MicroStrategy reveals $500 million debt offering to acquire Bitcoin

Michael Saylor is not slowing down even after accumulating more Bitcoin than every spot Bitcoin ETF in the US.

MicroStrategy announced on Mar. 13 a new private offering of convertible senior notes totaling $500 million, and the money will be used to expand the company’s Bitcoin (BTC) holdings. The notes will be unsecured senior obligations of MicroStrategy and will bear interest payable every March 15 and September 15 of each year, beginning on September 15, 2024. The maturation of the notes is set for March 15, 2031.

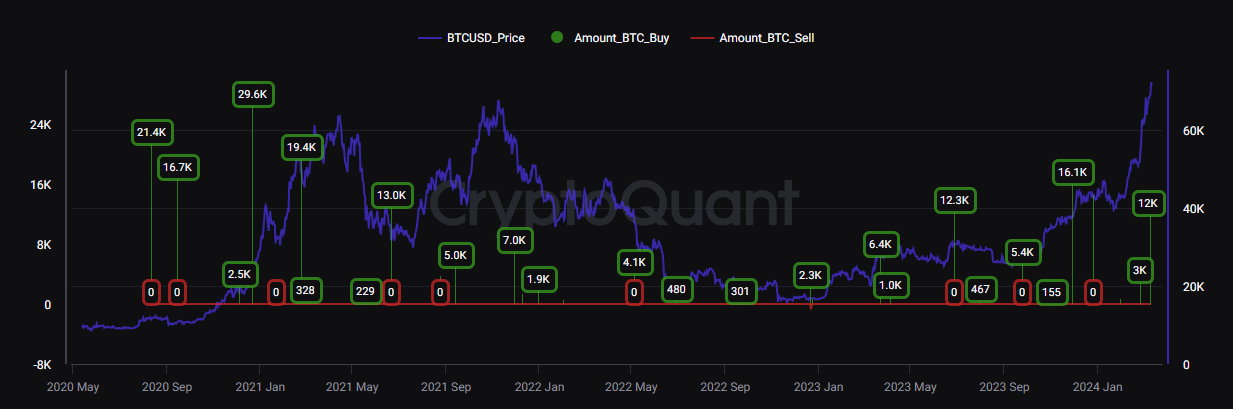

Less than a week ago, the company founded by Bitcoin advocate Michael Saylor added 12,000 BTC to its holdings at an average price of $68,477, being the first Bitcoin acquisition at a price over $60,000 for the company. MicroStrategy now has 205,000 BTC, at an average price of $33,706, with more Bitcoins under management than any of the ten spot BTC exchange-traded funds (ETFs) in the US.

Saylor’s strategy for its tech company has been bearing fruit, with over $7.7 billion of unrealized profit on its $14.6 billion Bitcoin chest, according to on-chain data platform CryptoQuant. Since last year’s November, MicroStrategy has been consistently buying Bitcoin every month, totaling 37,755 BTC accumulated.

If price predictions are fulfilled and Bitcoin hits $100,000 by mid-2025, the unrealized profit of MicroStrategy’s BTC holdings will surpass $13.5 billion, with a return on investment of 197% within five years.