Bitcoin metrics indicate return of speculative activity in crypto

New demand holds 41% of Bitcoin wealth, signaling a shift in market dynamics, research firm Glassnode points out.

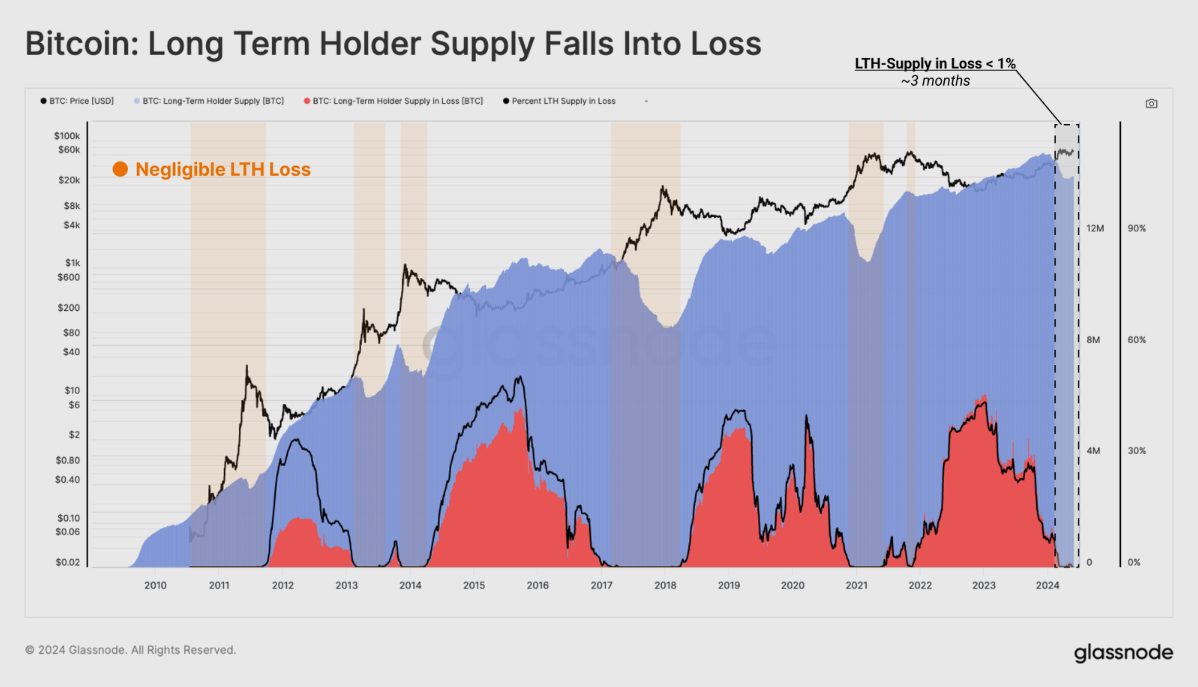

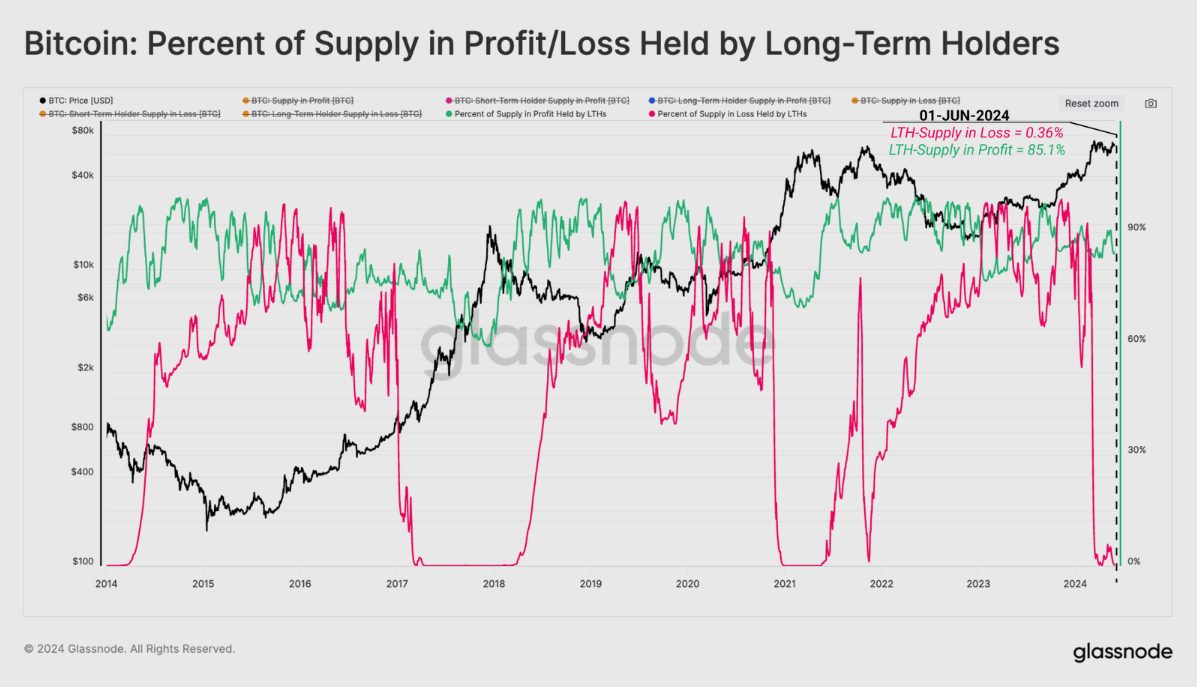

Bitcoin’s market dynamics are showing early indications of renewed speculation in the crypto market, as reported by Glassnode. Long-Term Holders (LTH) are currently sitting on unrealized profits, with only a minuscule 0.03% in losses, signaling the onset of a potential bull market’s euphoric phase.

Over the past two months, the Sell-Side Risk Ratio for both Long and Short-Term Holders has balanced out, suggesting that the market has absorbed the expected profit and loss within the current price range, setting the stage for possible significant volatility ahead.

A notable shift has occurred with the spending of long-dormant coins, which has led to spikes in metrics such as Realized Cap, Spent Output Profit Ratio (SOPR), and Coindays Destroyed. However, by using an entity-adjusted variant of the Realized Cap, Glassnode filtered the actual capital inflows in Bitcoin, which currently stands at an all-time high (ATH) valuation of $580 billion.

The “Realized Cap HODL Waves” metric reveals that 41% of network wealth is held by coins younger than three months, indicating a wealth transfer to new demand. This pattern is consistent with previous cycles, where new demand eventually accounts for over 70% of network wealth.

Despite a slowdown in liquidity and speculative activity, the recent reclaiming of the $68,000 level has brought most Short-Term Holders back into profit.

Moreover, the market’s consolidation just below Bitcoin’s all-time high has created a significant cluster of Short-Term Holder coins around the current spot price, highlighting substantial investment in this range and introducing the risk of heightened investor sensitivity to price fluctuations.

The recent pullback to $58,000 marked a 21% correction, the largest since the FTX collapse, pushing 56% of the Short-Term Holder supply into a loss. Yet, the magnitude of unrealized loss aligns with typical bull market corrections, suggesting stabilization is on the horizon.

Long-Term Holders continue to exhibit confidence, with only 4.900 BTC held at a loss, representing a mere 0.03% of their supply. This contrasts with the Short-Term Holders, who bear the brunt of market losses, especially near peak prices.

The market is also anticipating the Mt.Gox distribution event, with the Trustee’s recent wallet consolidation signaling preparations for the return of 141,000 BTC to creditors by October. Mark Karpeles, the former CEO of Mt.Gox, confirmed the wallet movements were part of this process.