QuarkChain ICO Review And QKC Token Analysis

Share this article

QuarkChain ICO Overview

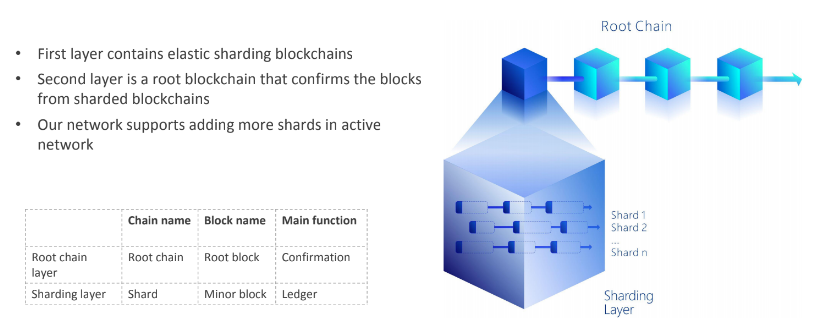

The QuarkChain ICO (QKC Token) is raising funds toward a multi-layer, peer-to-peer transaction blockchain. The first layer of system contains shards, while the second layer is comprised of a root chain. The architecture of QuarkChain is predicated on finding a balance between security, scalability and decentralization.

QuarkChain ICO Value Proposition

Scalability and security do not go always hand-in-hand when it comes to blockchain technology. QuarkChain have set out to find a solution that balances both these needs through by separating the two main functions of the chain into separate layers.

The first layer contains all minor blockchains, or shards, which process a sub-set of all transactions independently. As the number of shards increase, so to does the number of transactions which can be processed concurrently.

The second layer of QuarkChain is the root chain. The primary function of the root chain is to confirm all blocks from the sharded chains, but does not process transactions itself.

QuarkChain allows for two types of transactions- in-shard and cross-shard. In-shard transactions occur between addresses on the same shard. However, setting the QuarkChain ICO apart from other high-throughput solutions is the ability to conduct cross-shard transactions. The throughput of the cross-shard transactions system will scale linearly as the number of shards increases.

Illustration of 2 Layer Architecture

To simplify the user experience of the cross-shard system, QuarkChain is developing a Smart Wallet. All addresses owned by the user in any shard are accessible via a single private key.

Theoretically, a user may have many addresses associated with disparate shards. To address this issue, QuarkChain employ both a primary and secondary account within the wallet. The primary account contains the address of the user’s default shard, while the secondary manages the remaining addresses in other shards.

To simplify management of funds, any transaction executed in a secondary account will revert the remaining balance back into the primary account. The user balance will then remain in the primary account, eliminating the confusion caused by multiple balances across multiple shards.

QuarkChain ICO tokens (QKC) are ERC-20 compatible and distributed on the Ethereum blockchain. After the mainnet is launched in Q4 2018, the ERC-20 tokens will be converted to the mainnet token by pre-mining. Future QKC will be produced by miners.

QKC are the sole means of transacting value in the system and supply a reward for miners. QuarkChain will support smart contracts on the Ethereum Virtual Machine (EVM) to enable future compatibility with existing dApps, which will benefit from increased scalability.

QuarkChain ICO Team

Qi Zhou is Founder and CEO of QuarkChain. He has software engineering experience with the likes of Google, Facebook, and EMC, where he developed sharding and clustering solutions. Qi holds a PhD from Georgia Tech in Electrical and Computer Engineering.

Yaodong Yang is a Research Scientist with the QuarkChain ICO. He is the Cofounder of Demo++, a startup incubator. He is also a Prof. at Xi’an Jiaotong University and holds a PhD in Engineering from Virginia Tech.

Xiaoli Ma is also a Research Scientist with QuarkChain. She currently serves as a professor at Georgia Tech and is an Institute of Electrical and Electronics Engineers Fellow.

Anthurine Xiang serves as CMO. For the last 4 years Anthurine has worked in Silicon Valley, with companies such as LinkedIn, Chartboost, Beepi and Wish. She holds an MSE in System Analysis and Economic Management from Johns Hopkins University.

Below is a list of the advisors working with QuarkChain:

-

- Leo Wang – Head of PreAngel VC and prolific crypto investor

- Mike Miller – Liquid2 Ventures, Founder and Chief Scientist at IBM Cloudant

- Bill More– Founder/CEO of DSSD, later acquired by EMC

- Arun Phadke– Professor Emeritus of Electrical Engineering at Virginia Tech

As the project progresses, QuarkChain are adding new members to the team. More details on the team and their background can be found here.

