Michael Saylor’s Strategy buys $90 million in Bitcoin at $78,800

Saylor's bold Bitcoin investment strategy aims to boost corporate treasury holdings despite recent financial challenges.

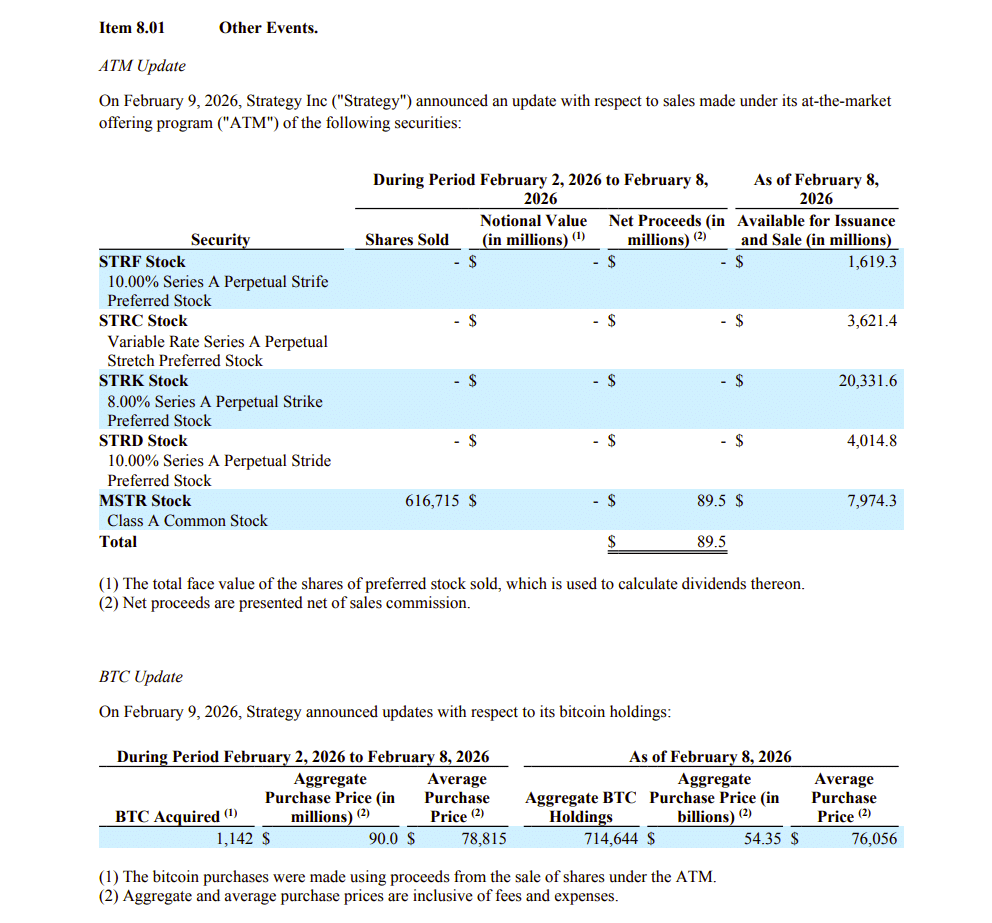

Strategy, the business intelligence firm that has become the largest corporate holder of Bitcoin, added 1,142 BTC to its reserves over the past week, bringing total holdings to 714,644 BTC valued at roughly $49 billion.

Strategy has acquired 1,142 BTC for ~$90.0 million at ~$78,815 per bitcoin. As of 2/8/2026, we hodl 714,644 $BTC acquired for ~$54.35 billion at ~$76,056 per bitcoin. $MSTR $STRC https://t.co/tJ7Ilwpc2l

— Strategy (@Strategy) February 9, 2026

The company disclosed today that it spent $90 million on the latest batch of Bitcoin between February 2 and February 8, acquiring the stash at an average price of $78,815 per coin. Funding came from the sale of MSTR common stock, which generated $89.5 million in net proceeds.

Michael Saylor, founder and executive chairman of Strategy, has spearheaded the firm’s pivot toward treating Bitcoin as its primary treasury reserve. The average cost basis across all holdings now stands at $76,056 per token.

The acquisition follows a purchase earlier this month, when Strategy bought 855 BTC for $75 million. The company maintains approximately $37.6 billion in remaining capacity across its common and preferred stock ATM programs.

Strategy’s aggressive accumulation strategy has encountered headwinds in recent months. The firm reported a net loss of $12.4 billion in the fourth quarter of 2025, driven largely by mark-to-market fluctuations.

MSTR edged down in premarket trading on Monday after closing up 26% last Friday, per Yahoo Finance.

Earn with Nexo

Earn with Nexo