Shutterstock cover by Mahambah

NEAR Launches USN Stablecoin on Testnet

NEAR could soon break out on news of the official launch of the USN stablecoin.

NEAR could soon launch its own stablecoin to compete with Terra’s UST. Speculation over the news appears to be pushing NEAR closer to a key resistance level that could send the token into price discovery mode if broken.

NEAR Edges Closer to Break Out

NEAR appears to be gaining momentum for a significant bullish impulse as the utility of the network could be able to expand.

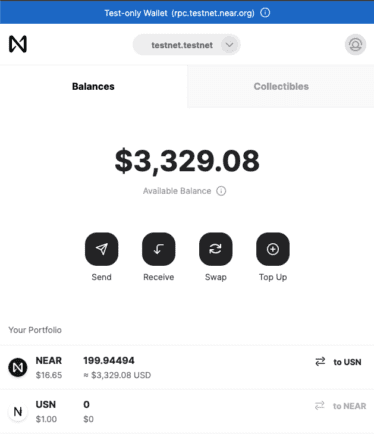

Speculation is mounting among cryptocurrency enthusiasts over the launch of a NEAR-native stablecoin. Dubbed USN, it is said that it could follow a similar mechanism to Terra’s UST, where NEAR tokens would be burned when users want to mint the stablecoin to increase its demand. USN could also offer an annual interest rate of around 20%, according to Crypto Insiders’ founder Zoran Kole.

The USN stablecoin recently went live on the NEAR public test network, which has generated excitement among market participants.

Although there have not been any official updates about USN’s launch date, it appears that NEAR could break out in anticipation of the news.

The token has been consolidating within a symmetrical triangle on its four-hour chart since early April. As prices move closer to the pattern’s apex, the probability of a bullish breakout increases. Slicing through the $17 resistance level could result in a 32.5% upswing to a new all-time high of $22.4.

It is worth noting that the asset must avoid closing below $15 because such a price movement could invalidate the optimistic outlook. Breaching this crucial support level could encourage traders to exit their positions, putting some downward pressure on the coin. Under such circumstances, prices could fall to $14 or even $12.50.

Disclosure: At the time of writing, the author of this piece owned ETH and BTC.

Earn with Nexo

Earn with Nexo