Nexo card sees $50M in holiday spending boosted by its credit function

Nexo card's holiday surge and FinTech Breakthrough Award win highlight crypto's growing role in consumer payments.

Nexo’s “Holiday Spending Report 2023/2024” report revealed an increase in the use of its Nexo Card during the holiday season, with spending exceeding $50 million, a 43% jump from the previous quarter. The card, which operates in Dual Mode as both credit and debit and lets users spend and borrow against Bitcoin, Ethereum, and stablecoins, has also contributed to the preservation of crypto assets by preventing the sale of 2,200 BTC and 41,000 ETH. This surge in usage coincides with a 4.5-fold increase in the card’s user base.

The Nexo Card is related to other products offered by the crypto services provider, including Instant Crypto Credit Lines and an Earn product which offers yield to users. In addition to the spending report, Nexo has been honored with the “Consumer Payments Innovation Award” at the 8th annual FinTech Breakthrough Awards.

“The Nexo Card’s holiday performance, as well as its success at the FinTech Breakthrough Awards, not only illustrates a significant adoption of crypto transactions but also signals a shift towards digital currencies in everyday spending. With our Dual Mode Nexo Card, clients not only embraced the digital revolution but also demonstrated how indispensable such products are in the ecosystem. We are honored by the recognition from both FinTech Breakthrough and our clients,” said Elitsa Taskova, CPO of Nexo.

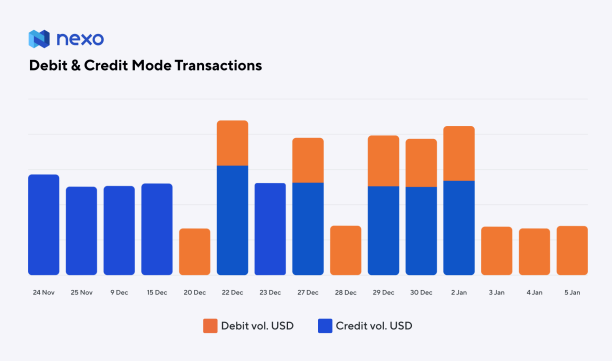

The report reveals that Nexo cardholders preferred to use the credit function during Black Friday and the Christmas period, while a balance between credit and debit was registered when the celebrations peaked on New Year’s Eve.

As for the reasons behind this pattern favoring the credit function, the report highlights benefits such as cashback and maintaining the crypto instead of selling for payments can be two of the main reasons.

This trend also aligns with the broader credit card usage pattern, consisting of consumers often reserving debit cards for daily expenses and credit cards for more substantial purchases or online transactions where additional protections are valued.

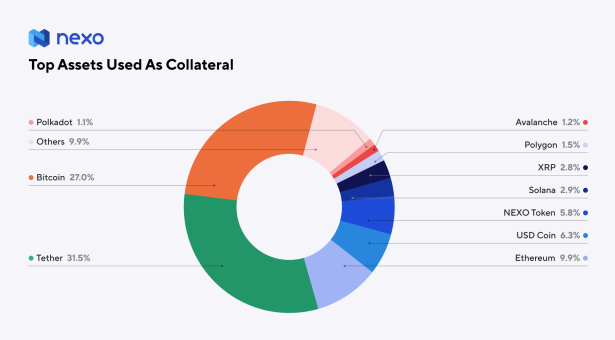

The Tether USD (USDT) was the most used crypto as collateral to enable credit functions with a 31,5% share. Bitcoin came close with 27%, while Ethereum stood at a fair distance with almost 10%.

“This move not only exemplifies strategic management by individual users but also highlights the Card’s pivotal role in shaping a more resilient and thoughtful crypto market environment. Among the other cryptocurrencies available on Nexo as collateral Solana’s SOL and Ripple’s XRP are notable mentions per cardholder’s choice, following the most popular collateral options,” revealed the report.

The report also points out that the Nexo Card was used in 164 countries, with Southern Europe accounting for over 33% of overall volumes in credit and almost 40% in debit.

Nexo advertises with Crypto Briefing. The editorial team independently selected this article for publication.