QuarkChain ICO Strengths and Opportunities

QuarkChain are currently already running the first version of their Testnet ahead of schedule. During our audit, we observed the capacity of the Testnet to run 2k TPS. According to the QuarkChain Development Roadmap, the team aim to achieve 10k TPS as their next milestone and will continue to scale the product from there. QuarkChain have made their Github publicly available.

Quarkchain’s impressive progress on the development front could lead to a viable sharding solution before Ethereum.

When it comes to sharding, Ethereum are taking their time with exploring different options. Should QuarkChain achieve such high-throughput, it could position the project amongst the few first-movers that offer viable solutions to this pressing issue.

QuarkChain is also EVM compatible- dApps that benefit from a high-throughput solution will have the option to switch over to QuarkChain at any point. This leaves a crucial door open for adoption of the network.

QuarkChain ICO Weaknesses and Threats

Competition for a high-throughput solution is fierce. The first name that comes to mind at the mention of high-throughput scaling is of course, Zilliqa. There is also Fusion, aiming for a Testnet release in Q2, and of course Ethereum. As always, adoption of the protocol is the crucial piece of the puzzle here when it comes to which chain(s) end up at the top.

At the moment, QuarkChain have yet to establish official partnerships, though they’ve indicated efforts are underway. In their whitepaper, QuarkChain point to several target industries that could benefit from deployment of the product – one such market is the development of decentralized mobile applications. In an effort to foster adoption for this use case, QuarkChain are creating on-chain developer tools for use on Android devices.

A share of QCK is also reserved to incentivize developers who build dApps on QuarkChain. While such strategies indicate the team are moving in the right direction, we’ll be on the lookout for any partnership agreements with enterprise clients as a sign of which market and use case scenarios QuarkChain go after.

The Verdict on QuarkChain

The QuarkChain ICO is a serious contender as far as scalability solutions go. The team have made it a point to focus on their product before moving on to build their community and establish partnerships, which they lose some points on for now.

As the release of the public Testnet approaches, however, we will monitor their progress on the latter two fronts. Regardless, the team behind QuarkChain are exceptional and have showcased their potential via the Testnet.

You can read a deeper code review of QuarkChain by Andre Cronje here.

As a Top 5% rated project, we are making a medium bet on the QuarkChain ICO (QKC Token).

Learn more about the QuarkChain ICO in our 2900-strong Telegram Group!

We have rated hundreds of projects to unearth ICOs in which members of our team intend to invest.

We won’t often go into further depth on projects that we don’t consider as candidates for our investments after the initial rating process, which is why you will usually see our stamp on our detailed ICO reviews – they are the best we have found. However, on occasion, we might also rate a well-hyped project that does not meet our personal investing criteria.

The Crypto Briefing Top 5 stamp is awarded to ICO projects that we rate in the top 5% of all projects.

QUARKCHAIN ICO REVIEW SCORES

SUMMARY

The QuarkChain ICO (QKC Token) is using an evolved 2-layer architecture to create blockchain scalability using sharding technology. We have witnessed their Testnet achieve 2,000 transactions per second (TPS) and their current goal is 10,000 TPS. While other projects are aiming for similar scaling, QuarkChain’s technology may become viable before some competitors – a focus which may have been at the expense of developing a community and partnerships to actually use it. Outstanding prospect.

Founding Team……………………….9.3

Product…………………………………..8.2

Token Utility…………………………..9.7

Market…………………………………..9.3

Competition…………………………..6.0

Timing……………………………………9.8

Progress To Date……………………5.5

Community Support & Hype…..7.1

Price & Token Distribution……..6.6

Communication……………………..10.0

FINAL SCORE……………………….8.2

UPSIDES

- CEO and dev team have experience with sharding and clustering

- Novel solution that balances need for throughput with security and decentralization

- Testnet already running ahead of schedule at desired capacity

DOWNSIDES

- No enterprise partnerships

- Serious competition in race for scalability

- Low level visibility and community hype

Today’s Date: 4/16/18

Project Name: QuarkChain

Token Symbol: QKC

Website: www.quarkchain.io

White Paper: https://www.quarkchain.io/quark.pdf

Crowdsale Hard Cap: $20 million

Initial Supply: 2.2 billion

Total Supply: 10 billion

Token Distribution: TBA

Price per Token: TBA

Initial Market Cap (at crowdsale price): $33 million

Fully-diluted Market Cap (at crowdsale price): $150 million

Accepted Payments: ETH

Countries Excluded: China, US

Bonus Structure: N/A

Presale Terms: N/A

Whitelist: TBA

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article