OMG Network Ready to Plummet After Prices Triple

OMG continues climbing upwards while different on-chain metrics show that prices are ready to drop.

OMG Network puts its Layer-2 scaling solution to work after a new partnership with Tether. Speculators saw this as a reason to go all-in, causing prices to soar.

Enabling Faster and Cheaper Transactions

OMG Network, previously known as OmiseGo, made headlines following dramatic price action this past week. Over the last 7-days, OMG prices more than tripled, hitting a new yearly high of just under $6.

The sudden spike in demand for OmiseGo seems to be fueled by increased usage of its Layer-2 scaling solution for the Ethereum protocol. Tether, the largest stablecoin by market capitalization, recently announced that USDt was live on OMG Network.

The integration is expected to help ease the congestion on Ethereum’s blockchain and provide cheaper and faster transactions for users of the stablecoin.

“Today, we’re excited to announce the launch of Tether on the OMG Network that supports thousands of transactions per second at a third of the cost of the same transaction on Ethereum. We’re delighted to address these fundamental issues and drive further growth and adoption of open financial services,” said Vansa Chatikavanij, CEO at OMG Network.

The announcement combined with hot market action means that speculators are pouring into this ERC-20 token to get in on the buying frenzy.

OmiseGo Social Engagement Metrics Explode

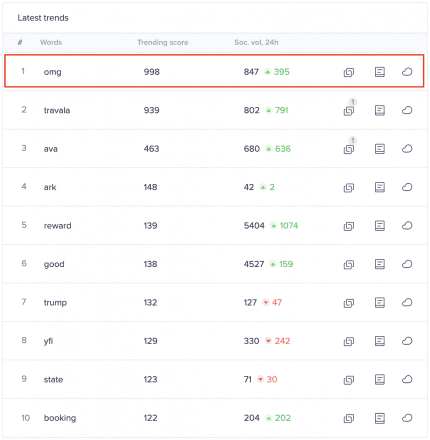

Data shows that the number of OMG-related mentions on different social media networks surged over 14x in the past two days. The rising chatter around the token allowed it to move to the number one spot on Santiment’s Emerging Trends list.

Increased attention is not necessarily a good sign for the continuation of the uptrend. When prices pump and the crowd starts paying attention, then the dump usually follows shortly after.

Dino Ibisbegovic, head of content and SEO at Santiment, maintains that within two weeks after a given cryptocurrency claims one of the top three positions on this list, prices generally drop by roughly 8%. Therefore, increased crowd attention can be considered a leading indicator of a short-term price correction.

OMG Support and Resistance Levels

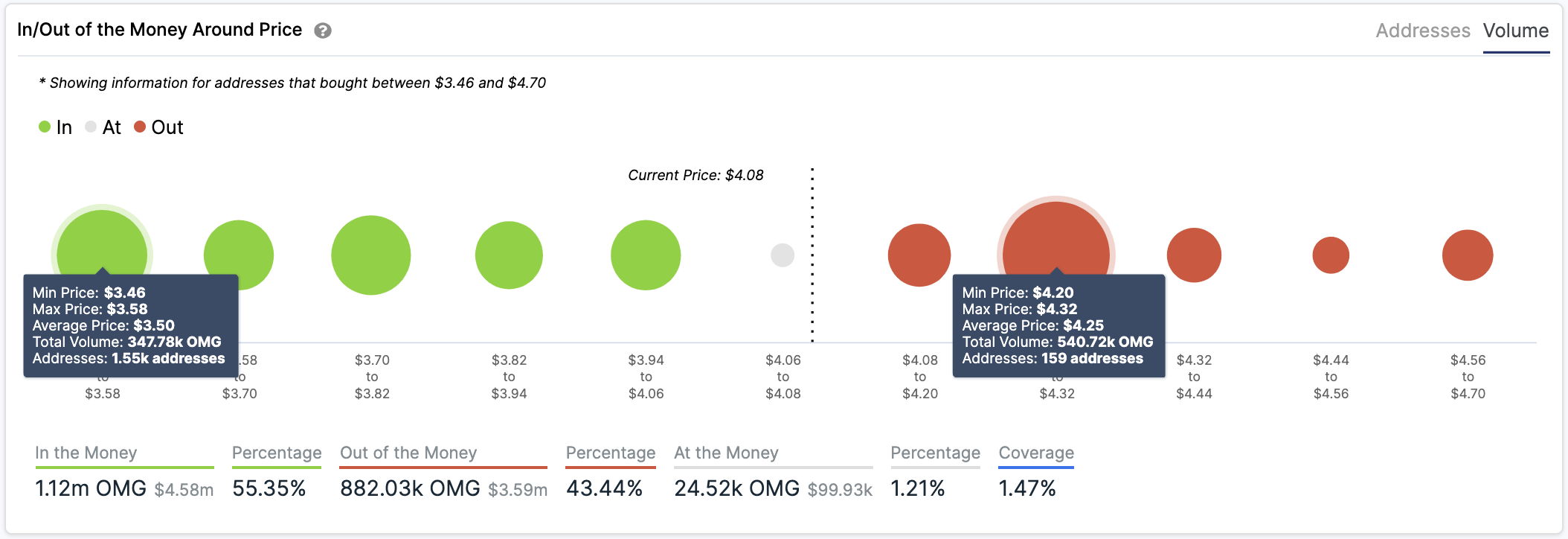

In the event of a downturn, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals there is a crucial support level underneath this token that could hold falling prices at bay. Based on this on-chain metric, roughly 1,600 addresses had previously purchased nearly 350,000 OMG around $3.5.

This significant supply barrier may have the ability to absorb some of the selling pressure. Holders within this price range would likely try to remain profitable in their long positions and even buy more tokens to allow prices to rebound.

Even so, the sudden exuberance around OMG Network means that prices can stay at unrealistic levels for longer than most short traders can stomach. In the last few hours, OMG already blew up a stiff resistance level at $4.3, where 159 whales held around 540,000 OMG.

Without any significant supply barriers ahead, the sky is the limit for OMG—at least in the short-term. But what goes up must come down, it’s just a matter of time.