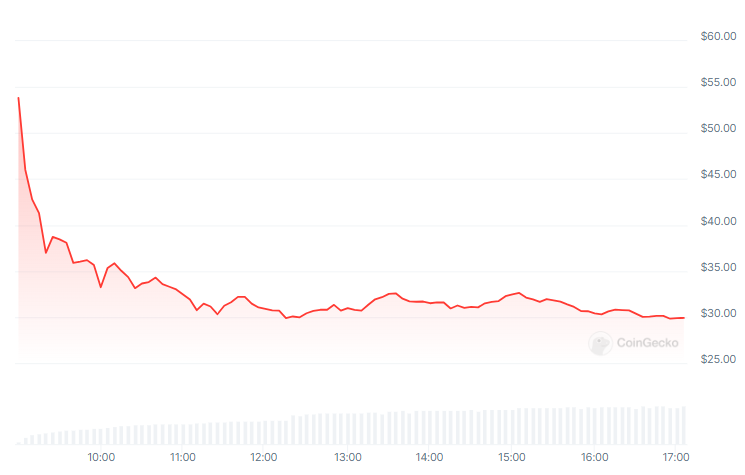

OMNI crashes 44% less than 12 hours after its airdrop

The slump might not be related to the perceived value of the token but to an accumulation movement directed at other assets.

Rollup interoperability infrastructure Omni Network launched its native OMNI token today, and its price crashed 44% at the time of writing, according to data aggregator CoinGecko. Now sitting at $30.03, the OMNI exhibits a fully diluted valuation of over $3 billion and a $318 million market cap. In the last 24 hours, the trading volume for OMNI reached almost $447 million.

However, the crash might not be tied to the perceived value of the token, instead following the movements of the crypto market as a whole. As Bitcoin (BTC) tumbled over 12% in the last seven days, losing its $60,000 price level briefly today on some centralized exchanges, other tokens followed its pullback. Therefore, major crypto on the market offers new buying opportunities that investors are quick to seize.

As an airdropped token, investors see OMNI as new liquidity through selling and rotating the capital into those major coins. The same fate fell on PRCL, the airdropped token for real-world asset-based derivatives exchange Parcl, which bottomed today at $0.4658 after falling 25%.

Although not guaranteed, those tokens may see a recovery within the next few days, after the market finishes its accumulation movement on other tokens. The trader identified as Rekt Capital shared on X that a pre-halving retracement is on course and that it can be identified in previous halving cycles. The next phase is an accumulation period, followed by a parabolic uptrend started by Bitcoin.

3 Phases of The Bitcoin Halving

1. Final Pre-Halving Retrace

Bitcoin has produced two -18% retraces prior to the Halving in the span of just over a month

In mid-March, BTC pulled back -18% before recovering to $70000 and now in mid-April BTC has retraced -18% again

This… pic.twitter.com/2BKBQXpPOV

— Rekt Capital (@rektcapital) April 17, 2024

Earn with Nexo

Earn with Nexo