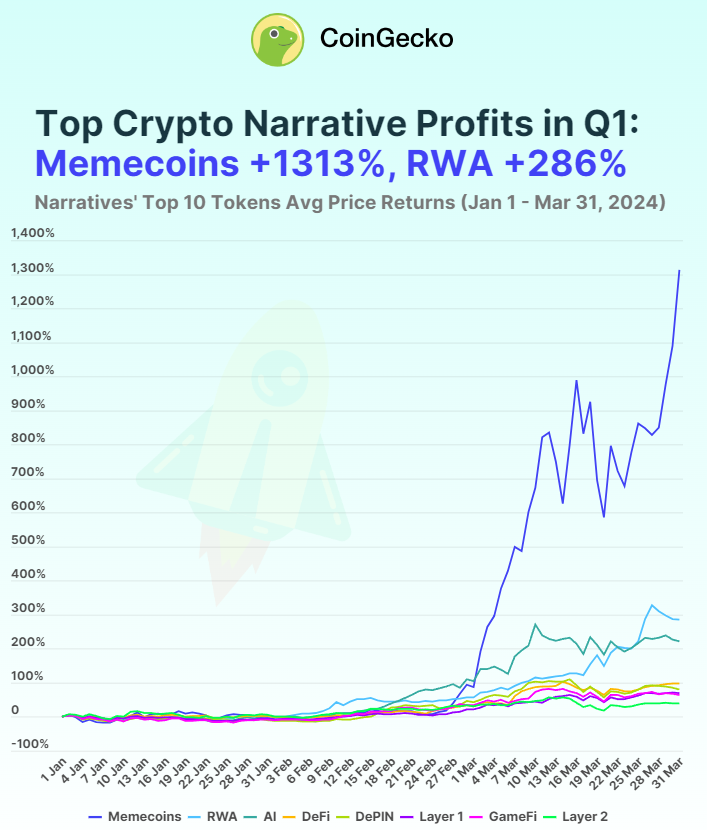

Meme coins skyrocket with record-breaking Q1 returns: CoinGecko

Memecoins dominate Q1 with gains outpacing RWA and AI narratives.

Memecoins have emerged as the top-performing crypto narrative in the first quarter of 2024, with an average return of over 1300% across its leading tokens, according to an April 3 report by data aggregator CoinGecko. Notably, Brett (BRETT), BOOK OF MEME (BOME), and cat in a dogs world (MEW) have significantly contributed to this surge.

BRETT, in particular, saw a staggering 7727.6% increase in value by the end of Q1 from its launch price. The dogwifhat (WIF) token also experienced a substantial gain of 2721.2% quarter-to-date after going viral, fueling the current meme coin frenzy.

The profitability of meme coins was 4.6 times higher than the next best-performing narrative of real-world assets (RWA), and 33.3 times more than the Layer-2 (L2) narrative, which had the lowest returns in Q1. RWA tokens also performed well, with MANTRA (OM) and TokenFi (TOKEN) seeing QTD gains of 1074.4% and 419.7%, respectively. However, XDC Network (XDC) experienced a 15.6% decline.

The artificial intelligence (AI) narrative closely followed, with a 222% return in Q1. All large-cap AI tokens posted gains, with AIOZ Network (AIOZ) leading at 480.2% and Fetch.ai (FET) at 378.3%. Even the lowest gainer, OriginTrail (TRAC), returned 74.9% in Q1, indicating a collective interest in AI tokens.

The decentralized finance (DeFi) narrative saw moderate gains of 98.9% in Q1, with Ribbon Finance (RBN) leading at 430.8% QTD after pivoting to Aevo. Other DeFi tokens like Jupiter (JUP), Maker (MKR), and The Graph (GRT) also reported strong returns. DePIN, despite initial losses, ended the quarter with 81% returns, with Arweave (AR), Livepeer (LPT), and Theta Network (THETA) as top performers.

Alternative layer-1 narratives posted 70% returns, with Toncoin (TON) and Bitcoin Cash (BCH) outperforming others. GameFi narratives matched Layer 1 with 64.4% returns, led by Echelon Prime (PRIME), Gala (GALA), and Ronin (RON). Layer 2 narratives lagged, with only 39.5% gains, as established Ethereum L2s like Arbitrum (ARB), Polygon (MATIC), and Optimism (OP) underperformed, while Stacks (STX) and Mantle (MNT) saw stronger returns.