‘Asia’s MicroStrategy’ Metaplanet secures ¥1 billion loan to acquire additional Bitcoin

The firm reinforces its strategy to accumulate BTC and hedge against currency risks.

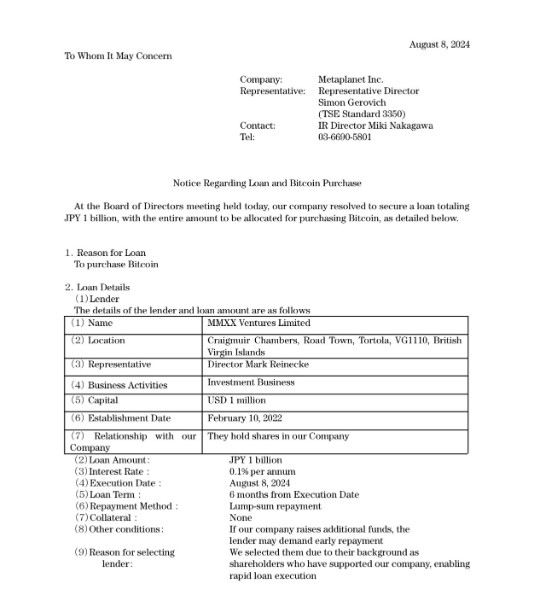

Metaplanet, a Japanese publicly traded company often compared to MicroStrategy, announced today it has secured a loan of 1 billion yen (around $6.8 million). The entire loan amount is dedicated to purchasing Bitcoin, a decision ratified at the company’s latest Board of Directors meeting.

The loan, obtained from MMXX Ventures Limited, carries an interest rate of 0.1% per annum with a six-month term and will be repaid in a lump sum.

The announcement comes one day after the company announced plans to raise approximately $70 million via a stock rights offering, with about $58 million earmarked specifically for Bitcoin investments.

Metaplanet has demonstrated strong confidence in Bitcoin by leveraging both debt and equity financing to accumulate more BTC. The firm’s strategy is inspired by MicroStrategy’s Bitcoin playbook, which has been accumulating Bitcoin since 2020.

Metaplanet views Bitcoin as a long-term investment and a hedge against currency depreciation, particularly in light of Japan’s economic challenges, including a declining yen and high government debt levels.