Lighter hits $200B in 30-day trading volume, overtaking Hyperliquid amid LIT token launch

LIT serves as the core asset for its DEX and broader financial infrastructure roadmap.

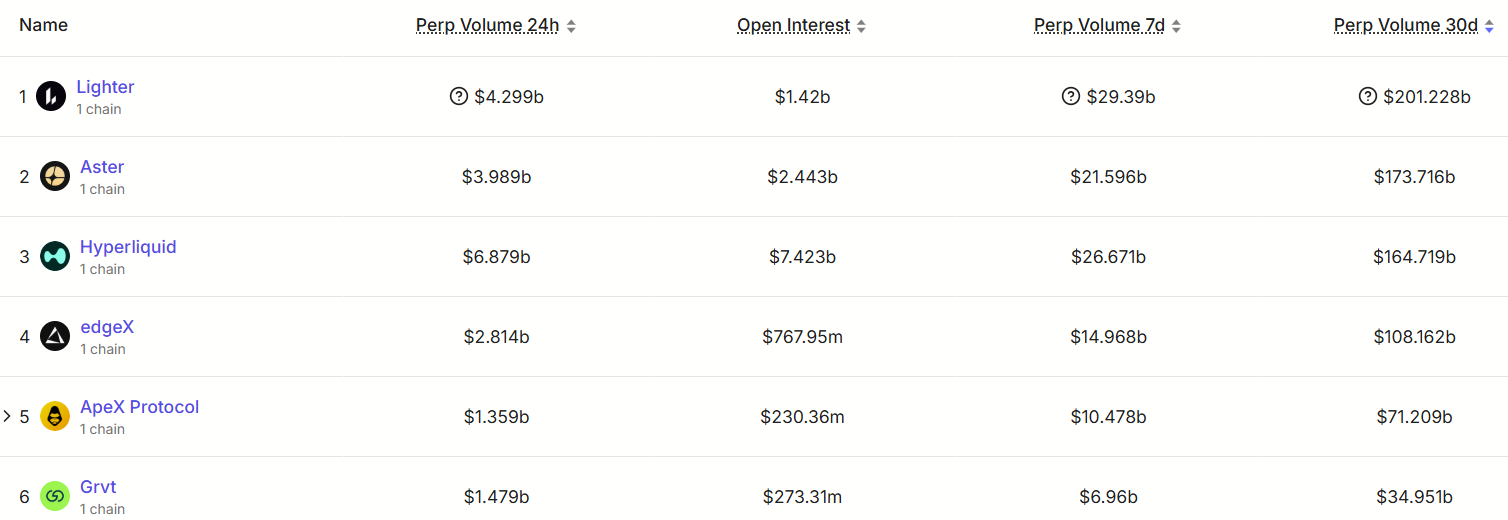

Lighter, a DEX focused on perpetual futures trading, recorded roughly $200 billion in 30-day trading volume, surpassing Aster and Hyperliquid as activity accelerated around the launch of its LIT token, according to data from DefiLlama.

Over the same period, Aster recorded about $173 billion in trading volume, while Hyperliquid saw roughly $165 billion. On a 7-day basis, Lighter also led with $29 billion, ahead of Hyperliquid and Aster.

Hyperliquid still dominated 24-hour perpetuals activity with $6.8 billion in volume, compared with $4.3 billion on Lighter.

An Ethereum-based perpetuals DEX, Lighter runs on its own ZK-powered app chain, offering fast, low-cost trading with self-custody and a CEX-style order book.

The Lighter Infrastructure Token (LIT) went live today as the project’s main economic and functional token. The token will be used for staking and platform utilities such as access, execution, and data services, with additional plans for fee payments and market-data verification.

We are announcing the Lighter Infrastructure Token (LIT)! Lighter is building infrastructure for the future of finance and the native token is key to aligning incentives. In this thread, we will describe the structure of the token, broader vision, and roadmap of use cases.

— Lighter (@Lighter_xyz) December 30, 2025

Lighter distributed 25% of the total LIT supply to early users in Points Season 1 and 2 as part of its ecosystem allocation.

In total, 50% of the supply is reserved for the community and future growth programs, while the remaining 50% goes to the team and investors, subject to a one-year lockup and three-year vesting schedule.

The team says value generated by Lighter products will ultimately accrue to LIT holders, with revenues directed toward growth or token buybacks depending on conditions.

LIT is currently trading at approximately $2.6, according to CoinGecko. The token secured its first major centralized exchange spot listing on Coinbase.

LIT is also available on Bybit’s perpetual futures platform, expanding trading options for derivatives traders.

Earn with Nexo

Earn with Nexo