BlackRock registers iShares Staked Ethereum Trust ETF in Delaware

BlackRock’s latest filing hints at enabling investor participation in Ether staking rewards through a regulated ETF structure.

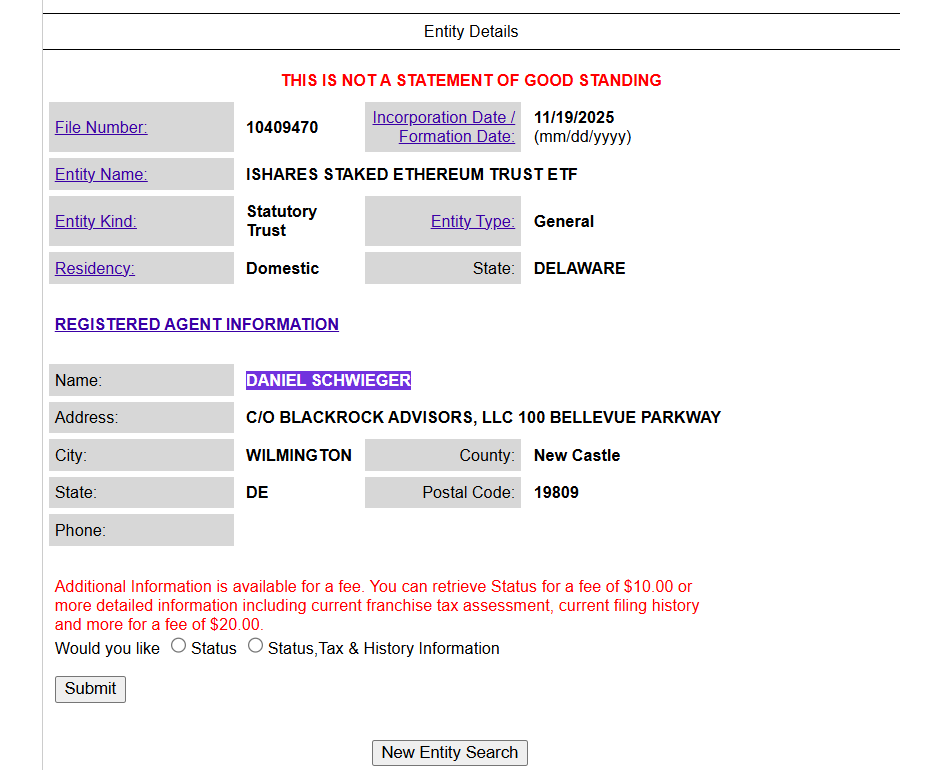

BlackRock has registered a new statutory trust in Delaware under the name iShares Staked Ethereum Trust ETF, according to records from the Delaware Division of Corporations. Delaware registrations have typically preceded formal ETF applications to the SEC in recent crypto developments.

The registration comes after Nasdaq filed Form 19b-4 with the SEC to enable staking for BlackRock’s iShares Ethereum Trust (ETHA), allowing the ETF to stake its Ether through approved providers and classify rewards as income.

However, the SEC has recently removed the requirement for 19b-4 filings for crypto exchange-traded products. Under the new generic listing standards, exchanges can now list qualifying crypto-commodity ETPs without submitting a product-specific 19b-4 rule change each time.

BlackRock joins 21Shares, Fidelity, Franklin Templeton, and Grayscale, all seeking to add staking to their Ethereum ETFs. Before spot ETH ETFs were approved, firms removed stakes from their applications amid concerns staking services could be treated as unregistered securities.

The REX-Osprey ETH + Staking ETF is the first US Ethereum staking ETF, which offers exposure to ETH while also distributing native staking rewards to investors.