Bitcoin and Ethereum ETFs saw sharp outflows in Hong Kong market

Mainland Chinese investors may face hurdles accessing Hong Kong crypto ETFs.

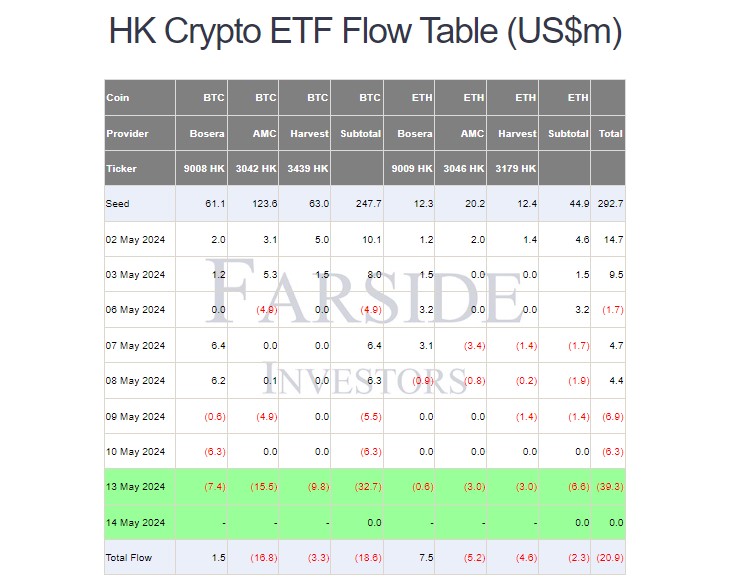

Hong Kong’s spot Bitcoin and Ethereum exchange-traded funds (ETFs) recorded massive outflows in the latest trading session, according to data from Farside.

On Monday, three Bitcoin funds—Borsera, AMC, and Harvest—experienced outflows totaling $32.7 million, marking the largest since their launch. Currently, these funds have approximately $247 million in Bitcoin under management (AUM).

Ethereum ETFs also reported outflows, with $6.6 million leaving the funds. These Ethereum funds now have a total AUM of nearly $45 million.

Overall, the combined outflows for Bitcoin and Ethereum ETFs in Hong Kong have reached $20.9 million.

Do mainland Chinese investors get access to Hong Kong-listed crypto ETFs?

Discussions are ongoing about the possibility of mainland Chinese investors gaining access to the newly launched Hong Kong’s crypto ETFs. According to a recent report from South China Morning Post (SCMP), these new crypto ETFs are “technically” accessible to mainland Chinese investors.

In other words, mainland Chinese investors with Hong Kong bank accounts could potentially purchase shares as long as they pass KYC (know-your-customer) requirements. However, the report also noted that stringent KYC procedures could pose a challenge, as not all brokerages accept mainland ID cards.

Plus, despite potential access to Hong Kong ETFs, Beijing’s ban on commercial crypto trading within mainland China remains in effect. Bloomberg analyst Eric Balchunas previously pointed out this existing trading ban as one of the major challenges.