Polymarket hits weekly all-time high in user activity tied to US election

Bitcoin price dips during debate, trader predicts October breakout for crypto markets.

Last night’s US presidential debate sparked user activity in the Polygon-based prediction market Polymarket, as the weekly percentage of election-related users reached an all-time high of 72.8%. The previous record was registered in the July 15th week, at 70.7%, according to a Dune Analytics dashboard by Richard Chen.

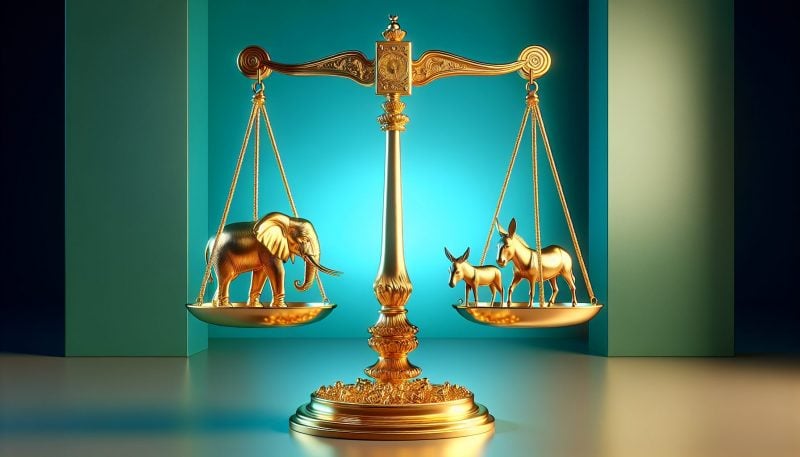

Vice president Kamala Harris’ odds on Polymarket to win the US presidential elections tied with former president Donald Trump at 49% following last night’s debate. For brief periods on Sept. 11, Harris took the lead by 1%.

Harris snagged 3% of Trump’s odds, and the bets on a favorable outcome for the Democrats’ representative surpassed $116 million. Trump still holds a lead in bets, with over $133 million destined for the outcome involving the former president winning the election.

Moreover, possibly due to a lack of remarks related to crypto, Bitcoin’s (BTC) price fell up to 3% during the debate duration. It recovered slightly and now BTC is down by 0.8% over the past 24 hours, which is not a staggering price variation in current market conditions.

Lazy September followed by an explosive Q4

The trader who identifies himself as Rekt Capital highlighted on a Sept. 11 X post that Bitcoin usually starts an upward movement within 150 to 160 days after its halving, which is a period that ends in the next two weeks.

However, the trader pointed out September’s track record for risk assets, as the month historically offered limited average returns.

“More realistically, chances favor a breakout in October, which has historically been a strong month for Bitcoin, especially in Halving years like 2024,” he added.

Additionally, comparing the current cycle with previous halvings, Rekt Capital showed that Bitcoin registered an upside for the entirety of Q4 in the two previous cycles. Thus, despite a parabolic movement being unlikely in September, chances are that Bitcoin might start significant growth next month.

Earn with Nexo

Earn with Nexo