Shutterstock cover by Virrage Images

Ripple Trading Volume Jumps 1,500% Amid Crypto Bear

Ripple's XRP saw a sudden spike in trading volume, potentially leading to an unexpected price movement.

Ripple’s trading volume jumped by more than 1,500% on July 15. Although the increase in network activity was short-lived, the move could hint at an upcoming spike in price volatility.

Ripple Prepares for Volatility

Traders are turning their attention to Ripple.

XRP saw a significant spike in trading volume on July 15, which could hint at a major price movement.

Santiment noted that XRP had seen a surge in interest across all major cryptocurrency exchanges late Friday. The on-chain analytics firm affirmed that approximately 19 billion XRP tokens were traded between 23:00 and 00:00 UTC on July 15. The sudden spike in network activity may anticipate an “unordinary” price action for this digital asset, the firm said.

XRP’s trading volume later returned to previous levels. It’s hovering at around 1.23 billion XRP at press time.

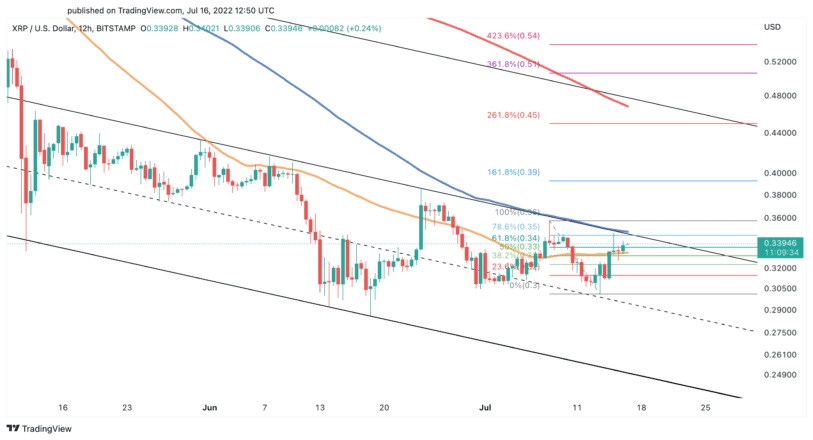

From a technical perspective, XRP appears to be approaching a significant area of resistance after posting a 13.3% increase over the past three days. The 100-hour moving average and the upper boundary of the parallel channel that developed on the four-hour chart are acting as significant hurdles at around $0.35. XRP needs to gain enough momentum to overcome this supply barrier and trigger a bullish breakout toward the 200-hour moving average at $0.45.

It is worth noting that a rejection from the $0.35 resistance wall could invalidate the optimistic outlook. Failing to slice through this price level could trigger a spike in selling pressure that pushes XRP below the 50-hour moving average at $0.32. If XRP losses this vital area of support, a downswing to $0.30 or even $0.25 could follow.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.