Grayscale Ethereum ETF suffers nearly $2 billion outflow since debut

Grayscale's ETHE could exhaust its Ether holdings within a few weeks if this pace of outflows continues.

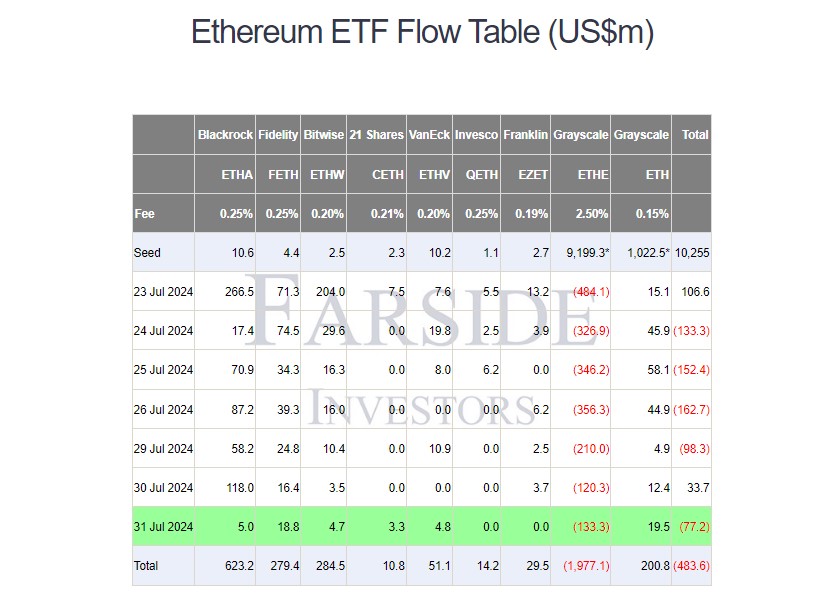

Investors have yanked almost $2 billion from Grayscale’s Ethereum exchange-traded fund (ETF) since it was converted from a trust, data from Farside Investors reveals. The fund, operating under the ETHE ticker, saw its market value plummet to $6.7 billion amid Ether’s price decline.

Grayscale’s ETHE shed $133 million on Wednesday, a significant loss but not its worst day on record. The fund saw its largest outflow on its ETF debut day, when investors withdrew $484 million.

In contrast, the lower-fee version of ETHE, the Grayscale Ethereum Mini Trust (ETH), extended its inflow streak to seven days. With $19.5 million flowing into the fund on Wednesday, its total net inflows have exceeded $200 million.

While ETHE charges an annual management fee of 2.5%, ETH has a much lower fee. At 0.15%, the Ethereum Mini Trust fund is the cheapest spot Ethereum ETF on the market. Offering the spinoff at an early stage appears to be Grayscale’s right bet after its experience with the Bitcoin Trust (GBTC).

Other competing Ethereum ETFs launched by BlackRock, Fidelity, VanEck, Bitwise, and 21Shares took in over $36 million on Wednesday. Overall, the group of US spot Ethereum ETFs saw approximately $77 million in outflows, reversing the positive trend reported yesterday.

Grayscale’s Bitcoin Mini Trust gained on its first day

The Grayscale Bitcoin Mini Trust (BTC), a spinoff of GBTC, started trading today following regulatory approval earlier this month. The ETF attracted $18 million on its first day while GBTC reported zero flows, according to Farside Investors’ data.

Grayscale’s BTC offers the lowest management fee at 0.15% among ETFs providing direct Ether exposure. With the new offering, the asset manager aims to reallocate 10% of Bitcoin from its existing Bitcoin Trust to the new mini version, creating a more cost-effective option for Bitcoin ETF investors.

The mini fund is also expected to alleviate selling pressure on GBTC and capture a portion of its capital outflows.