Commodity-backed tokens surpass $1.1b market cap, gold most popular

Gold-backed tokens comprise majority of $1.1B commodity crypto market

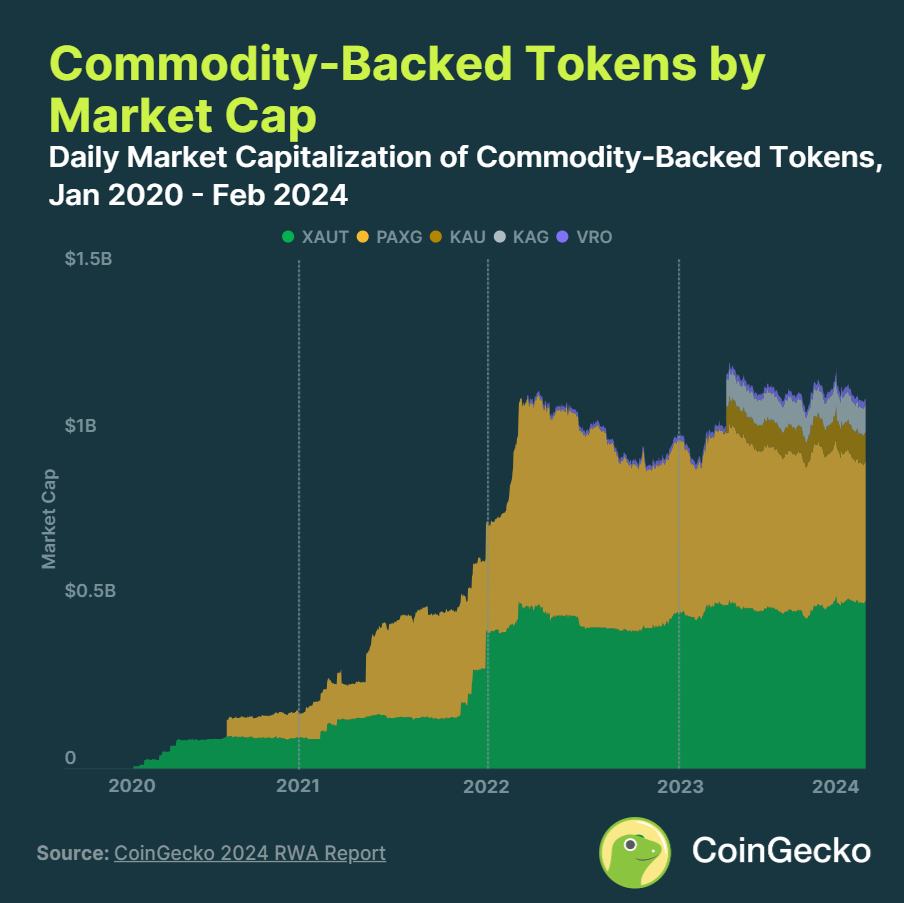

Commodity-backed crypto tokens have reached a $1.1 billion market capitalization, according to “RWA Report 2024: Rise of Real World Assets in Crypto” report by CoinGecko.

The report points out that gold remains the most popular commodity used as backing, with gold-backed tokens like Tether Gold (XAUT) and PAX Gold (PAXG) accounting for 83% of the market cap for commodity crypto tokens. XAUT and PAXG represent ownership of one troy ounce of physical gold stored by the issuer.

“Despite the dominance of tokenized precious metals, tokens backed by other commodities have also been launched,” the report highlights. “For example, the Uranium308 project has released tokenized uranium which is pegged to the price of 1 pound of U3O8 uranium compound.”

While commodity tokens have seen growth, their $1.1 billion market cap is just 0.8% the size of fiat-backed stablecoins. The majority of real-world asset tokens remain US dollar-pegged, with stablecoins like Tether’s USDT, Circle’s USDC, and MakerDAO’s Dai dominating the sector.

USDT continues to dominate the stablecoin market with a 71.4% market share or $96.1 billion in circulation. Meanwhile, USDC’s share dropped after it lost its 1:1 dollar peg during March 2023’s US banking crisis. USDC has failed to recover its former position since then.

The market cap of all stablecoins has grown from $5.2 billion at the start of 2020 to a peak of $150.1 billion in March 2022 before declining. After bottoming out, the stablecoin market cap has begun slowly increasing again, now at $134.6 billion.