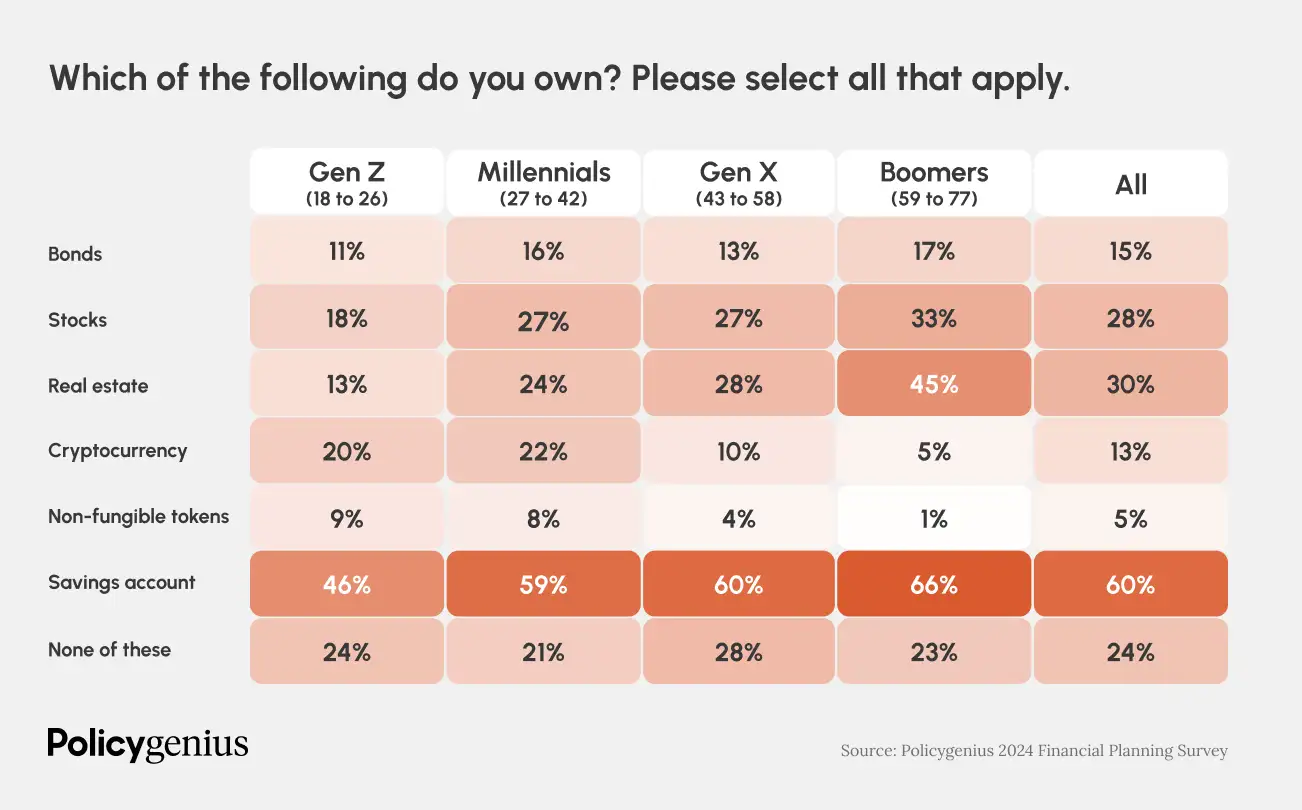

Investment preferences among generations are becoming increasingly distinct. A recent survey conducted by Policygenius and YouGov found that 20% of Gen Z (ages 18 to 26) own crypto, a figure that is notably higher than their ownership of stocks (18%), real estate (13%), and bonds (11%). Owning real estate is less common for younger generations due to affordability issues.

“Home affordability is at its lowest point since the Great Recession, as a combination of high interest rates, stagnating incomes, and low housing stock have put [homeownership] out of reach for many Americans,” said the survey.

According to the survey’s findings, millennials (ages 27 to 42) show a slightly higher propensity for investment, with 27% owning stocks and 22% owning crypto, while 24% have invested in real estate.

The data suggests that baby boomers continue to adhere to traditional investment patterns, with the highest ownership of stocks (33%) and real estate (45%). However, their engagement with crypto (5%) and NFTs (1%) is minimal, indicating a stark generational divide in the adoption of digital assets.

All generations value financial professionals, but older generations rely on them more, the survey reports. Compared to older generations, “Gen Z and millennials are more than twice as likely to turn to social media first with a financial question.” In contrast, only 2% of Gen X and baby boomers would consult social media first.

The survey further shows that 62% of millennials and Gen Zers have tried at least one financial “hack,” such as no-spend challenges or “infinite banking” (borrowing against a whole life insurance policy). These hacks, often popularized on social media, have seen significant engagement, with no-spend challenges amassing over 90 million views on TikTok.

The survey also explores the emotional aspect of financial management, revealing that 31% of baby boomers feel proud of how they manage their finances, a sentiment that is less prevalent among younger generations, with 23% of Gen Z expressing the same level of pride.

“This makes senses: Baby boomers are wealthier on average and more likely to own real estate than younger generations,” said the survey.