Mainframe ICO Review And MFT Token Analysis

The Mainframe ICO and MFT Token are launching a distributed, decentralized network to disrupt the encrypted communications and data services market. Mainframe is essentially a network of layers that leverages blockchain and cryptography for communicating and sharing data securely and efficiently.

Mainframe ICO Overview

The Mainframe ICO and MFT Token are launching a distributed, decentralized network to disrupt the encrypted communications and data services market. Mainframe is essentially a network of layers that leverages blockchain and cryptography for communicating and sharing data in a secure and efficient manner.

For individuals across the world subjected to surveillance and censorship to enterprises which routinely suffer costly data breaches, the need for a better way to communicate and transmit data is clear as day. The Mainframe ICO offers their network as a solution. (By the way, we find the name intriguing – Mainframe for a decentralized network?)

Mainframe Value Proposition

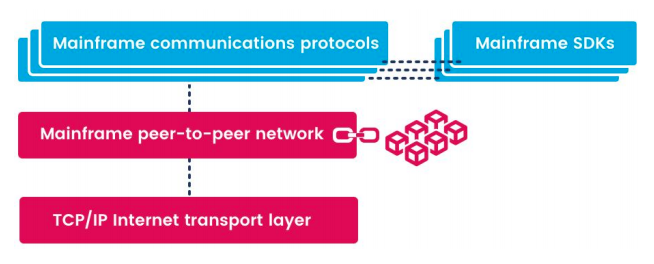

The Mainframe network consists of multiple layers that deploy a combination of advanced cryptography and distributed ledgers to grant users absolute control over their communications.

At the lowest level, Mainframe consists of a p2p network used to propagate and execute blockchain transactions. This network layer abstracts the underlying geographically traceable Internet transport layer it relies on, randomly assigning addresses to each peer or node. Value can be exchanged between nodes on this network using tokens.

Mainframe provides additional protocols above this transport layer for secure communications. Each Mainframe node exposes various p2p service interfaces to application layers, including interfaces for blockchain transactions, packet routing, packet holding, file storage and data services

In turn, each of these p2p services is provided entirely by peers operating in incentivized cooperation with one another, without reliance on any managed infrastructure.

Mainframe architecture (source: Mainframe whitepaper):

Mainframe deploys five fundamental mechanisms to incentivize network functionality, facilitate scalability and ensure resistance to disruption:

- Encryption: the Mainframe network uses advanced encryption technology and offers secure messaging for P2P and group communications.

- Dark Routing: nodes will be part of a decentralized network, making messaging activities almost impossible to track.

- Incentivization: Rewards are given out to nodes that support the network incentivizing the support and growth of the decentralized infrastructure.

- Peer-to-Peer Architecture: The network is constructed using p2p architecture, which distributes all application data throughout the network. As a result, the network can neither be censored nor shut down.

- Interoperability: The Mainframe network allows for interoperability among systems, and the platform will eventually be made available for integration with any app, network, or blockchain.

The MFT Token is the underlying token of the Mainframe network . MFT will be used to reward nodes that keep the network running. Nodes will receive rewards for the timely and efficient relay of packets, the delivery of packets from sender to receiver and provision of reliable decentralized data storage and services.

Additionally, MFT can also be used as an exchange of value in marketplaces on the Mainframe platform. MFT is an ERC20 token.

Mainframe ICO Team

The Mainframe team consists of 12 full-time employees based in both London and remote locations. A full list of the team can be found here.

Mick Hagen is the CEO and Founder of Mainframe. Mick has previous entrepreneurial experience founding Undrip, a content discovery app which after two years was nixed in favor of launching Mainframe. Prior to Undrip, Mick founded Zinch which was later acquired by Chegg (NYSE: CHGG).

Carl Youngblood is CTO of Mainframe. He has over 20 years of experience as a full stack developer. Since 2009 he has held senior developer and CTO positions with various enterprises.

Brad Hagen is head of Business Development and Sales. Brad is a Co-founder of Zinch. He has also successfully founded his own startup Brandr, which was acquired.

Mainframe do not have any designated advisors, but do disclose some of their individual investors. Among them are Lars Rasmussen, Co-founder of Google Wave and the startup that became Google Maps (and also the lead engineer on the Facebook Workplace product in London), and George Ell, Director of Western Europe for Tesla.

Mainframe ICO Strengths and Opportunities

At the present state of the industry, services like Slack provide organizations with a way to communicate in real-time utilizing features such as file sharing. The catch of course is that data on services like Slack is visible to the service provider, which must be trusted for both security and to maintain the service itself.

Compromised data and service outages therefore still remain a possibility and do in fact happen. Even fully encrypted messaging platforms utilize centralized infrastructure to operate or store customer data, leaving them open to such issues.

The simultaneously decentralized and distributed nature of Mainframe improves on the models of previous platforms by eliminating the possibility of a data breach or service outage.

The distributed nature of the Mainframe network means that as participants in the network join and leave, the network has the ability to adapt itself accordingly. As the network scales, the number of possible routing paths between any two nodes increases, reducing the overall effect the loss of nodes will have on the network. The p2p layer of the the Mainframe network ensures nodes discover new pathways when a peer is dropped in order to maintain the overlay network.

