Shutterstock cover by El.Archi

Polygon Daily Transactions Tank 50% After Gas Fee Hike

Polygon has sparked criticism in the community after “recommending” higher gas fees.

Polygon has increased transaction fees to avoid spam attacks on the network. However, the community has not welcomed the update. MATIC is at risk of a steep correction.

Polygon Network Activity Drops

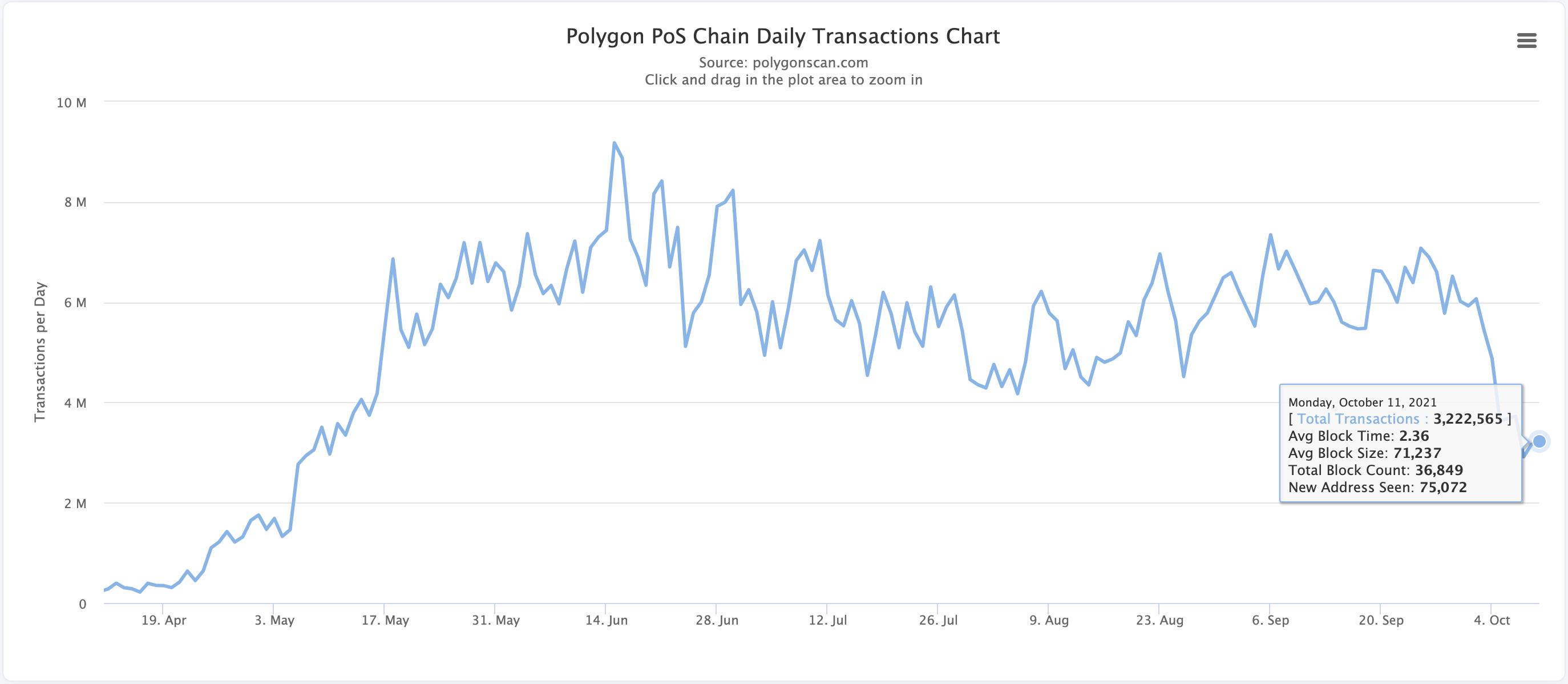

On-chain activity on Polygon is plummeting.

The average daily transaction count on the network has dropped by nearly 50% over the last few days. Roughly six million transactions were made on Oct. 3, while on Oct. 11 only three million transactions were recorded.

The considerable decline in network activity appears to be correlated to the recent spike in gas prices.

Polygon’s co-founder Sandeep Nailwal proposed to increase the transaction fees on the network from 1 gwei to 30 gwei in an attempt to curb spam transactions on the blockchain. The move sparked criticism among the community over how “decentralized” the network is. However, rather than a default upgrade, the change was more of a “recommendation.” Nailwal said:

“This change has been recommended to reduce the spam transactions in the network. As it is a client-level configuration, you are free to run your node with old/different settings as per your wish.”

While the spike in transaction fees aims to make spam attacks more difficult, it also discourages developers from building new applications on top of the Polygon network. Get Protocol developer kasperk said their project was considering moving to other networks after the cost of minting NFT tickets suddenly increased by a factor of 30.

MATIC Edges Closer to Volatility

Polygon’s MATIC token does not appear to have reacted to the gas price increase yet. It’s currently consolidating, making a series of lower highs and higher lows, which has led to the formation of a symmetrical triangle on its daily chart.

As MATIC edges closer towards the triangle’s apex, the odds for a substantial spike in volatility increase. A daily candlestick close outside of the $1.40 to $1.10 price pocket should determine where the asset is heading next.

MATIC could rise by more than 84% to retest the mid-May all all-time high of $2.70 after overcoming the overhead resistance. Still, a spike in selling pressure that pushes below the $1.10 support level could result in a steep correction to $0.62.