Mt. Gox Bitcoin sell-off fears are exaggerated: CoinShares study

Bitcoin distribution impact softened by staggered release and market liquidity, while Bitcoin Cash faces higher sell-off risk.

The idea of the Mt. Gox Bitcoin (BTC) sell-off spooked the crypto market more than the actual impact it could have on BTC price, according to a recent study by asset management firm CoinShares. A worst-case scenario is a 19% daily drop if all BTC are sold concurrently, although this is a very unlikely one.

Currently, the Mt. Gox trustee holds 142,000 BTC and an equal amount of Bitcoin Cash (BCH), valued at $8.85 billion and $55.25 million respectively. Luke Nolan, Ethereum Research Associate at CoinShares, highlighted that creditors were met with two choices: receive 90% of what they were owed in kind this month, or wait for the end of the civil litigation.

An estimated 75% of creditors opted for early repayment, reducing the July distribution to about 95,000 BTC. Additionally, the list of Mt. Gox creditors also include claims of 10,000 BTC and 20,000 BTC by Bitcoinica and MtGox Investment Funds (MGIF), respectively.

“However, MGIF has already publicly reiterated that it does not plan to sell its bitcoin holdings. So from the 95,000 we can reduce the potential market impact to 75,000 bitcoin,” Nolan added.

Therefore, only 65,000 BTC will be distributed to individual investors. Yet, Nolan points out the fact that investors’ holdings are roughly 13,600% up since the Mt. Gox incident, and selling all their BTC would be “an exorbitant tax event.”

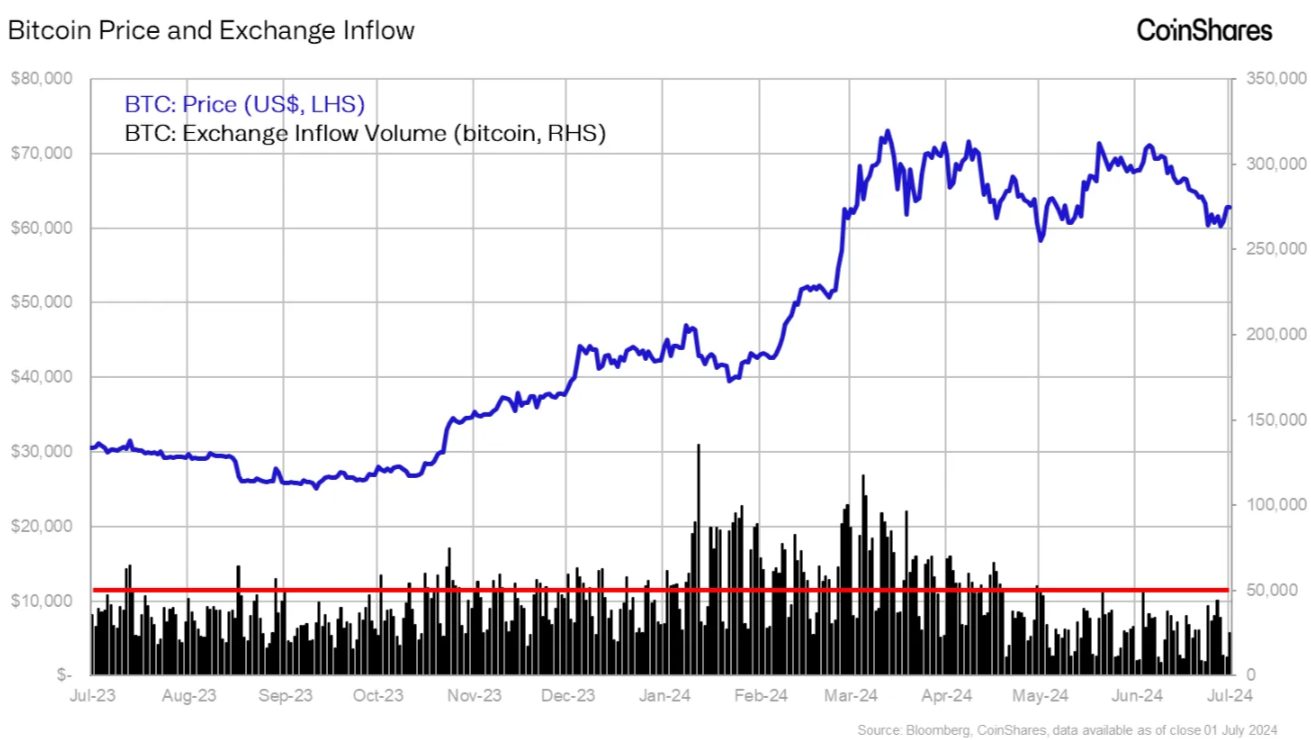

Moreover, the distributions will occur on several exchanges on different dates throughout the month, which makes large concurrent selling less likely. Daily exchange inflows have averaged 32,000 BTC over the past year, with the peak being 150,000 BTC at the spot Bitcoin exchange-traded funds (ETFs) launch on January 11th.

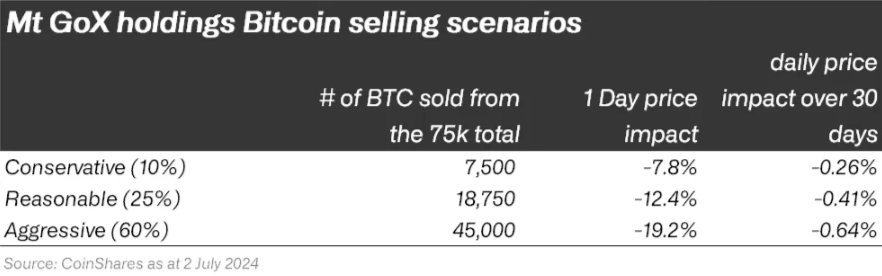

“With our bottom line of 75,000 bitcoin that could hit the market, we can break that down into a few scenarios and estimate the potential price impact using a simple Sigma Root Liquidity model. Assuming our estimate of US$8.74bn of daily traded volume on trusted bitcoin exchanges, in the worst case scenario US$2.8bn could be sold.”

If this nearly $3 billion in Bitcoin is sold in one day, Nolan assessed that the market “could cope with these volumes easily”, as it has already been tested by the substantial liquidations from the Grayscale ETF this year. Hence, a 19% slump in a single day is the estimate of CoinShares analysts. However, they believe this scenario is unlikely to happen.

Notably, in the scenario where all Mt. Gox creditors’ BTC is sold over the course of the next 30 days, the impact would be minimal. “Taken in combination with the chance for interest rate cuts this year, it will be likely offset by these price supportive events.”

Bitcoin Cash, with its smaller $8 billion market cap and lower liquidity, is more vulnerable to selling pressure. An estimated 80% of distributed BCH may be sold by creditors, potentially causing significant market disruption, the study concluded.