Inflows into crypto investment products exceed $4 billion in February

Solana-related products were the only ones to register a slump in assets under management, data from CoinShares shows.

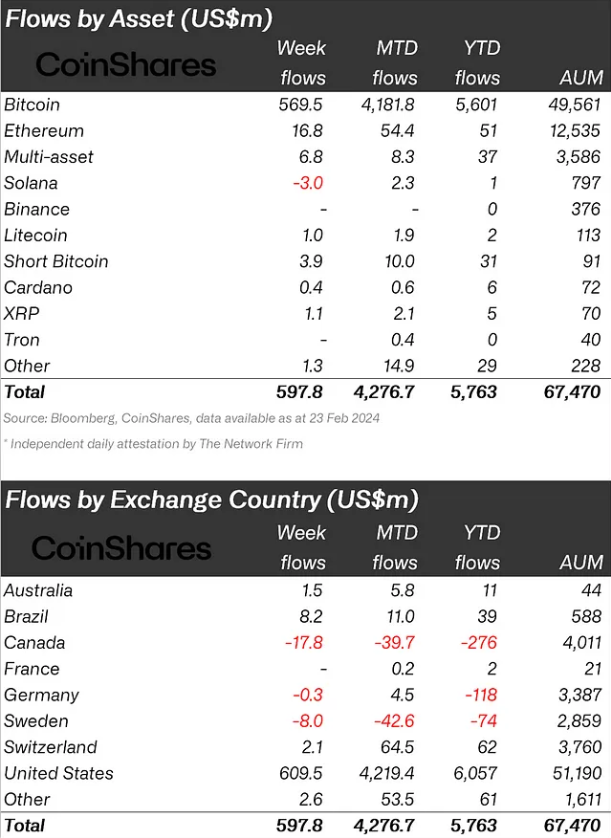

Crypto investment products amassed close to $4.3 billion in inflows in February, a Monday report by asset manager CoinShares points out. Last week, investors allocated almost $600 million to different crypto products, marking the fourth consecutive week of positive inflows, bringing the year-to-date total above $5.7 billion.

Regionally, the US accounted for the majority of these inflows, totaling $610 million, despite a $436 million outflow from major issuer Grayscale. Brazil and Switzerland also experienced minor inflows of $8.2 million and $2.1 million, respectively, while Canada and Sweden faced outflows of $18 million and $8 million.

Bitcoin dominated the inflows, with $570 million last week, contributing to a year-to-date total of $5.6 billion. Ethereum also added to the inflows, with investors raising their exposure to almost $17 million. Chainlink and XRP registered US$1.8m and US$1.1m inflows, respectively.

Out of the crypto assets listed by CoinShares in its report, only Solana faced outflows last week, with a $3 million drop in assets under management (AUM). This is likely due to recent technical issues.

The total AUM for digital assets reached a peak of $68.3 billion earlier in the week, the highest since December 2021, though still below the November 2021 all-time high of $87 billion. This surge in inflows accounts for 55% of the record inflows seen in 2021.

Despite the growth in digital assets, blockchain equities experienced a decline, with $81 million in outflows, indicating a cautious stance among equity investors.