Robinhood rolls out micro XRP, Solana futures following token relisting

Retail investors gain greater access and risk management with new micro-sized futures contracts on major digital assets.

Robinhood, the leading fintech company providing a comprehensive financial services platform, announced Friday that it has added micro futures contracts for XRP and Solana, and Bitcoin Friday futures to its trading platform.

New crypto futures are now on Robinhood.

Trade micro XRP, Solana, and Bitcoin Friday futures with lower margin requirements and seamless execution with our trading ladder.

— Robinhood (@RobinhoodApp) June 27, 2025

The move expands Robinhood’s crypto derivatives to nine distinct offerings, with the total number of crypto assets supported on its futures market being four, including Bitcoin, Ethereum.

Robinhood has already offered standard XRP and Solana futures on its platform.

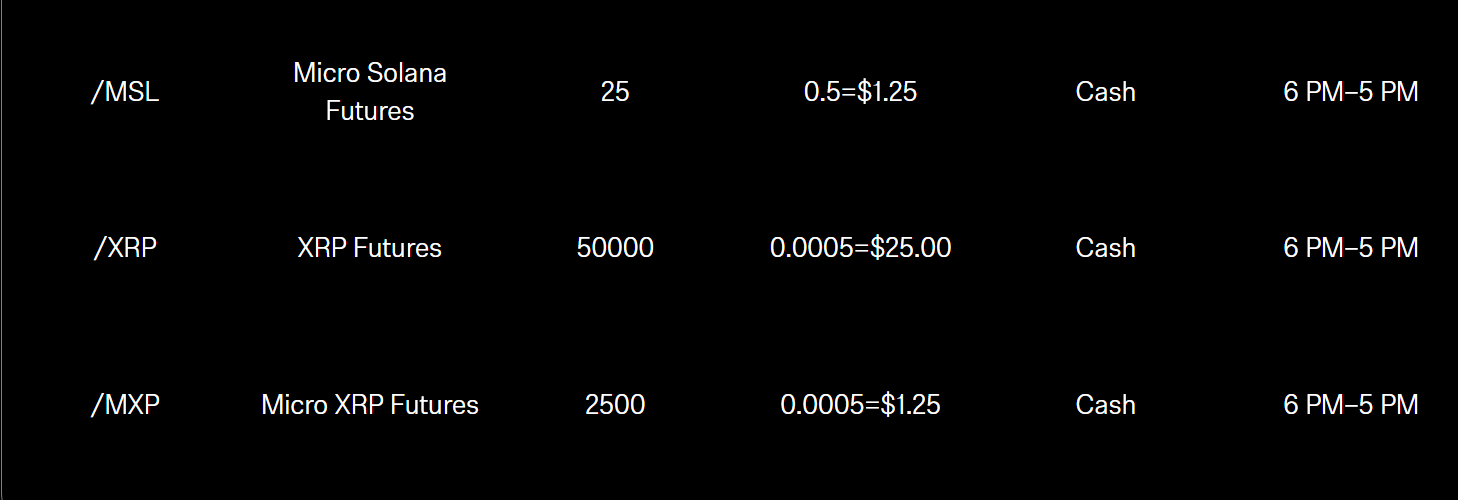

The new micro XRP futures contract features a contract multiplier of 2,500, with each tick of 0.0005 equivalent to $1.25, compared to $25 in the full-sized contract.

The small contract size enables retail traders and those with more conservative risk profiles to trade XRP futures without high capital requirements. These crypto futures are cash-settled and trade nearly 24 hours daily, from 6 PM to 5 PM ET.

The micro Solana Futures contract operates with a multiplier of 25, where each 0.5 tick move equals $1.25, offering traders more precise position-sizing options and reduced exposure. Like its XRP counterpart, it is cash-settled and follows the same trading schedule.

The latest additions come after Robinhood Crypto announced the relisting of Solana, XRP, and Cardano on its US trading platform in response to user demand for more diverse investment options. The firm also aims to attract new customers through diverse trading options.

Not just Robinhood, several major derivatives platforms have expanded their crypto offerings under the new administration.

Earlier this year, CME Group and Coinbase added more crypto futures products, including contracts tied to XRP and Solana, signaling growing institutional demand and regulatory momentum for digital asset derivatives.

Earn with Nexo

Earn with Nexo