The Mainframe ICO communications protocol is similarly designed so as to not rely on any specific set of nodes being present or connectable at a given time. Importantly, no entity (even Mainframe itself) can control or disrupt the operation of the network. The network service layers have also been designed to rely on specific nodes to support the development of fully decentralized applications.

For this reason, services have been designed to store individual shards of data across multiple nodes, while multiple nodes are designated to perform requested services. As a result of this network architecture, developers don’t have to manage their own infrastructure and consumers needn’t trust third parties for their services.

On the product progress front, the Mainframe ICO team have developed an alpha version of the first DApp built on the network, called Onyx. Onyx is described as a fully decentralized workplace messaging tool, similar to Slack, and is supported on all major platforms including mobile phones. It is already functional and available for download here.

The DApp runs the user Mainframe Node locally and connects to a network of Ethereum bootnodes deployed at data centers in Ireland, Northern California, and Tokyo. More can be read about the alpha release of Onyx here.

Mainframe ICO Weaknesses and Threats

The mainframe roadmap strategy has not yet been clearly laid out. In the whitepaper itself, there is a 3-stage roadmap specifically regarding development of the network, but no dates are provided.

Without an articulated roadmap for reference, there is no means by which to gauge the ability of the team to achieve targets. Roadmaps don’t just include development targets, but also targets for adoption efforts.

CEO Mick Hagen points out on his LinkedIn his previous startup shut down because of an inability to scale, which we believe further necessitates an explanation of what he plans to do differently this time to succeed.

To facilitate adoption by existing applications, Mainframe is built so that it can be integrated into any existing communication app. At the same time, Mainframe have released Onyx as a functional showcase of Mainframe’s potential, which the team describes as a more secure version of Slack.

What remains unclear is which approach to adoption the team plans to follow – direct competition through promoting their own communication apps, or winning over existing platforms for integration. With the plethora of potential use cases, it’s entirely possible a hybridized strategy could be deployed.

The issue right now is that there are no indicatiors pointing to which strategy Mainframe plan to employ for popularizing the platform. Currently, Mainframe have yet to establish strategic partnerships with enterprise clients to utilize Onyx or develop new DApps.

The Verdict on Mainframe ICO

The value proposition of the Mainframe network is impressive and the team behind the ICO have an ample amount of entrepreneurial and development experience behind them.

Despite these positive indications, we are concerned by the absence of a clearly defined strategy for adoption. While the dynamism of the Mainframe ICO leaves open the possibility for many roads to scale the product, which road it will be remains a mystery.

As a Top 10% rated ICO, we will be placing a small bet on the Mainframe ICO (MFT Token).

We have rated hundreds of projects to unearth ICOs in which members of our team intend to invest.

We won’t often go into further depth on projects that we don’t consider as candidates for our investments after the initial rating process, which is why you will usually see our stamp on our detailed ICO reviews – they are the best we have found. However, on occasion, we might also rate a well-hyped project that does not meet our personal investing criteria.

The Crypto Briefing Top 10 stamp is awarded to ICO projects that we rate in the top 10% of all projects.

Learn more about the Mainframe ICO from our Telegram Community by clicking here.

MAINFRAME ICO REVIEW SCORES

SUMMARY

The Mainframe ICO is a “project-waiting-to-happen” inasmuch as competitors in this space have not adequately solved the problem this team is working to resolve. With a strong team and experience of startup success and failure (which can be equally important) we see no reason that their solution might fail. However, we also prefer to see clear roadmaps against which to judge progress, and – vitally – a transparent plan for mass adoption that sets out a business strategy aside from the engineering development. In the absence of strong indicators or partnerships here, our rating is downgraded somewhat.

Founding Team……………………….8.6

Product…………………………………..7.3

Token Utility…………………………..9.1

Market…………………………………..7.8

Competition…………………………..5.0

Timing……………………………………8.8

Progress To Date……………………2.3

Community Support & Hype…..8.0

Price & Token Distribution……..7.4

Communication……………………..8.2

FINAL SCORE……………………….7.4

UPSIDES

- Value proposition that addresses significant need for security and anonymity

- Novel application of blockchain and encryption technology

- Significant hype and community support

DOWNSIDES

- High level of competition from established communication protocols

- Strategy for mass adoption is unclear

- No partnership agreements in place

Today’s Date: 3/7/18

Project Name: Mainframe

Token Symbol: MFT

Website: https://mainframe.com

White Paper: https://mainframe.docsend.com/view/j39qpui

Crowdsale Hard Cap: 30,000 ETH

Total Supply: 10 billion

Token Distribution: 50% to crowdsale, 25% to team, 25% to ecosystem

Price per Token: 1 MFT = 0.000006 ETH

Maximum Market Cap (at crowdsale price): $52,000,000

Accepted Payments: ETH

Countries Excluded: None

Bonus Structure: None

Presale Terms: N/A

Whitelist: Currently, the only way to whitelist is through the ambassadors program. Once the telegram group hits 20k members more details about the ICO will be released.

Important Dates: Crowdsale TBA please refer to their Telegram channel for more information

Expected Token Release: TBA

Additional Information: Mainframe Token Generation Event

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Earn with Nexo

Earn with Nexo