Maximizing Ethereum DeFi Yields through iEarn Finance

Navigating the dynamic world of DeFi yields

A new non-custodial dApp is making it easy to maximize Ethereum yields across different DeFi protocols. Using iEarn Finance, investors can find how to maximize their return on investment.

Dynamic Capital Allocation

Professional money managers help clients invest more actively. Recreating this capability in the world of permissionless finance is no easy task, requiring a complex system of smart contracts. iEarn Finance is one of the first trying to offer this kind of service. Right now, avid DeFi investors regularly scan the market for the best risk-adjusted returns. Say a user invests at an attractive rate in DeFiZap’s Uniswap pool but a few days later, interest rates fluctuate and becoming a liquidity provider on Curve Finance seems more profitable.

DeFi relies on market-determined yields. That is, demand, supply, and utilization of supply are key drivers of interest rates and ROI. If there aren’t many borrowers for DAI on Compound, the lending yield and borrowing rate both decrease. But if utilization of supply is high, lenders are compensated with a higher yield, and borrowers need to pay more in interest.

This creates a dynamic investing environment. Those looking to gain an edge need to invest strategically while actively watching the market.

iEarn Finance may reduce the labor needed to optimize a DeFi portfolio. Using decision trees, the application scans various investment avenues across DeFi—such as Uniswap Pools, Compound, Aave, Fulcrum, and dYdX—to find the best real returns for users based on the size of their investment.

There are two types of tokens native to iEarn: yTokens and iTokens. Simply put, yTokens offer investors direct yield through native liquidity pools, while iTokens provide indirect yield by investing in other protocols.

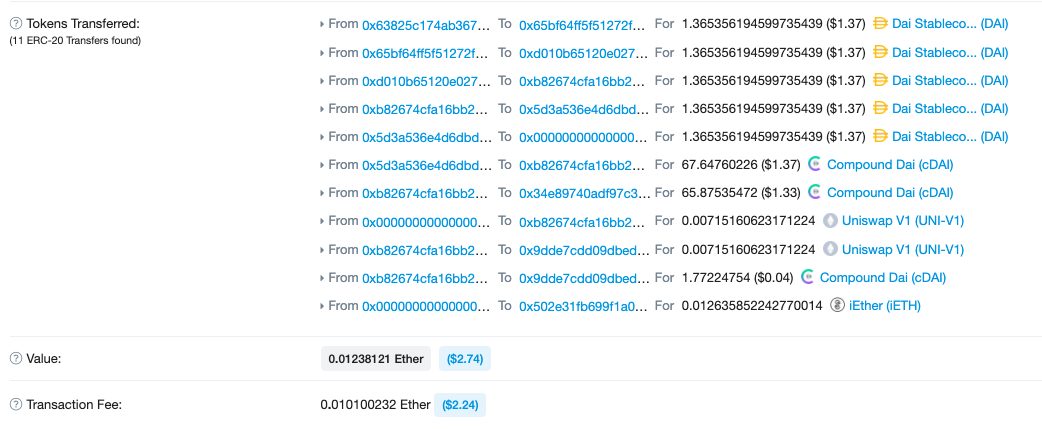

For the end-user, the process of minting iTokens is simple: deposit ETH (or any other accepted token) into the contract and mint an equivalent amount of iToken, such as iETH. In the background, deposited funds go through a series of transactions to allocate them to each component of the investment strategy.

Example Investment

These transactions execute the following actions: ETH is sent from a user’s wallet to iEarn Finance, half of this ETH is sent from iEarn to KyberSwap to convert it into DAI, the DAI is then transferred to Compound where it is deposited and cDAI (Compound’s wrapped DAI token) is minted. Finally, the remaining amount of ETH along with the cDAI are both deposited in Uniswap to become a liquidity provider in the cDAI/ETH liquidity pool.

It’s important to note that in order to become a liquidity provider on Uniswap, one must contribute funds in a 50-50 ratio between either ETH and an ERC-20 token or two ERC-20 tokens.

User funds are now split evenly between cDAI and ETH. The user will accrue profits by way of liquidity provision fees on Uniswap as well as the appreciation of deposited tokens.

Best of Permissionless Investing

The utility of this dApp is to give those without time or information the option to delegate their investment decisions to an algorithm that does it for them.

Unsophisticated investors and early DeFi users can leverage iEarn’s simple mechanics to maximize their ROI in DeFi.

iEarn Finance is attempting to automate the investment process for DeFi investors to maximize their ROI. The end goal is to grow the absolute amount of ETH invested.

While there are several investment opportunities in DeFi, finding each of these opportunities is a full-time job in itself. Lending markets have aggregators like Staked’s Robo Advisor for Yield (RAY) that collect funds and direct them towards the highest yield in the market.

However, there is no single product that finds the best opportunity across the stack, encompassing lending, providing pool liquidity, and utilizing derivatives. iEarn Finance could offer a solution, if it succeeds.

In the project’s official Telegram group, founder and developer Andre Cronje explained that, eventually, the algorithm will factor in investment size and potential slippage loss while making decisions. As of now, users choose the token and deposit themselves.

This is a high potential project, but users are requested to exercise caution when interacting with the contract as it is currently undergoing a third-party audit. A full report is expected in the coming week.

Disclosure: Andre Cronje is an equity-holder in Crypto Briefing.

Earn with Nexo

Earn with Nexo