Grayscale Ethereum ETF bleeds Thursday, outflows exceed $1 billion since debut

In contrast, the spinoff from Grayscale's Ethereum Trust has seen its net inflows consistently grow over the last three days.

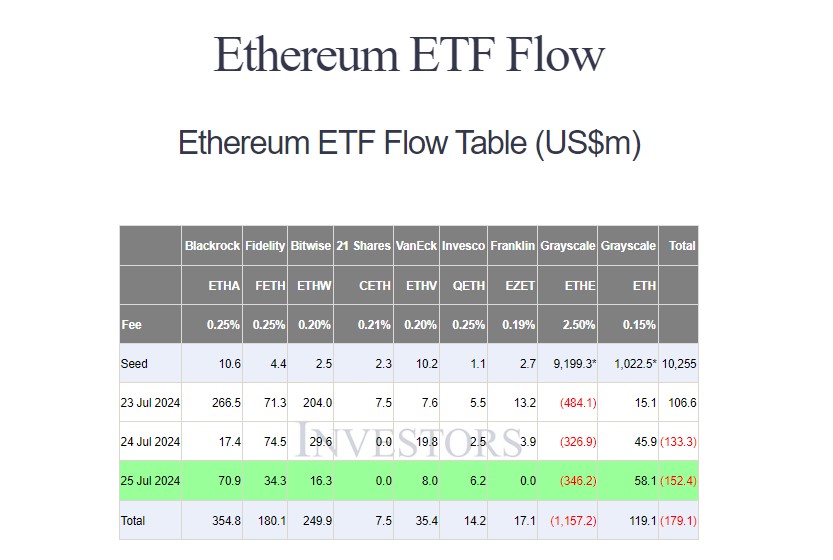

Grayscale’s Ethereum ETF (ETHE) ended Thursday with approximately $346 million in net outflows, extending its losses to $1.1 billion within three trading days since its conversion, data from Farside Investors reveals. After the third trading day, ETHE’s assets under management plummeted from over $9 billion to $7.4 billion, a remarkable decline since the launch of US spot Ethereum ETFs.

In contrast, BlackRock’s iShares Ethereum Trust (ETHA) led inflows on Thursday, attracting approximately $71 million. Grayscale’s Ethereum Mini Trust (ETH), a spinoff of Grayscale’s Ethereum Trust, followed with over $58 million in net inflows.

Other funds, including Fidelity’s Ethereum Fund (FETH), Bitwise’s Ethereum ETF (ETHW), VanEck’s Ethereum ETF (ETHV), and Invesco/Galaxy’s Ethereum ETF (QETH), also reported inflows. The remaining ETFs saw zero flows.

Despite inflows to eight Ethereum ETFs, the combined net outflow for all nine funds on Wednesday reached $152 million, the largest since their trading debut on July 23. This outflow was largely driven by Grayscale’s ETHE.

ETHE’s 2.5% fee makes it a considerably expensive option for investors who are looking to get exposure to Ethereum. Investors have been selling their ETHE shares and moving to lower-fee newcomers.

The situation is not entirely unexpected given the experience of Grayscale’s Bitcoin ETF (GBTC). The fund’s outflows topped $5 billion after the first trading month, according to data from Bloomberg.

However, this time, Grayscale’s Ethereum Mini Trust could help it get rid of the deja vu. ETH’s 0.15% fee makes it one of the lowest-cost spot Ethereum funds in the US market, and the fund’s inflows have consistently grown since it was converted into an ETF.

Earn with Nexo

Earn with Nexo