Hedging Strategies for a Crypto Bear Market

Finding effective ways to protect a crypto portfolio during a bear market is key for long term success in investing.

Bear markets are an inevitable part of investing. In crypto, they are usually more intense because of the industry’s volatile nature. As a response, many investors end up selling at a loss or impulsively buying into the next hot token hoping for a quick recovery.

What they should do instead is hedge, which is making additional investments that limit losses from their existing investments. For example, if you hold Bitcoin and its price falls, hedging can reduce your overall loss.

Are We in a Bear Market?

Since its peak in mid November 2021, the total cryptocurrency market cap has experienced a significant decline.

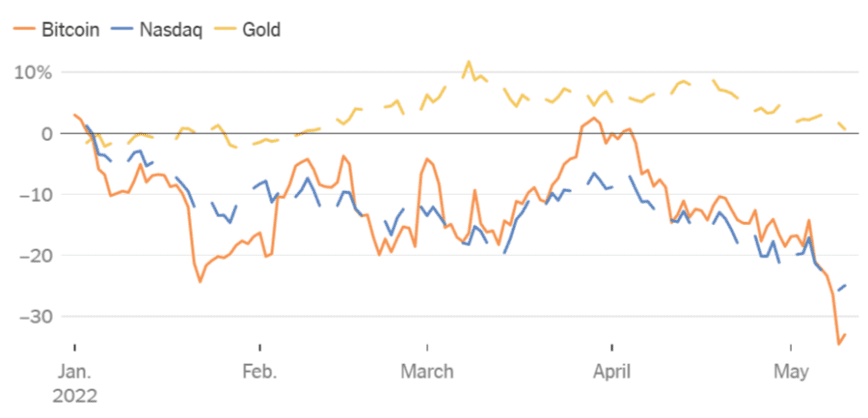

Take Bitcoin. Once considered a hedge against inflation, and regularly compared to gold, its recent price action has shifted to closely correlate with the Nasdaq 100.

What does this mean? Bitcoin is a “risk-on” asset. And as a consequence it is sensitive to interest rate movements both to the upside and the downside.

Generally, the Fed increases interest rates to fight inflation. Consumers tend to borrow less and limit spending which, in turn, causes the prices of financial assets like cryptocurrency to drop.

During periods of rising interest rates, investors usually park their assets in instruments that offer yield, like bonds. The contrary occurs when interest rates decrease, generally rewarding investors that put money into riskier assets.

With the recent announcement from the Fed to increase the Federal Funds Rate 75 basis points (the largest one-month increase in 28 years), many crypto investors’ portfolios have taken a hit.

But it’s not all doom and gloom. There are ways to make it out alive to the next bull market. The following section describes a set of hedging strategies to help crypto investors protect their portfolios: Short selling, increasing stablecoin exposure, options, yield farming and dollar cost averaging.

Short Selling

Short-selling allows investors to profit when the prices of crypto go down in value. The objective is to return a previously borrowed asset (in this case cryptocurrency) to a lender and pocket the difference. Unlike in a long position, where the upside is unlimited, gains are limited to the floor price of the asset.

Increasing Stablecoin Exposure

Although not entirely risk-free, stablecoins allow investors to escape volatility by pegging their value, generally, to fiat currencies. While holding positions in stablecoins, investors can even earn passive income by staking their coins using DeFi applications or depositing their tokens in centralized platforms or exchanges. Take caution though, as “extreme market conditions” can lead to platforms blocking fund withdrawals.

Crypto Options

Option contracts come in two flavors, calls and puts. Traders can protect long positions by buying put options. A put is a type of contract that allows the buyer of the agreement to sell a specific asset at today’s price during a later date.

In other words, buying a put contract is like buying portfolio insurance. It gives the chance to sell a falling token at a predetermined strike price.

Another possibility is to sell call options. Here the seller gets a premium for agreeing to deliver the underlying asset for an established price before a set date if the buyer demands it.

Yield Farming

Yield farming is a process where users can earn rewards by pooling their crypto assets together. Other users may use the cryptocurrencies added to these pools, which are controlled by pieces of software (known as smart contracts) for lending, borrowing, and staking.

Applications like Convex Finance or Balancer can offer APYs anywhere from 5% to 11%, rewarding users who deposit their BTC, ETH and stablecoins.

Dollar Cost Averaging

By dollar cost averaging one can lower the impact of volatility as purchasing an asset gets spread over time.The advantage of buying regularly during market downtrends is that it ensures higher returns if assets are held all the way to a bull market.

Conclusion

Although the crypto market is in panic mode, there are simple effective strategies to protect and even grow your crypto stack. Visit the Phemex Academy to learn more.

Earn with Nexo

Earn with Nexo